The coronavirus is spreading despite China’s substantial efforts to contain it. Spreading even faster: news stories about the new flu strain.

And the combination of the two is having a real impact on global markets.

The two forces are related, of course, but they are also separate. Let me dive in.

Coronavirus is a new strain of the flu that can progress enough to be deadly. That alone is not unique; the flu kills 300,000 to 640,000 people a year. There are four strains and dozens upon dozens of subtypes. The vast majority we have seen before, which means two things: we have a vaccine already in hand and some parts of the population are already protected from a previous exposure.

The coronavirus that is in focus today is a new subtype of a category of virus that we have all had before: the flus that sit in your nose, sinuses and upper throat. But while coronaviruses are usually tolerable, they certainly have the potential to become lethal. Both SARS and MERS were coronaviruses that became new human strains of the flu when they jumped from animals to humans, in 2002 and 2012.

This coronavirus, officially known as 2019-nCoV, seems to have taken the same path. Importantly, it also developed the ability to transfer between humans, which is why there are patients ill with the virus who did not visit the meat market in Wuhan where the outbreak started.

I’m not an infectious disease doctor or an epidemiologist, so I have no comments on how serious this is or will become.

I will say that we don’t yet know how deadly this virus is because we don’t have an accurate count of patients. We know how many have died but we don’t know how many caught the bug but did not get ill. Data is now filling in, and it seems this strain has a fatality rate around 3%, which is much lower than SARS, but that will change as more data is gathered.

I will also say that China is doing its utmost to contain the virus. There are some 50 million people on lockdown. Think about that for a moment! And with the World Health Organization labelling it a public health emergency, countries around the world are now working together to limit the spread. I think it’s likely containment will work. As such, I am not at this point worried about an epidemic.

That doesn’t mean the markets are calm.

Well, the S&P 500 has lost 3% in the two weeks since the virus became a global news story. In the same timeframe, gold has gained 2.2% to hit its highest price since 2013.

Base metals have been hit much harder, with copper down 6.5%, zinc down 6.4%, and nickel down 5.5% last week alone. Copper has, in fact, fallen for the last 12 straight sessions, which is its longest retreat in more than three decades.

So fear is having an effect.

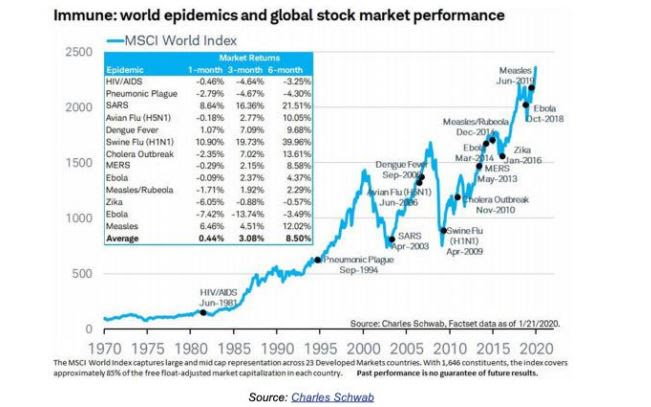

Should fear matter? History says no, not to overall stock performance.

Putting ‘fear’ aside for a moment, let me consider the reality of what’s going on in China. Sixteen cities are on lockdown. Businesses are not operating, factories are suspended, travel is off limits. The city of Wuhan alone is home to 11 million people (for comparison, there are 8 million in New York City) and its streets are deserted.

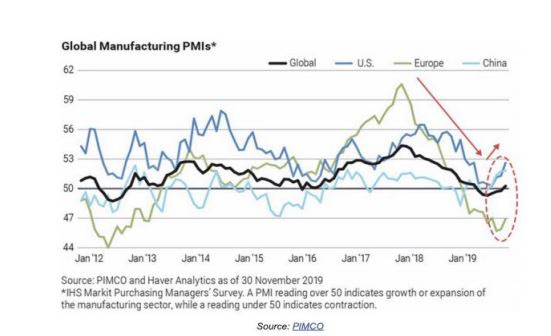

That will have a real economic impact. China is responsible for more than 50% of world demand for base metals, so the near-completely suspension of almost 4% of its population will matter. And China’s manufacturing PMI has been hovering near 50 for years now, which means any negative momentum will likely push it into contraction territory (below 50).

That said, it is only 4% of China’s population that’s on lockdown. And the lockdown is not likely to last that long (a month?). So while it will impact economic data, the impact won’t likely be dramatic. At this point, estimates are that Chinese GDP growth will be down 1.5% for the quarter – big but not huge.

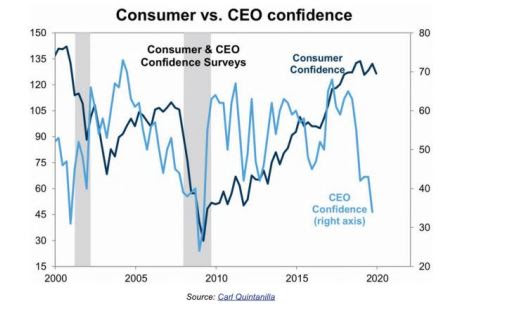

The thing is, the U.S. markets and the Chinese economy are different beasts, but they are similarly susceptible to this strain because both have been advancing on unconvincing engines for some time. When investors are confident in the engine, a bump in the road doesn’t matter…but when they aren’t convinced in the engine, bumps can become mountains.

The chart below is one example of where this weak economy bull market has led us: corporate CEOs have very little confidence in the setup, despite consumers remaining bullish. Such disparities have predicted previous recessions.

Where does this all leave us?

- At the start of the year, copper bulls had been getting excited that the red metal would soon start rising. Copper fell last year because of the trade war dampened growth expectations but its supply-demand fundamentals show that a stronger price is needed. That remains true but China’s Q1 setback has set the copper bull market back as well.

- The coronavirus is stoking fear – of an epidemic, yes, but for this conversation it’s more importantly stoking fear that weak Chinese demand will be the camel that breaks the bull market’s back. I think this very unlikely but it is still a possibility.

- Both of the kinds of fear listed above encourage investors to buy safe havens. Gold is benefitting.

Gold gaining on coronavirus is just like gold gaining on the threat of war between Iran and America. They are both what we call geopolitical pushes and such price moves usually unwind.

This time, though, I think context matters. Gold is not spiking in a vacuum; it is gaining out of a rising trend, which is supported by a long list of macroeconomic factors. In fact, investors have been buying gold to hedge the risk of a stock market correction or crash for some time now, so coronavirus gold buying is simply more of the same.

If gold really spikes in the next little while, don’t expect the spike to sustain. But because the macro arguments for gold are very strong, I think any spike correction will be just that, returning gold to its underlying upward trend.

If you would like a refresher on the macroeconomic fundamentals supporting gold, I went through precisely that in my presentation at the Metals Investor Forum a few weeks ago. To watch that 20-minute video click here or on the image below.