By Kathy Lien, Managing Director of FX Strategy for BK Asset Management.

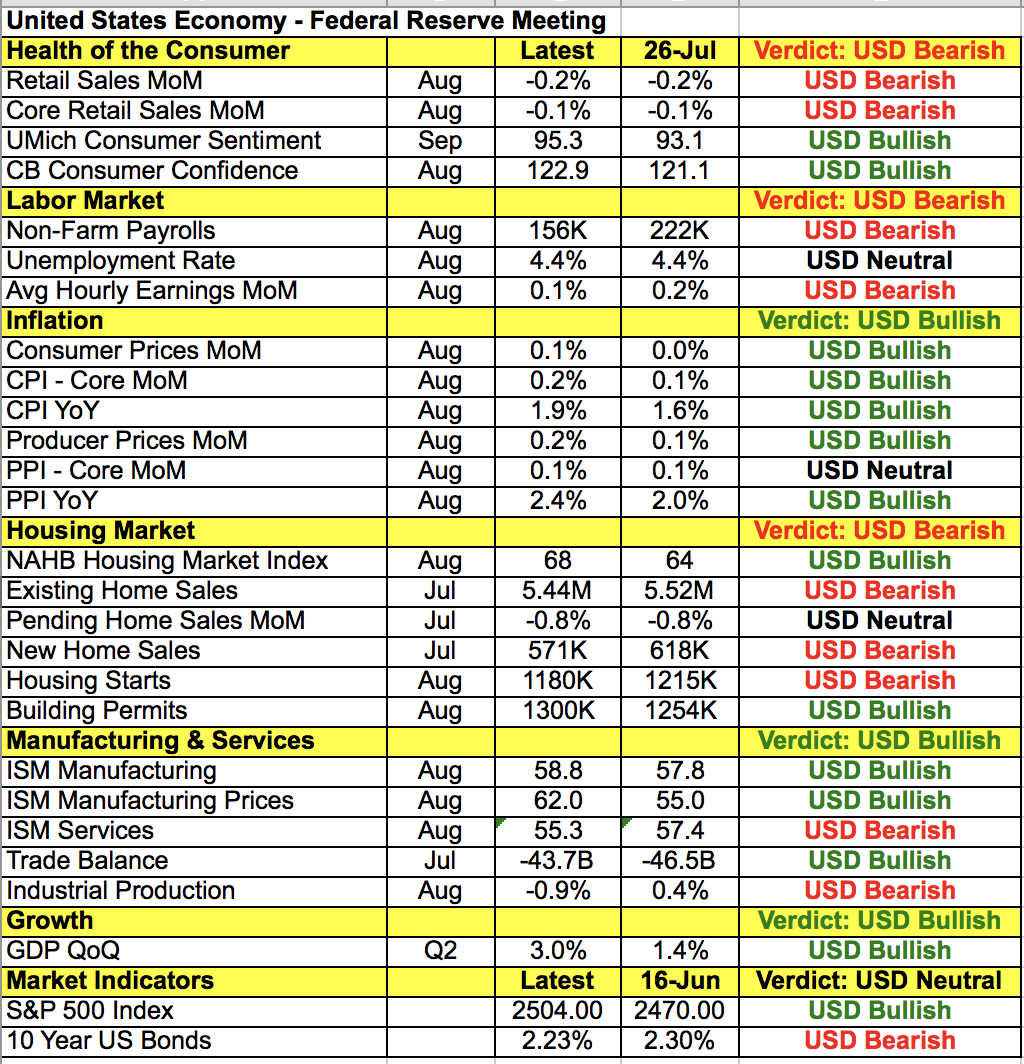

Investors have been buying U.S. assets aggressively ahead of Thursday’s Federal Reserve announcement because they believe that the Fed will reduce its balance sheet and confirm its plans to raise interest rates one more time this year. However while balance-sheet shrinkage is very likely, Janet Yellen may not want to drive U.S. rates even higher by signaling that a rate hike is around the corner and her guidance will be the main driver of Wednesday's dollar. Taking a look at the table below, employment, spending and wage growth weakened since the last monetary policy meeting. These are the most important parts of the U.S. economy and essentials inputs to Fed policy. Although inflation rose in August, the increase in consumer prices is distorted by the hurricane related rise in gas and lodging costs. In other words, there’s very little to be excited about with regards to the outlook for the U.S. economy.

The only thing that is unambiguously positive is the record-breaking moves in U.S. stocks and that’s the sole reason why the Fed could confirm its plan to raise interest rates one more time this year. However chances are, the uncertainty created by Hurricanes Harvey and Irma will hold them back as we won’t start to see their effects until next month’s economic releases. After that, the Fed will need to wait and see how quickly economic activity snaps back before taking action as it may not know how well the economy is really doing until November. Even then, if the recovery is strong it is hard to say whether it will last, which is why we believe the central bank will refrain from providing any clear guidance this month. We know that rates need to continue to rise, especially with U.S. stocks at record highs but subdued wage growth and the effects of Harvey should leave Yellen on the bench for the time being. If the Fed stops reinvesting proceeds from its bond buys but Fed Chair Yellen expresses nothing other than caution about the outlook for the U.S. economy, USD/JPY will fall below 111 and probably even sink down to 110.00. However if Yellen is optimistic and points to record-high stocks as a reason to continue policy normalization, USD/JPY will extend its gains to the 200-day SMA near 112.25.

It was quite an interesting trading day for EUR/USD, which touched 1.20 during the early European trading session. Although Eurozone data was good, the currency pair did not revisit that level until after the London close. The Eurozone’s current account surpluses increased in July and despite the European Central Bank’s plans to taper asset purchases, investor confidence ticked up in September. However at the start of the NY session, Reuters reported that “some elements of the ECB decision could be put off until December” because “ECB policymakers disagreed on whether to set a firm end date for their bond buying program in October.” Apparently these concerns stemmed from euro strength. EUR/USD dropped to 1.1950 on the back of this report but eventually found its way back to 1.20 before the NY close. This tells us that investors are not giving much credit to the Reuters report because even if it is true, the ECB is still in the process of normalizing monetary policy and will make some kind of announcement in October followed by another adjustment in December. So even if the changes in policy are gradual, they are still coming, which is ultimately positive for the euro. But how EUR/USD trades Wednesday hinges entirely on the Fed.

Sterling also edged higher against the dollar but the gains were limited by Brexit uncertainty. Boris Johnson, the U.K.’s foreign secretary threatened to resign if Prime Minister May pursues a “Swiss-style” soft Brexit advocated by Chancellor Phillip Hammond. May is scheduled to deliver a key Brexit speech on Friday and the weak support at this year’s election is strong reason for her to be more conciliatory with the EU. On Friday she will provide an “update to Brexit negotiations so far,” and hopefully provide the market with new information or proposals. After the June election, we can’t see May maintaining a hard-line approach and chances are she will provide sterling-friendly comments. U.K. retail sales are due for release Wednesday and economists are looking for slower spending growth. However with the British Retail Consortium reporting stronger sales growth and improvements seen in prices, the risk is to the upside for the report.

All three of the commodity currencies also performed well with the New Zealand dollar leading the gains. Dairy prices rose for the second auction in a row by 0.9%, the strongest increase since mid May. This helped investors shrug off weaker consumer confidence in the third quarter and the uncertainty of this weekend’s election. Current account numbers were due for release Tuesday evening and the improvement in trade activity between April and June put the risk to the upside for the report. The Australian dollar shrugged off the RBA minutes, which had something for bulls and bears. The RBA was happy to see the pickup in investment expectations and solid employment growth but they are also worried about high household debt and low consumer price growth. At the end of the day, though, the Reserve Bank sounds optimistic about the outlook for the economy, which may be enough to sustain the gains for AUD. Last but certainly not least, the Canadian dollar ended the day up slightly versus the U.S. dollar. It had been stronger at one point during the day but softer manufacturing sales and lower oil prices prevented the currency from experiencing a meaningful rally.