The Mastercard SpendingPulse data noted that black Friday shopping increased by 2.5% y/y, down sharply from a 12% y/y increase in 2022. When we think about this, adjusted for inflation, that would suggest a decline in Black Friday shopping in real terms, no matter which measure of inflation is used.

While we do not have inflation data for November, the PCE report for October, which is coming this Thursday, is expected to rise by 3.1% y/y and 0.1% m/m in October, down from 3.4% y/y and 0.4% m/m. Core PCE is expected to increase by 0.2% m/m and 3.5% y/y, down from 0.3% m/m and 3.7% y/y in September.

The other metric that will be very important will be the PCE Supercore metric, which was up 4.3% y/y and 0.4% m/m in September.

The market has been losing its focus on inflation, but Jay Powell, who is expected to speak on Friday in a fireside chat, hasn’t. He will also likely be the last Fed Speakers until the December FOMC meeting, as the blackout period begins.

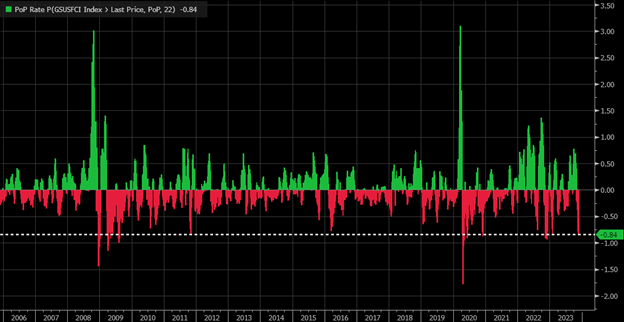

It seems highly likely that he will remind the markets that inflation is still a big concern of the Fed and that he will have no problem doing more and tightening policy further if needed. This could be especially true now that financial conditions have not only eased since the November FOMC meeting but have also given back all of the gains since the September FOMC meeting as measured by the Goldman Sachs (NYSE:GS) Financial Conditions Index.

Financial conditions have eased dramatically over the past 22 days, which is equal to what we would expect to see during periods of rate cutting, such as in 2008 and 2020.

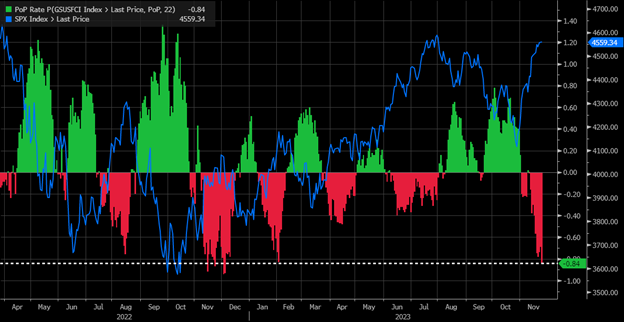

Unfortunately, since the start of 2022, this is not the first time that financial conditions have eased as if a rate-cutting cycle was beginning because similar happened in August 2022, November 2022, January 2023, and now.

All of these periods have seen big equity market rallies, followed by periods of financial condition tightening, and an equity market that gave back most, if not all, of the big gains, such as September 2022, December 2022, and February 2023. This strongly suggests the November 2023 rally is given back as well.

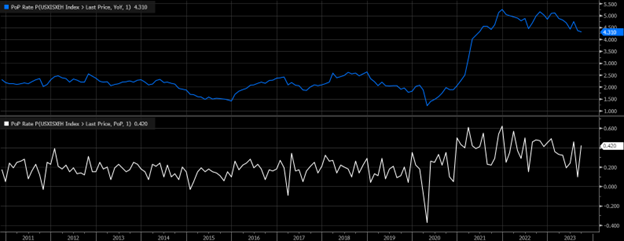

Because what is very clear is that when financial conditions persistently ease, it leads to higher inflation rates about nine months later, and when they tigthen, it leads to lower inflation rates, as the effects of financial conditions impact broader macro trends.

The chart below shows the CPI y/y rate of change pushed back by nine months and the GS financial conditions inverted. It clearly shows that the unprecedented easing of financial conditions in 2020 and 2021 led to a sharp rise in inflation in 2021 and 2022, and the fast tightening of those same conditions has led to inflation coming down in 2023. So, the Fed will have to be careful to control how much conditions ease from here.

What may be the best measure of real-time financial conditions is the CDX High Yield Spread Index, which correlates highly to the GS Financial Conditions index. Given where the CDX High Yield Spread Index is, if financial conditions do not tighten soon, financial conditions could collapse to levels that will become too accommodative for the economy and increase the risk of a real resurgence in inflation.

Why do we care about the CDX High Yield Index and Financial Conditions? Because the equity market is essentially trading with high-yield credit spreads, and as long as spreads narrow, stocks can rise, and if credit spreads begin to widen, stocks will fall, as the S&P 500 and Nasdaq 100 earnings yield trade right along with these credit spreads.

Meanwhile, the VIX oscillates with changes in high-yield credit spread.

So, if you are Powell, and you see how much financial conditions have eased and what it could mean for his inflation fight down the road, you have to think that he doesn’t want to see financial conditions collapse and fall back to levels that are stimulative to the economy, and more important stimulative to inflation.

On top of that, we know based on data from Goldman Sachs, and as noted in this weekend’s write-up (See: The S&P 500 May Be Heading Back to 4,100 Sooner Than You Think) and YouTube video, systematic flows are finished and could very easily shift from being buyers back to sellers of stocks, while the zero gamma level in the S&P 500 continues to creep higher.

It means that the rally in stocks off the October low is not only on shaky ground but the foundation of the rally is built like a house of cards because the entire rally was not built on an improving fundamental outlook but due to flows and positioning like the rallies in August 2022, November 2022, January 2023, and yes, even July 2023.

Those periods were followed by September 2022, December 2022, February 2023, and Aug/Sept/Oct of 2023, which saw, in most cases, the rally completely erased, or nearly entirely erased, and while this time may be entirely different, my thoughts are that it won’t be.

This Week’s Free YouTube Video:

See you Monday.