By Kathy Lien, Managing Director of FX Strategy for BK Asset Management.

Sterling is trading near a 2-year high ahead of the Bank of England’s monetary policy announcement and this strength along with the rise in U.K. yields tell us that investors are bracing for hawkishness from the central bank. When the bank last met in mid June, it shocked the market by voting 5-3 to keep rates unchanged. The three dissenting policymakers felt that an immediate rate hike was necessary given the level of inflation and the economy’s Brexit resilience. At first, Governor Carney did not seem to be on board but about a week later, he said they would debate a rate rise in the coming months, sparking the current rally in GBP. Bank of England Chief Economist Adam Haldane did not vote for a hike last month but said on numerous occasions since then that they seriously need to look at a rate hike. In other words, at least 5 members of the central bank are thinking about policy normalization and these views should make their way into Thursday’s Quarterly Inflation Report. The rate decision and Quarterly Report will be released at 11 GMT followed by Carney’s press conference at 11:30. All of this will be preceded by the latest PMI services and composite index, which are due at 08:30 GMT.

Here's why Thursday’s BoE meeting is important:

- BoE voted 5-3 to Leave Rates Unchanged. Forbes is gone so market will be keen to see if the 5-3 vote is sustained

- Economic forecasts could be upgraded

- Plans for major policy changes are often telegraphed in the Quarterly Inflation Report

- Governor Carney will be speaking

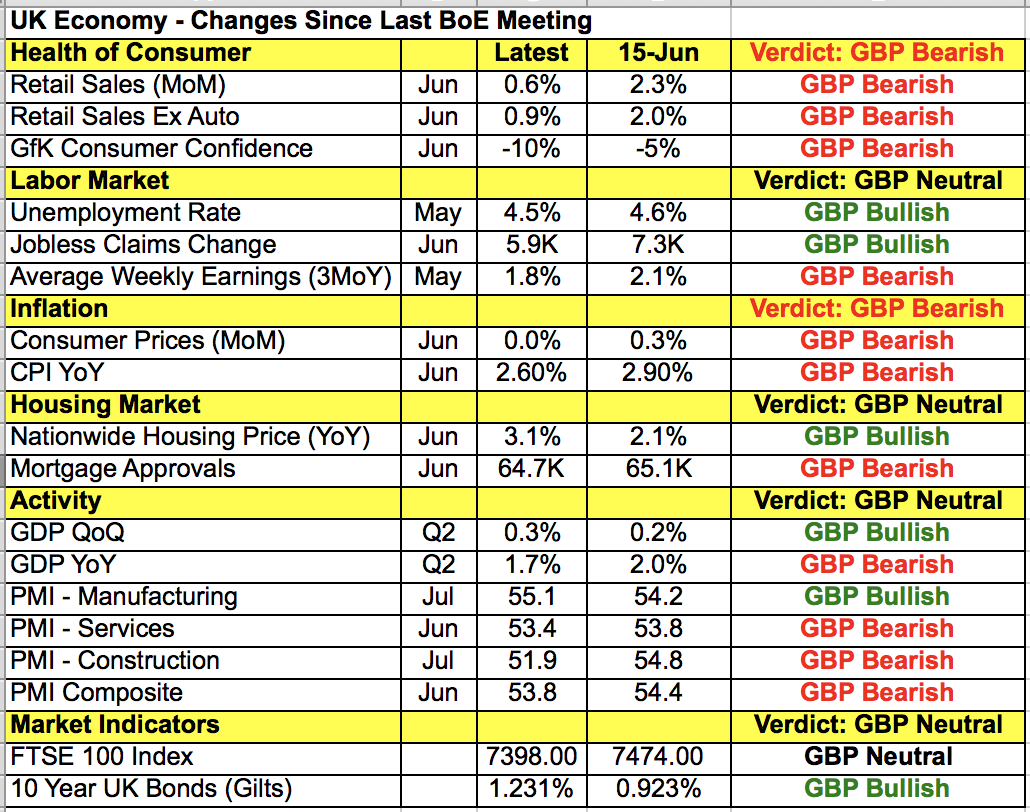

Taking a look at the table below, UK data hasn’t been great with spending, wages and inflation weakening since June, but the insistent hawkishness of UK policymakers suggests possible upgrades to their economic forecasts. Forbes’ term ended and Tenreyro who will most likely vote with the majority at her first policy meeting replaces her. That leaves Chief Economist Haldane to assume Forbes hawkish role. We know BoE Governor Carney also thinks the time to hike is near but unless its a deciding vote, he probably won’t dissent in fear of sending the wrong message to the market. As the central bank likes to telegraph major changes in policy in its Quarterly inflation report it could start preparing the market for policy normalization. If Haldane votes for a hike AND the BoE upgrades its inflation forecast, GBP/USD will soar. If BoE votes 6-2 to leaves rates steady, GBP will crash initially but recover if Carney is hawkish.

There wasn’t much consistency in Wednesday's U.S. dollar. The greenback appreciated against the Japanese yen, Swiss franc, Canadian and New Zealand dollars but experienced losses versus the euro and sterling. There were a number of factors that affected the dollar that led to diverging performance for the currency. First and foremost, the ADP report did not help the case for strong nonfarm payrolls and more importantly a Federal Reserve rate hike. Still, stocks climbed to fresh record highs as healthy earnings from Boeing (NYSE:BA) and Apple (NASDAQ:AAPL) supported risk appetite. President Trump also signed a Russia sanctions bill and initially the market didn’t like the fact that U.S. relations with another major player are getting strained, regardless of whether they are friend or foe. Lastly, contradicting Fed speak sent the dollar on a rollercoaster ride. The dollar gave up early gains when Fed President Bullard said he’s concerned about soft inflation data and therefore doesn’t support further moves in the near term. But it recovered after Fed Presidents Mester and Williams threw their support behind gradual removal of accommodation with the next steps being balance-sheet reduction. None of these 3 presidents is a voting member of the FOMC this year. With USD/JPY trading just under 111, Thursday’s non-manufacturing ISM report could decide whether this level is broken pre-NFP.

Although the dollar strengthened versus the yen, it continued to weaken against the euro with the single currency pair breaking above 1.19 for the first time since 2015. The only piece of data released Wednesday was Eurozone PPI, so no news must have been good news for the single currency as it shrugged the report off easily. The Australian and New Zealand dollars both traded lower although the losses for AUD were limited thanks to a sharp 10.9% rise in building approvals. Service sector PMI and the trade balance were due Wednesday evening. The New Zealand dollar was one of the day’s worst performers as a contraction in Q2 employment and drop in the participation rate offset the improvement in the unemployment rate. USD/CAD ended the day slightly higher despite an uptick in oil prices.