By Kathy Lien, Managing Director of FX Strategy for BK Asset Management.

Geopolitical risks are front and center for forex traders this month with terrorist attacks in Russia and Sweden and the U.S. airstrikes in Syria putting investors on edge. U.S. data took a backseat to these developments, resulting in a messy end to a busy trading week. The China–U.S. summit ended the best way possible — with no shots fired from either side. Instead, President Trump said “tremendous progress” was made and declared the U.S. relationship with China as “outstanding.” Without going into details he also said “I believe lots of very potentially bad problems will be going away.” In a statement released by China, President Xi told Trump, “We have a thousand reasons to get China–US relations right and not one reason to spoil the China–US relationship.” While President Xi won’t be happy with the U.S. attacks on Syria (as their views are more closely aligned with Russia), this was the best ending that the markets could have hoped for from one of this week’s most dangerous event risks. Meanwhile, we believe that the weakness in March Nonfarm Payrolls will come back to haunt the dollar as the market looks forward to the latest U.S. retail sales and core cpi reports. Geopolitical risks and softer U.S. data could keep investors risk averse, leading to weakness in USD/JPY and other highbeta currencies like the euro. The U.S. decision to take direct military action in Syria is shifting U.S.–Russian relations and that could be bad news for the markets. Fox News reported that a Russian warship has entered the eastern Mediterranean heading toward 2 US Navy destroyers that launched airstrikes last night. While many investors may be confused by USD's quick recovery post-payrolls, the move was driven by a combination of short covering, the positive outcome to the U.S.–China summit and a flight to safety into U.S. dollars.

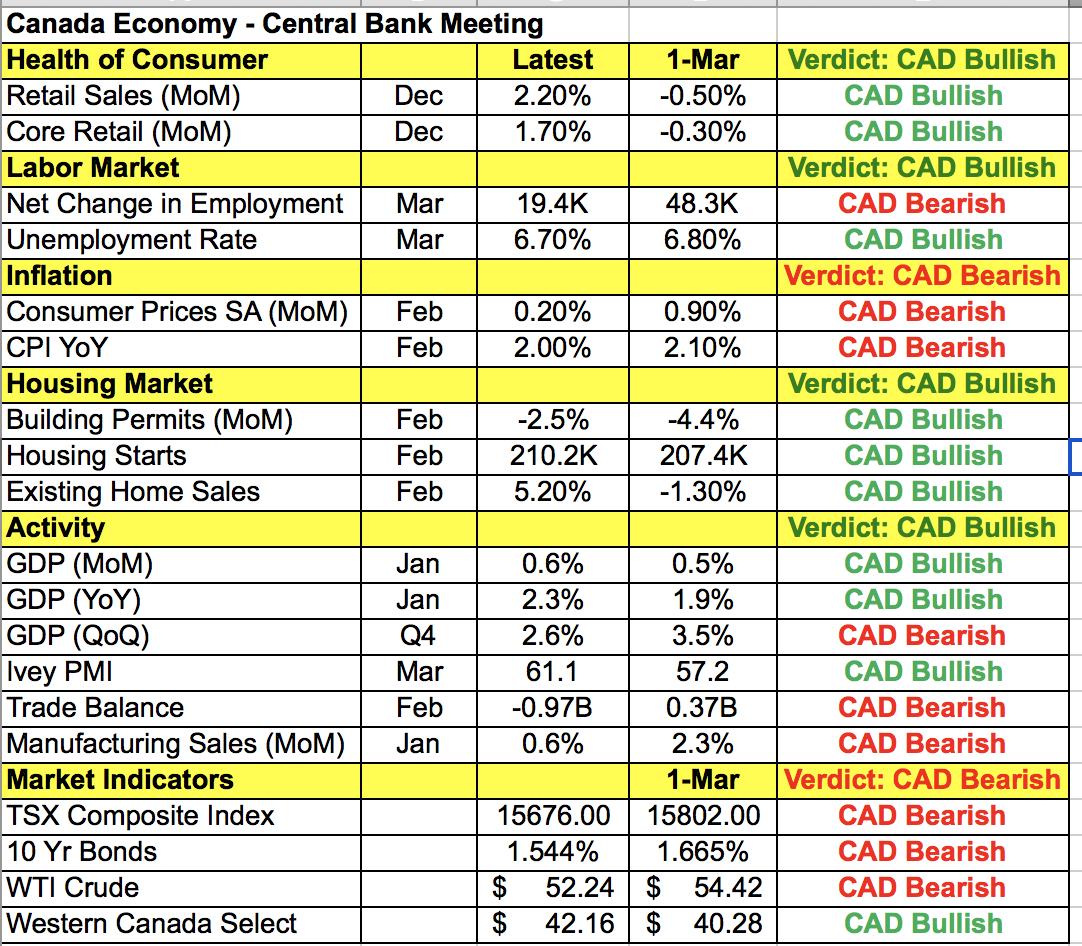

Stronger-than-expected Canadian data and a rise in oil prices helped the Canadian dollar stave off further losses. Syria is not a major oil producer but its geographic location and alliances with major Middle East oil producers raises fear for additional uncertainty in the region. The latest Canadian economic reports were strong with Canada adding another 19.4K jobs in March. Full-time and part-time jobs increased, indicating that there was no letup after the strong rise in February. The IVEY PMI index also jumped to 61.1, its highest level in more than a year. All of these developments are important going into Wednesday’s Bank of Canada monetary policy announcement. This month’s meeting will be more market moving than last month’s because it will be followed by a press conference from Bank of Canada Governor Poloz. The last time the central bank met, it expressed concern over low wage growth, slack and the competitive challenges faced by the export sector. In the past month, economic activity has been uneven. The pressure on exports intensified with the trade balance returning to deficit in February. Inflation is also low with CPI growth slowing to 2%. Yet job growth, manufacturing activity and consumer spending have been strong. So we may not see any major changes to the central bank’s outlook. With that in mind, if the BoC hardens its dovish bias by reiterating its concerns, the Canadian dollar will sell off. However, if BoC emphasizes the improvement in spending and labor activity, USD/CAD will fall hard from its elevated levels.

The Australian and New Zealand dollars traded lower this past week with AUD/USD reaching 75 cents on the back of risk aversion. The latest Australian economic reports were mixed with retail sales and manufacturing activity slowing while service-sector and trade activity grew. These contradictory reports created more confusion than clarity and gave investors very little reason to buy AUD. In the coming week, Australian labor data and China’s trade balance will be the numbers to watch. The RBA has recently expressed concern about the labor market, which makes this month’s report particularly important. China’s trade balance will most likely rebound after the unexpected deterioration last month. There’s quite support for AUD/USD at 75 cents but it is looking risky. As there are no major New Zealand economic reports scheduled for release in the new trading week, NZD will most likely take its cue from AUD, regional data and the market’s appetite for U.S. dollars.

After trading in an exceptionally tight range for most of the week, the euro finally broke down on Friday, falling to its lowest level versus the U.S. dollar in 3 weeks. The move had nothing to do with data as German industrial production and trade activity improved in February. Instead, ongoing terrorist attacks in Europe are making investors nervous about Marine Le Pen’s chances of becoming the next President of France. She is running on a campaign of anti-immigration, anti-terrorism and the latest polls show her virtually neck and neck with Emmanuel Macron going into the first round of voting on April 23. The latest terror attacks probably won’t make it into next week’s ZEW survey but we continue to expect the euro to trade with a heavy bias despite improving domestic conditions. At the same time, ECB officials are still worried about inflation — central bank President Draghi said this past week that it is clearly too soon to declare success on inflation and that ECB needs more inflation confidence to change its stance. As such, he sees no need to deviate from the wording of forward guidance even as the balance of growth risks seem to be shifting upward. ECB member Constancio agrees that it is too soon to declare success on inflation and Praet believes rates should stay at current or lower levels well past QE.

Finally, sterling ended the week lower against most of the major currencies. Data has been mostly weaker and is likely to worsen as the U.K. moves toward leaving the European Union. Although service-sector activity accelerated, manufacturing and construction activity slowed in March. Friday’s Halifax house price report, industrial production and the trade balance also missed expectations. Next week, we’ll get more insight into whether the hawkish dissent from BoE member Forbes at the last monetary policy meeting is justified. This past week’s data and the cautious comments from BoE member Vlieghe certainly puts her views into question. Vlieghe believes the BoE should be cautious as the U.K. consumer slowdown could intensify. The U.K.’s inflation and employment reports are scheduled for release next week. Inflation is an exceptionally important input into the central bank’s policy.