ETFs related to sustainability took off in 2020 and further accelerated in 2021 before hitting a wall in 2022. According to Morningstar Canada, there were 42 Canadian-domiciled sustainable investment funds launched in 2020, with 73 launched in 2021. The pace slowed in 2022 amid market volatility. However, thus far in 2023—we would like to observe sustainability ETF flows to get a read on investor positioning relating to sustainability.

We think tracking inflows are important for gauging investor sentiment. While inflows don’t necessarily have any bearing on the performance of the underlying securities, it does give a sense as to where the puck might be headed in terms of investor capital.

Total net inflows into sustainability related ETFs YTD (as of April 19, 2023) have totaled approximately $1.17 billion according to data from Trackinsight. This indicates growing interest by investors in 2023 aimed at rekindling the growth of sustainability ETFs.

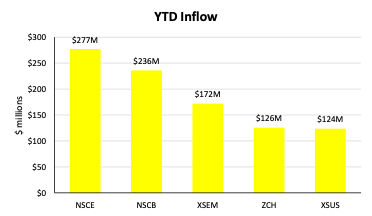

Given the positive inflows, we highlight the top 5 ETF inflows amongst the group.

Top 5 Canadian ESG ETF Inflows YTD (as of April 19, 2023)

Source: Trackinsight (April 2023)

NBI Sustainable Canadian Equity ETF (NSCE)

- AUM: $1.7 billion

- Expense Ratio: 0.69%

- YTD Performance: +8.2% return

- YTD Inflow: $277 million

The top inflow ESG ETF in Canada so far this year was National Bank Investment’s Sustainable Canadian Equity ETF which focuses on equities of Canadian companies through a sustainable lens and was launched back in March 2020.

NSCE holds some of the “blue-chip” Canadian stocks and has a greater weighting towards the Financials and Industrials sectors, with a 30% and 28% exposure to each, respectively. Its largest holdings include Constellation Software Inc. (5.0% of its value), Canadian Pacific Railway (4.8% of its value), Intact Financial Corporation (TSX:IFC) (4.7% of its value), Royal Bank of Canada (TSX:RY) (4.6% of its value), and Toronto-Dominion Bank (TSX:TD) (4.5% of its value).

NBI Sustainable Canadian Bonds ETF (NSCB)

- AUM: $633 million

- Expense Ratio: 0.63%

- YTD Performance: +2.7% return

- YTD Inflow: $236 million

National Bank Investments captures the top two spots on top inflows this year, with its offering of sustainability bonds in addition to equities. This ETF was launched alongside National Bank’s Equity ETF in March 2020. It holds a diverse mix of Canadian investment grade bonds, provincial bonds, corporate bonds, and municipal bonds. It also has a varied term allocation, with around one-third allocated to the 1-5 year duration, 5-10 year duration, and 10+ years duration.

iShares ESG Aware MSCI Emerging Markets Index ETF (XSEM)

- AUM: $217 million

- Expense Ratio: 0.32%

- YTD Performance: +3.5% return

- YTD Inflow: $172 million

Third on our list of top sustainability ETF inflows is iShares’ ESG Aware MSCI Emerging Markets Index ETF (XSEM), which allows Canadian investors to gain exposure to large and mid-cap emerging markets stocks which maintain positive ESG characteristics at a very reasonable cost of only a 0.32% expense ratio.

This ETF is highly diversified, with around 310 holdings across a variety of countries; including China, Taiwan, India, South Korea, Brazil, South Africa, Saudi Arabia and others.

BMO (TSX:BMO) MSCI China ESG Leaders Equity Index ETF (ZCH)

- AUM: $234 million

- Expense Ratio: 0.72%

- YTD Performance: +3.3% return

- YTD Inflow: $126 million

For a 0.72% expense ratio, BMO Asset Management offers the MSCI China ESG Leaders Index ETF (ZCH) which holds Chinese companies that retain a higher MSCI ESG rating than peers, with diversity across different sectors.

There are 152 holdings in this ETF, with a very top-heavy allocation—with around 42% of its total market value concentrated in two stocks: Tencent Holdings and Alibaba (NYSE:BABA) Group.

iShares ESG MSCI USA Index ETF (XSUS)

- AUM: $358 million

- Expense Ratio: 0.23%

- YTD Performance: +6.7% return

- YTD Inflow: $124 million

Rounding out our top 5 list is the lowest cost ETF offering on the list—iShares ESG MSCI USA Index ETF (XSUS). This ETF provides exposure to large and mid-cap US stocks that emphasize companies with positive ESG characteristics. The fund was launched in early-2019 and holds approximately 319 stocks across different sectors, however with a tilt towards technology and healthcare sectors.

Data as of April 24, 2023, unless otherwise noted.

This content was originally published by our partners at the Canadian ETF Marketplace.