5 big analyst AI moves: Nvidia stock ’likely to outperform in 2H26’

On Friday, March 10, 2023, Silicon Valley Bank (SVB) failed after depositors rapidly withdrew their funds, marking the largest banking failure in the U.S. since the 2008 financial crisis. To learn about what the collapse of SVB could mean for Canadian investors, read our article here.

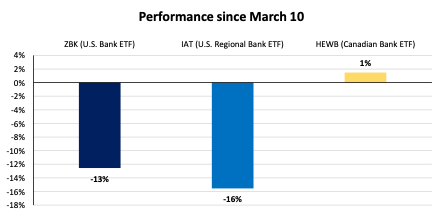

It’s been over a month, and since then, the financial markets have had time to digest what caused this issue and acted accordingly. Here is a summary of three ETFs, and their performance since March 10.

Data as of market close on April 21, 2023.

Source: Yahoo Finance

Above, we observe three ETFs:

- BMO (TSX:BMO) Equal Weight US Banks (TSX:ZBK): ZBK is a Canadian-listed ETF offered by BMO Global Asset Management which houses 18 stocks across the U.S. banking sector. This ETF remains relatively unconcentrated given that the largest holding has around an 8.8% weight.

- iShares U.S. Regional Banks ETF (NYSE:IAT): A broader ETF holding 39 U.S. bank stocks offered by iShares. This ETF is more top-heavy with the top five holdings making up around 45% of its market value.

- Horizons Equal Weight Canada Banks Index ETF (TSX:HEWB)(HEWB): HEWB holds the Big Six Canadian banks in almost equal weights. Given that the Canadian banking sector is heavily consolidated to begin with, it is no surprise that this ETF is more concentrated than its U.S. counterparts.

So what does this tell us? Based on the stock performance of the underlying constituents within these ETFs, we can see that sentiment surrounding the U.S. banks has suffered due to the SVB breakdown.

Investors vote with their money and the underwhelming performance of the U.S. banks shows their votes have been cast—i.e., sell the U.S. banks. North of the border, Canadian banks have held up well—actually increasing in value—with minimal contagion spillover from the waning confidence in the U.S. banking system.

This tells us that investors still feel safe holding the Canadian banks; and they have good reason to.

Canadian banks weathering the storm

Canadian banks have weathered far worse than this recent drama—which has died down as depositors were reassured that their funds would be safe by the government and Federal Reserve.

If we turn the clock back circa 15 years, the 2008 global financial crisis was just that, global; and created fears of an international banking collapse that could have potentially ruined the world’s economy (not a hyperbole). Despite the fear, Canadian banks emerged in 2009 relatively unscathed with stock prices hitting record highs in the autumn of 2009.

Canadian banks are diverse & dominant

The Canadian banking sector was not always concentrated. More than 100 years ago, the Canadian chartered banks, insurance companies, securities brokers and mortgage lenders were scattered across many different firms (much like the U.S. is today). However, over time, a wave of consolidation brought all these different types of companies together into financial conglomerates that do much more than your “traditional banking”.

While the Big Six banks engage in regular banking activities (e.g., taking deposits and underwriting loans), they also offer services to clients that are often overlooked, including insurance services, wealth management services, and operating large capital markets divisions. Basically, a one-stop-shop of financial services that the moniker “bank” does not capture.

Could an SVB-esque failure ever unfold in Canada?

SVB failed due to a particular set of circumstances: a mismatch between in the duration of its deposits and its loan base. SVB couldn’t pay back depositors because their funds were locked into longer-term bonds and loans that decreased in value as interest rates rose.

This particular issue would not arise in Canada due to:

- Greater conservatism and higher capital held to pay back depositors;

- Very diverse operations with multiple sources of funds and income generating businesses;

- Stringent regulatory oversight and the ability to actually work together with regulators given that the oversight only has a few large banks to oversee.

Bottom line: It is highly improbable (if not impossible) that a similar situation to SVB could unfold in Canada, which is reflected in how well the Canadian bank stocks have held up. However, this doesn’t mean that Canadian banks are invincible. They are still highly exposed to the overall Canadian economy and it is no secret that the average Canadian consumer is more debt-laden than their U.S. peers which is something investors should pay close attention to.

Data as of April 21, 2023.

This content was originally published by our partners at the Canadian ETF Marketplace.