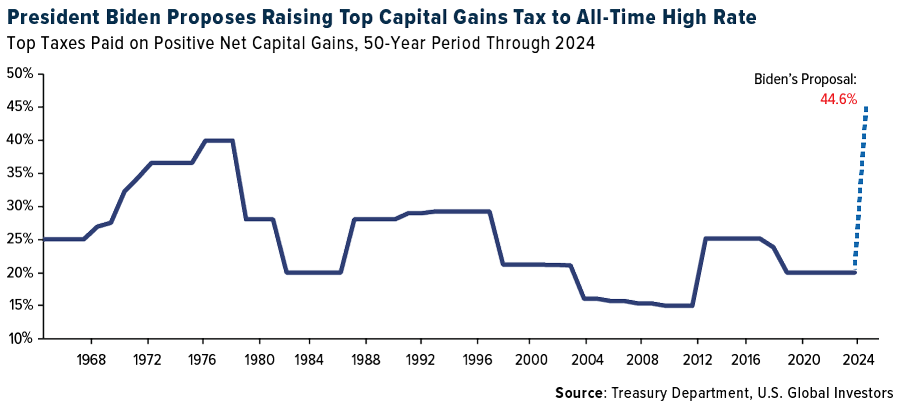

Last week, before she accepted the Democratic Party’s nomination for president, Vice President Kamala Harris threw her support behind President Joe Biden’s tax proposals for 2025, which include a steep 44.6% capital gains rate and an unprecedented 25% tax on unrealized gains.

I’ve spoken before about the absurdity of taxing unrealized gains. Today I want to discuss another alarming measure Harris supports: price controls.

For those unaware, price controls are a type of government regulation that sets limits on how much prices or wages can increase. These can take the form of price ceilings, such as rent controls, or price floors, like minimum wage laws.

On the surface, these measures might seem as though they’re intended to protect consumers from inflation, but in reality, they often do more harm than good—and there are thousands of years’ worth of examples. The economic principles that guide our markets are delicate, and when government intervention disrupts these natural forces, the consequences can be severe.

Price Controls Are a Recipe for Shortages and Stagnation

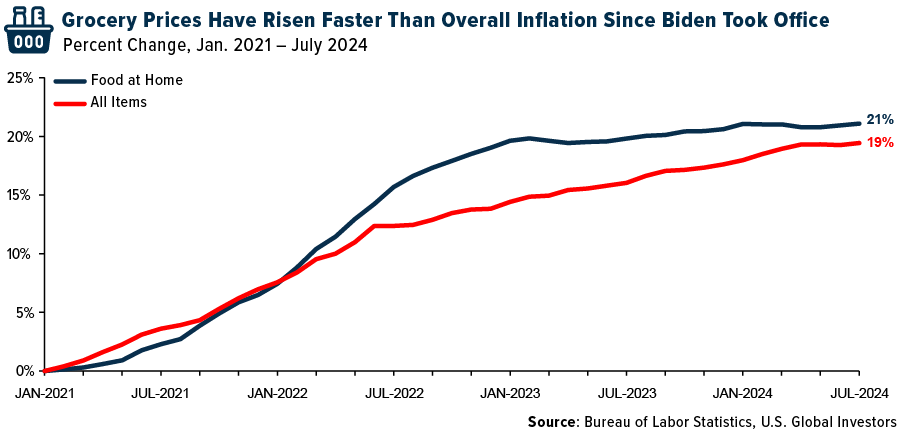

Consider the issue of inflation, which has been a persistent concern for many Americans. We’re all feeling the pinch at the grocery store, where food prices have risen 21% on average since Biden’s inauguration.

Harris’s proposed solution—price controls—sounds appealing, but it’s a Band-Aid on a bullet wound.

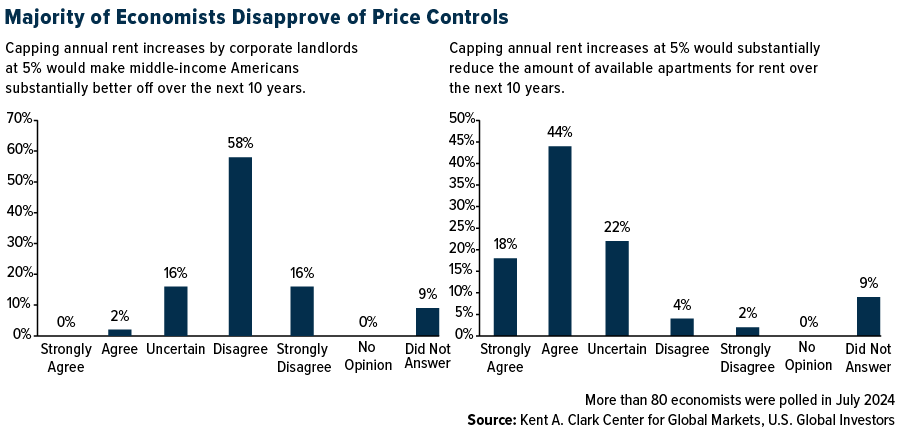

Most economists agree that price controls are not the answer. According to regular surveys conducted by the Chicago Booth School, a majority of economists do not believe that price controls could effectively limit U.S. inflation over the course of a year.

In a July survey, three quarters of economists either disagreed or strongly disagreed with the statement that capping rent hikes at 5% annually would help Americans over the long run. Similarly, an overwhelming 62% either agreed or strongly agreed that controlling price increases would lead to “substantial” supply shortages.

Nixon’s Price Freeze: A Cautionary Tale of Economic Mismanagement

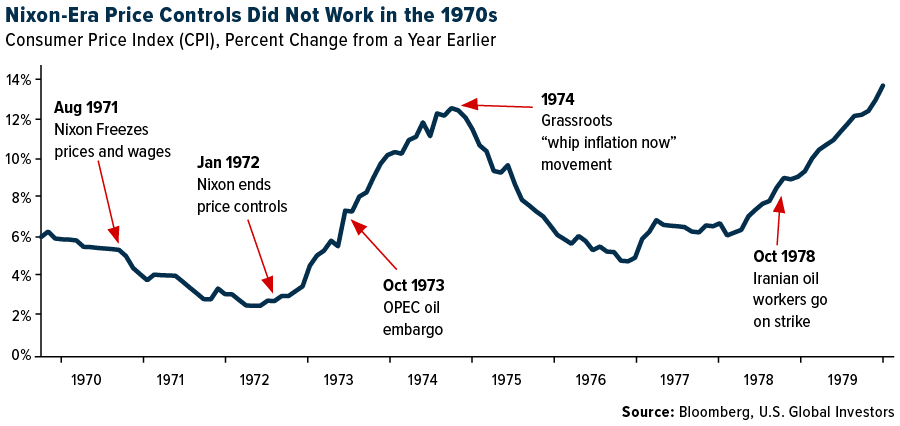

We don’t have to look very far back in U.S. history to see the dangers of price controls. In August 1971, President Richard Nixon imposed a 90-day freeze on all prices and wages in the United States.

At first, the move was popular, giving Nixon a boost in his re-election bid the following year.

But the initial success was short-lived. Nixon’s plan contributed to a decade of stagflation—a toxic mix of high inflation and slow growth that eroded living standards for millions of Americans.

It wasn’t until 1983, midway through Ronald Reagan’s first term as president, that the economy finally began to recover. In a radio address in October of that year, Reagan pointed to “solid evidence that America has turned the corner toward long-term economic expansion.”

Why Lowering Gas Prices Could Lead to Higher Costs and Shortages

The lesson is clear: Price controls are not a sustainable solution. They distort market signals, leading to inefficiencies and economic stagnation. Remember, prices serve as marketplace indicators. High prices might be frustrating for consumers, but they send an important message to producers: There’s profit to be made here, so invest more. For consumers, high prices signal scarcity, which encourages them to use resources more wisely.

Take gasoline as an example. If gas were to soar to $5 a gallon, people would probably cut back on non-essential driving. Meanwhile, the high price would encourage oil companies to ramp up production, which would eventually lead to lower prices.

But what if the government artificially capped gas at, say, $2 a gallon? It would send the wrong signals to both consumers and producers. Consumers would drive just as much as before, if not more, exacerbating the scarcity, while producers would have less incentive to increase supply. This could lead to even higher prices down the road or, worse, 1970s-style gas shortages.

Unrealized Gains Tax Could Trigger a Mass Capital Outflow from the U.S.

Harris’s support for a tax on unrealized gains would also have far-reaching consequences for the U.S. economy. As I’ve said before, taxing gains on assets you haven’t sold yet is not just absurd, it’s dangerous. It’s a policy that would drive capital out of the country at an unprecedented rate, leading to a loss of tax revenue and a weakening of our financial system.

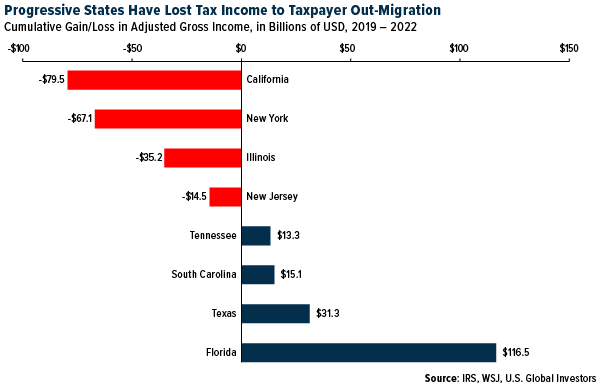

We’re already seeing a mass exodus of wealth from high-tax states like New York and California to more tax-friendly states like Florida and Texas.

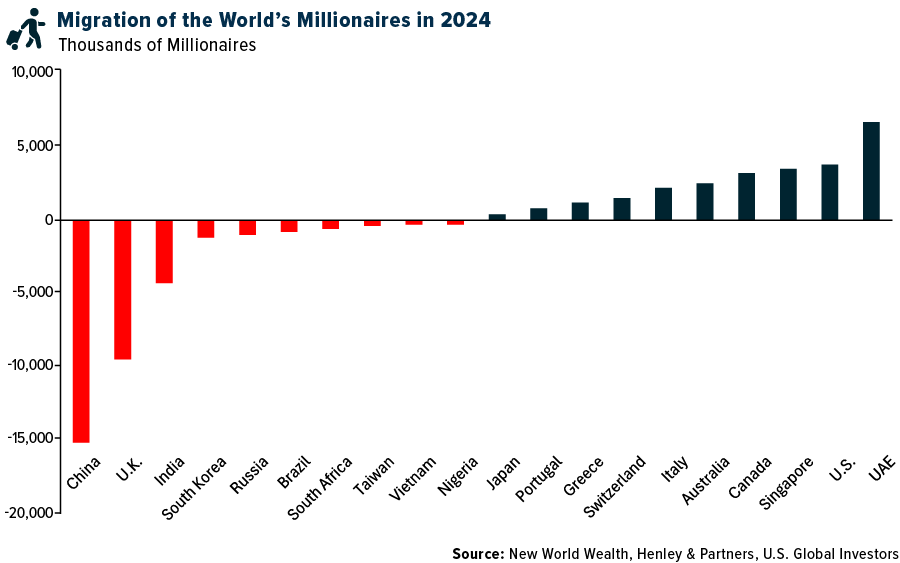

But this trend is not limited to the U.S. Globally, the movement of millionaires from countries with burdensome tax policies to more welcoming environments is accelerating. According to the Henley Private Wealth Migration Report, an estimated 128,000 millionaires are expected to relocate this year, surpassing the previous record set in 2023.

The United Arab Emirates (UAE) ranks first in attracting this wealth by offering a business-friendly environment and luxurious living conditions. Conversely, countries like China and the United Kingdom are facing significant outflows of high-net-worth individuals (HNWIs) due to slowing growth, geopolitical tensions and unfavorable tax regimes.

The implications of this “great millionaire migration” are profound. Wealthy individuals contribute significantly to the tax base, and their departure can cripple a nation’s finances.

Supporting Free Markets and Limited Government

The economic policies Vice President Harris supports—price controls and the taxation of unrealized gains—are misguided at best and catastrophic at worst. As history has shown us, these measures disrupt market forces, stifle economic growth and can lead to financial crises.

If we want to preserve America’s prosperity, we must resist these flawed policies and instead embrace the principles of free markets and limited government intervention. The stakes are too high to do otherwise.

***

Past performance does not guarantee future results. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.