Ethereum (ETH) bottomed in June last year at around $900 and is now trading at $1900. That is a >100% gain in less than one year. Meanwhile, unfortunately, most are still bearish on ETH, maybe because they missed the boat, as even the staunch perma-bears cannot make such a move.

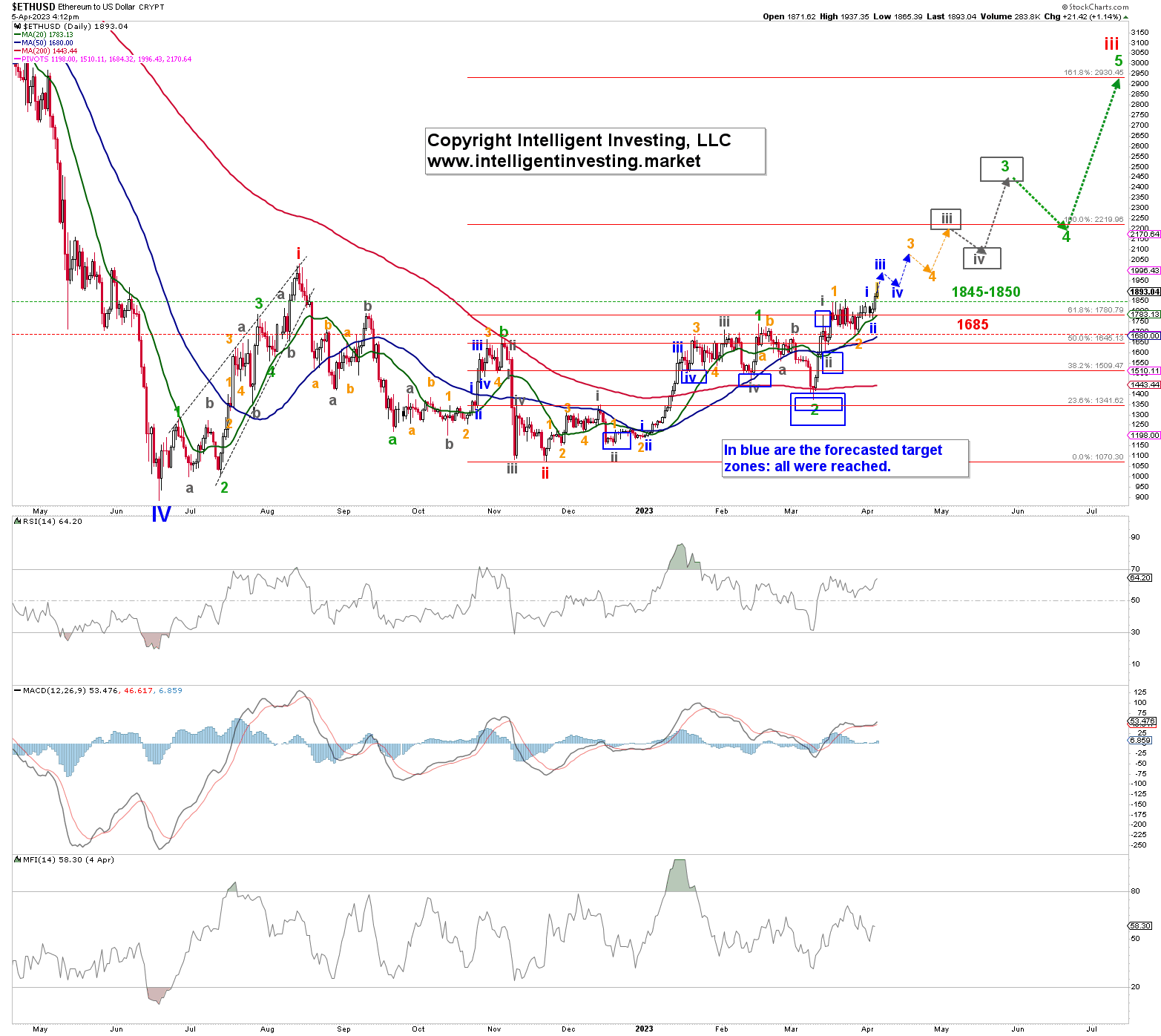

Using the Elliott Wave Principle, we have tracked ETH since that June low primarily as five-wave-sequences higher and three-wave sequences lower. That is a bullish pattern. Take a look at the Ethereum daily chart with detailed EWP count and technical indicators.

In more detail, ETH should now be in blue W-iii of orange W-3 of grey W-iii as long as it stays above Monday’s low at $1765 minimum, whereas $1685 is now the critical level. Why? Because below that level means that the sequence of “nested 1st and 2nd waves” in EWP-terms is invalidated, with already a first warning for the Bulls below Monday’s low.

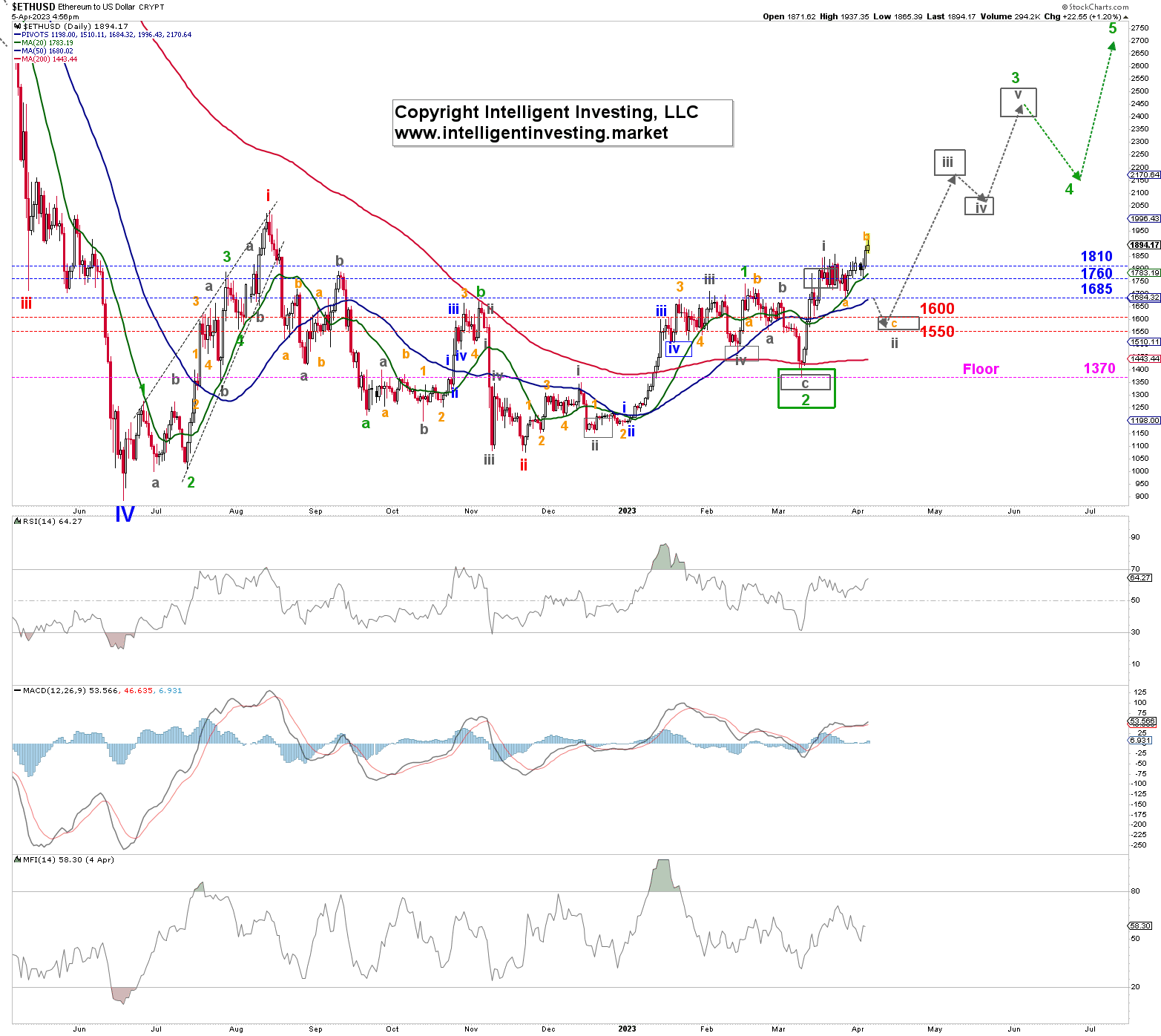

If that happens, we are dealing with a more complex grey W-ii in the form of an irregular flat. And we then anticipate $1550-1600 to be reached again before the Bullish sequence starts anew. See Figure 2 below. However, that is our alternate option.

You may think, “So you say it can go up or down…” but that is not what we are saying. Instead, what we are saying is our preferred, primary expectation remains for higher prices, as we have been correctly Bullish on ETH since October (!) last year, see here.

Still, we recognize that ETH will have to stay above certain levels to keep that immediate upside momentum going. Those levels can be used as a stop loss, for example. Being cognizant of those price levels prevents disaster in one’s portfolio. It is one’s insurance policy in other terms.

Thus, ETH continues to follow our preferred scenario of an EWP-based impulse path higher and has topped and bottomed in most of the EWP-based target zones. See the blue target zones in the first chart. This foresight is the true power of the EWP, as few would have foreseen this setup months ago. Ultimately, as long as $1685 holds, with a first warning below $1765, we continue to view ETH as immediately Bullish.