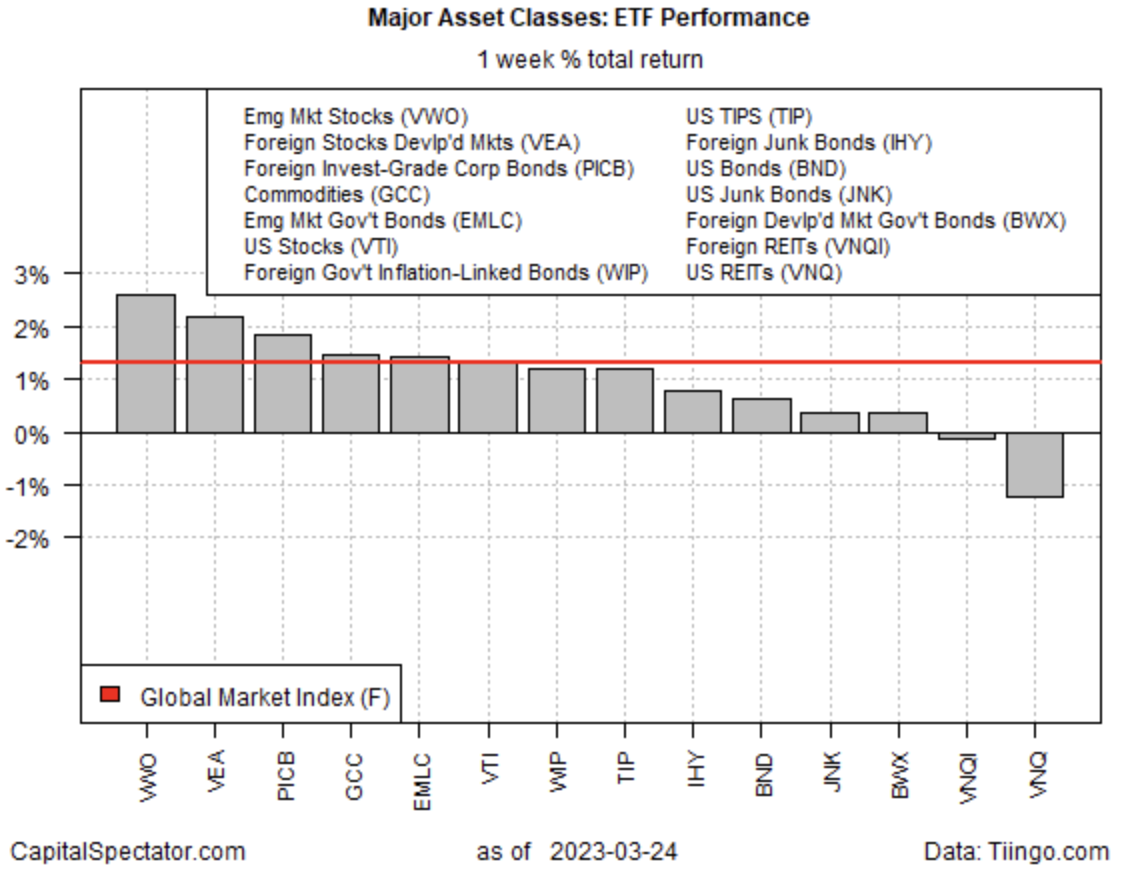

Nearly all the components of the major asset classes posted gains last week, based on a set of proxy ETFs. Real estate shares in the US and around the world were the downside exceptions, based on trading through Friday’s close (Mar. 24).

Stocks in emerging markets led last week’s rallies. Vanguard FTSE Emerging Markets Index Fund ETF Shares (NYSE:VWO) rose 2.6%, the ETF’s first weekly gain in the past three. Nonetheless, the fund still appears vulnerable to a downside bias. Unless VWO can build on its recent gains, or at least stabilize, the rise from October’s lows looks like a brief interruption in an ongoing bear market for the ETF.

Nearly all the primary markets around the world posted gains last week, with the exception of property shares in the US and abroad. Vanguard Real Estate Index Fund ETF Shares (NYSE:VNQ) posted the biggest decline, falling 1.2% and closing near its previous low in October.

REITs have suffered this year despite a moderate gain for US stocks overall. The recent banking crisis isn’t helping, says Bianca Rose, senior portfolio manager at Morningstar Investment Management. The turmoil has highlighted two risk factors for real estate firms, she explains. Real estate investment trusts (REITs) are especially vulnerable to tenant risk and financial system stability in the current environment, she advises.

Last week’s broad rally lifted the Global Market Index (GMI.F), which rose for a second week, gaining 1.3%. This unmanaged benchmark holds all the major asset classes (except cash) in market-value weights via ETFs and represents a competitive measure for multi-asset-class-portfolio strategies.

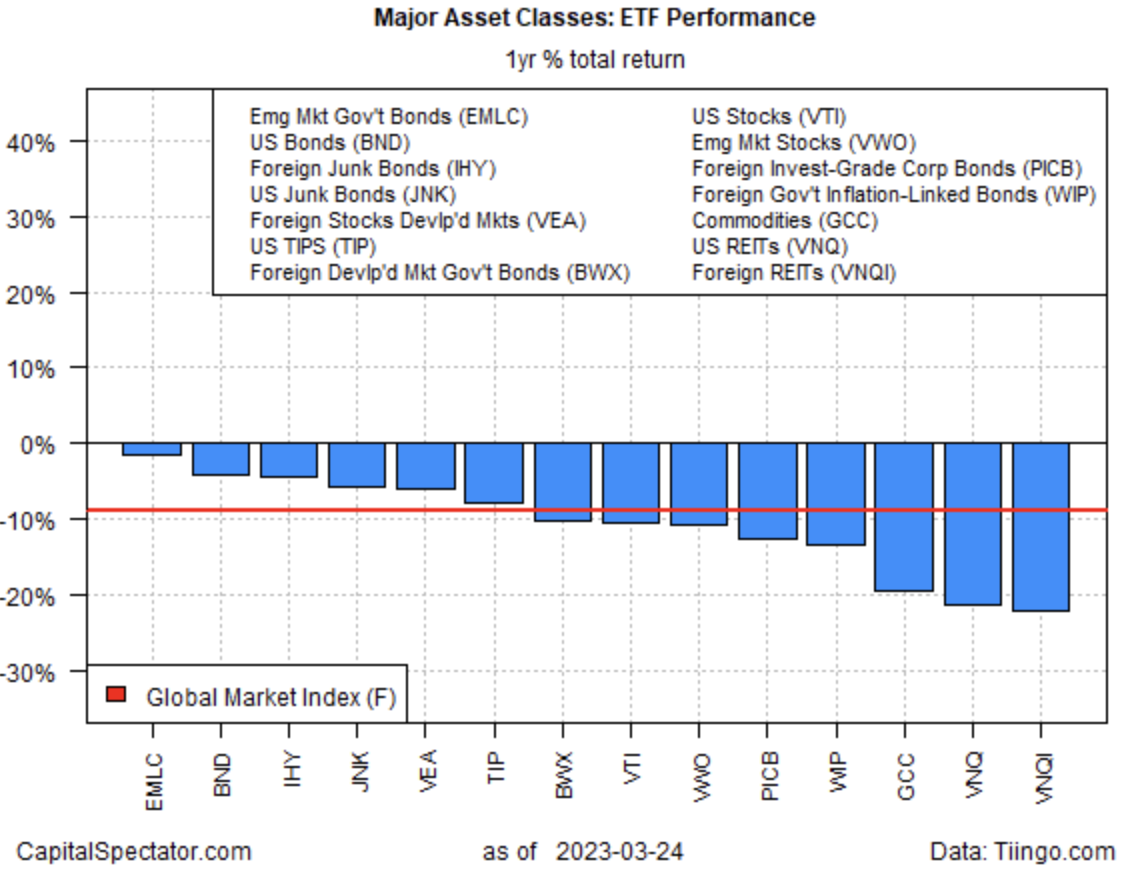

All the major asset classes remained underwater for the trailing one-year trend. The deepest one-year loser: global real estate shares outside the US via Vanguard Global ex-U.S. Real Estate Index Fund ETF Shares (NASDAQ:VNQI), which is closed down 22.1% on Friday vs. the year-ago level after factoring in distributions.

GMI.F is also in the red with an 8.9% loss over the past 12 months.

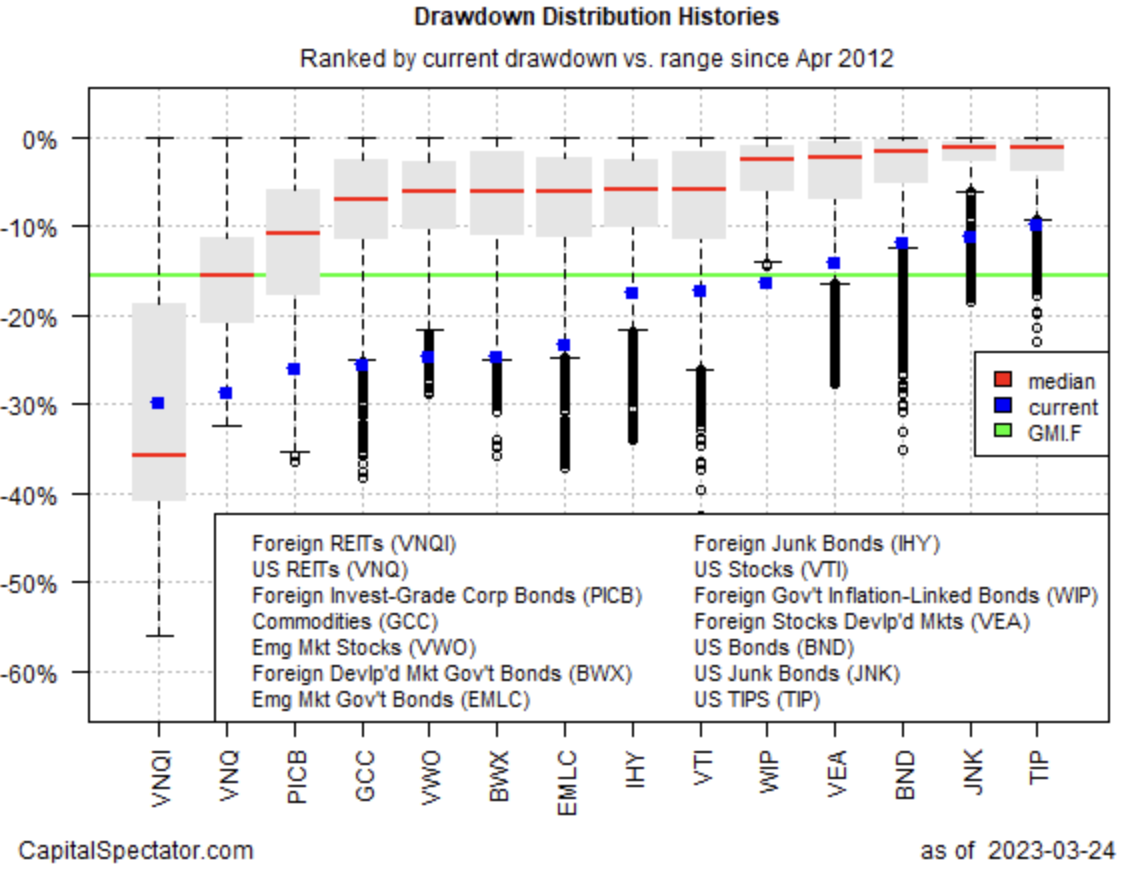

Comparing the major asset classes through a drawdown lens continues to show relatively steep declines from previous peaks for markets around the world. The softest drawdown at the end of last week: iShares TIPS Bond ETF (NYSE:TIP), which closed with a 9.9% peak-to-trough loss.