Looking at the numbers right now for cannabis stocks might make you feel like you’ve already missed the biggest party of the year. The North American Marijuana Index—a measure of the largest growers, ancillary players, and cannabinoid-based drugmakers in North America—has tripled over the past 12 months and is up more than 600% since January 2016.

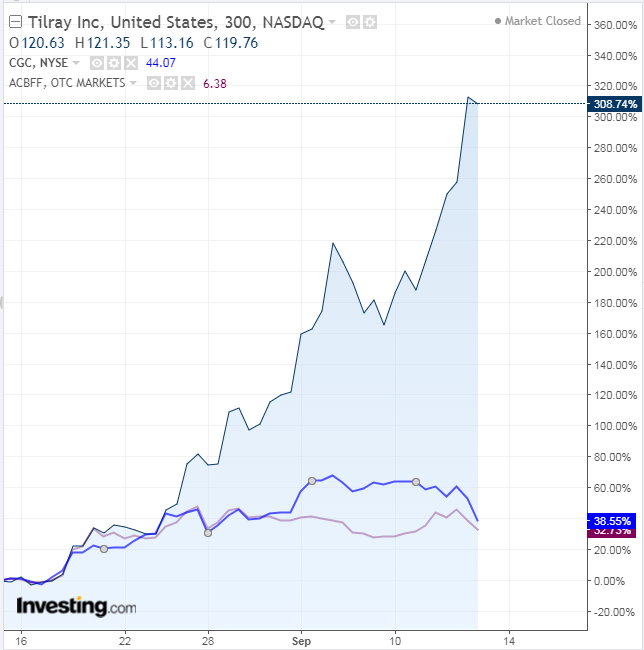

These gains have been led by Canadian producers, including Canopy Growth (NYSE:CGC), Tilray (NASDAQ:TLRY) and Aurora Cannabis (OTC:ACBFF).

Canopy Growth, for example, has almost doubled so far this year, while Tilray is up more than 300% since its initial public offering in July. If you're not following the marijuana sector, you might be wondering what’s the investor rush all about?

The biggest trigger of the eye-popping rally was Canada’s decision to legalize the recreational use of marijuana starting October 17. The assumption is lots of weed demand will shift to the legal market from the black market. Canadian adults spent C$5.7 billion ($4.39 billion) on marijuana last year, 90% of it for illegal, non-medical purposes, according to Statistics Canada.

Beyond Canada, marijuana use remains a federal crime in the US, but nine states and the District of Columbia already allow recreational consumption. Many countries, including the U.K. and Mexico, are in the process of approving use of medical marijuana, fueling expectations that global weed demand is going to surge.

Tilray stock jumped about another 12% Thursday after the medical-cannabis producer said it received regulatory approval to export more products to Germany. Tilray's medical-cannabis oil was already on shelves in German pharmacies. The company will soon be able to sell its whole-flower products as well, making it the only producer that sells both types in Germany.

A Vote of Confidence from the Booze Industry

Another reason for big excitement for the marijuana sector is the increasing interest by global alcohol producers. Constellation Brands (NYSE:STZ), the maker of Corona beer, fueled the latest investor frenzy when it announced a $3.8 billion investment in Canopy last month, increasing its stake in the producer to 38%.

Constellation Brands Chief Operating Officer Bill Newlands said early this month that the cannabis industry on its way to becoming a worldwide business.

“This is not going to be limited to Canada,” Newlands said at the Barclays Consumer Staples Conference in Boston. “This will undoubtedly be a market that develops in the United States. It’s developing around the world in places like Germany and Australia and other markets.”

So, is it still worth dipping your toes and buying some top marijuana stocks? In our view, it’s hard to justify the valuations of some of the top companies and it seems a “bong bubble” is emerging.

Tilray, valued at nearly $10 billion, currently trades at a price-to-sales ratio of about 348. That’s more than 83 times higher than Apple (NASDAQ:AAPL), the most valuable company in the S&P 500. And Canopy, with the market cap of around $6 billion, made about $60 million (C$77.9 million) in total revenue in fiscal 2018 while it was still losing money.

Bottom Line

There is no doubt that marijuana demand is surging globally and some of these companies will be able to translate that growth potential into sales. But buying at a point when these producers are entering an execution stage to prove that they can make money is a risky bet.

If the demand assumptions that are fueling gains in these stocks prove wrong, we might see a big collapse in values. After all, weed is a commodity. And every commodity trade is cyclical in nature, going through boom-and-bust cycles.

But if you’re a high-risk investor and you like speculative trades, then it’s better to stick with the market leaders, such as Canopy Growth and Aurora Cannabis. Those companies are expected to lead all growers in annual production and are well positioned to market their products.