This article was written exclusively for Investing.com

Earnings season is approaching, and it may prove to be one of the more critical earnings seasons in recent years, especially with the markets at all-time highs and valuations at peak levels. This means for stocks to continue to push higher, this earnings season, in particular, will need to not only be good, but better than expected so that estimates can be revised higher.

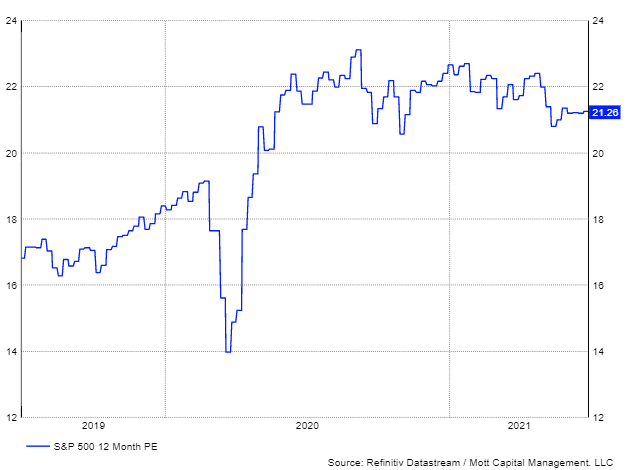

The equity market isn't cheap, currently trading around 21 times 12-month forward earnings estimates. More importantly, the multiple on the S&P 500 has been relatively constant for about a year now, trading between 20 and 23 times estimates. This is super important because stocks can only rise from here if multiples expand further in the absence of positive earnings revisions. Given the recent trend, higher multiples seem unlikely.

Multiple Expansion and Upward Revisions

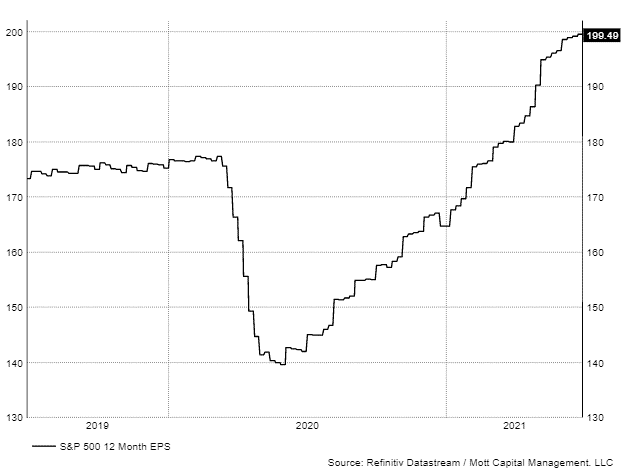

The S&P 500 currently trades at 21.2 times 12-month forward earnings estimates of roughly $200 per share. But what is evident is that the PE ratio for the S&P 500 has been above 20 since May of 2020. But more importantly, after peaking at roughly 23, it has been slowly moving lower, suggesting the market is going through a period of PE compression.

The S&P 500 has continued to push higher, despite the PE ratio declining because earnings estimates have climbed sharply. Since May of 2020, the 12-month forward earnings estimates for the S&P 500 have risen from $139.50 to approximately $200, gaining more than 43%. Unless earnings estimates continue to push higher, it will be tough for the equity market to sustain these high valuations, especially if the PE ratio continues to come down.

Slowing Growth

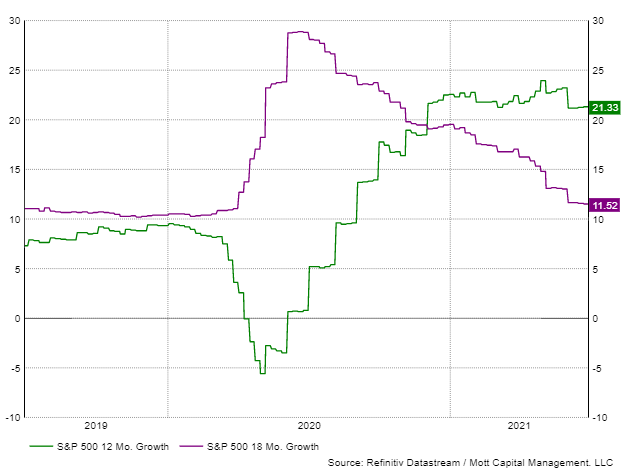

For that to happen, second-quarter results will not only need to come in as expected, but much better than expected because earnings growth rates will slow dramatically from now until the end of 2022. The growth rate on earnings for the next 12 months is currently 21.3%. However, looking at 18 month forward estimates, growth will fall to around 11.5%.

Priced To Perfection

The declining PE ratio may reflect the expectations for slowing growth rates that are likely to come in the months ahead. But if the PE ratio falls, then it will be up to positive earnings revisions to keep the S&P 500 afloat. If the second quarter doesn't deliver or, worse, disappoints, it could be a problem for the priced to perfection stock market.

It doesn't get much better for the NASDAQ Composite, with that index facing many of the same headwinds as the S&P 500. A high PE ratio and slowing growth rates also pose the same threat here. Like the S&P 500, the NASDAQ will need to see its earnings estimates continue to push higher. It will require a strong showing from the second quarter to keep the uptrend in place.

As a result, this may prove to be one of the more critical earnings seasons to come in some time. If all goes well, then perhaps the equity market rally can continue for a while longer. But if it proves to be even a hint weaker than expected, it could be a big problem for what's to come.