Jackson Hole was a pivotal moment for markets; as Federal Reserve Chair, Jay Powell indicated, he was earnest about getting inflation to cool off, and it was going to be a long and challenging road ahead. The markets got the message loud and clear, resulting in a massive decline over the next several weeks.

But since that October low, the S&P 500 has increased sharply, almost 16%. It has yet to reach the massive gains witnessed in August, where the S&P climbed by nearly 19%, but the gains are still enormous. The significant increases have resulted in a considerable easing of financial conditions, likely to pressure Powell to confront the markets again on Nov. 30.

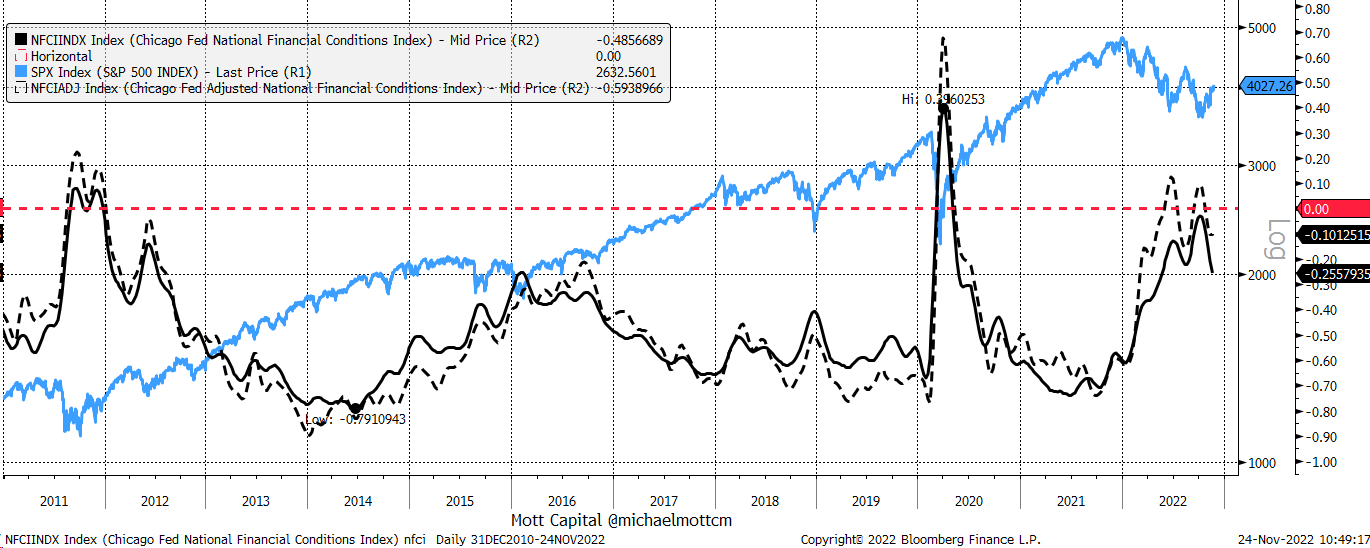

Financial Conditions Have Eased Too Much

What makes this Nov. 30 speaking event at the Brookings Institution all the more interesting is that financial conditions have eased back to levels that were last seen in August heading into Jackson Hole, and by one measure easier than at Jackson Hole.

The Chicago Fed National Financial Conditions Index (NFCI) and Adjusted NFCI show that conditions have eased dramatically from being restrictive back to being accommodative. The Adjusted NFCI has fallen back to its August lows, but the traditional measure has fallen below its August lows.

This is a problem for the Fed and potentially why Jay Powell will need to deliver a more hawkish message to markets at the end of November. The Fed transmits monetary policy through verbal guidance and rate hikes; this results in financial conditions easing or tightening. The Fed has made it clear that its monetary policy needs to be restrictive. The data showed that the policy had become restrictive in late October and early November. However, since the CPI report, that has all changed.

The October CPI Report May Have Given False Hope

The CPI report gave investors hope that the US has seen peak inflation, and that may very well be the case, or it may not be the case. The October CPI report had a hidden fact that many investors may have overlooked due to a change in the health insurance costs, which had to do with a technical change in its calculation. This change will not be reflected in the PCE and Core PCE results when they come out on Dec. 1. Currently, estimates for PCE are for it to rise by 6% year on year (yoy), while core PCE is expected to increase by 5.0% yoy.

Jay Powell needs to re-emphasize on Nov. 30 the Fed's commitment to raising rates to bring inflation down through tighter financial conditions and that one CPI will not be enough to suggest the Fed's job is done.