- August was a terrible month for markets

- All eyes on upcoming inflation data, Fed policy meeting

- Investors should brace for retest of June 16 low

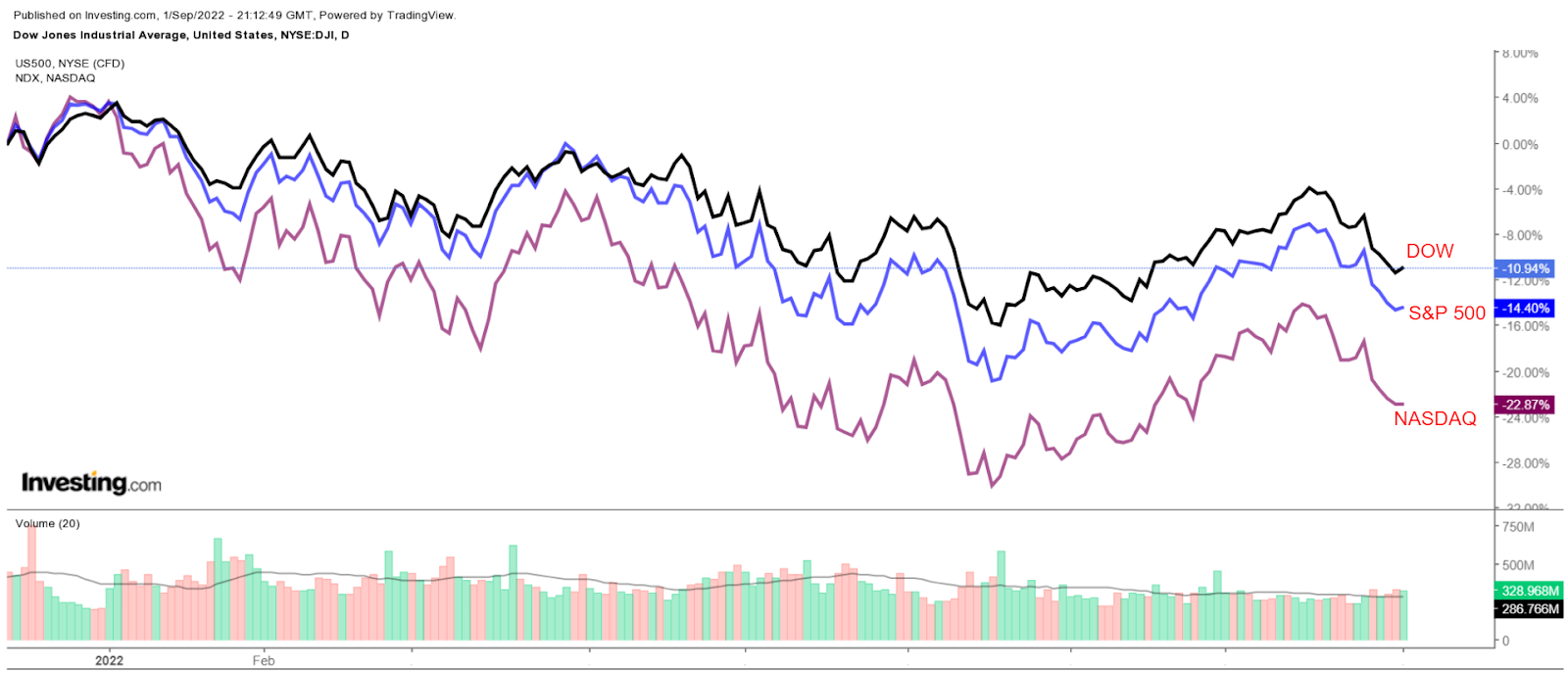

Coming off their worst August since 2015, stocks on Wall Street have gotten off to a volatile start to September as investors worry about the Federal Reserve’s aggressive rate hike plans to combat soaring inflation.

Year to date (ytd) the S&P 500 is down 16.5%, the Dow dropped 12.7%, and the Nasdaq slumped 24.8%.

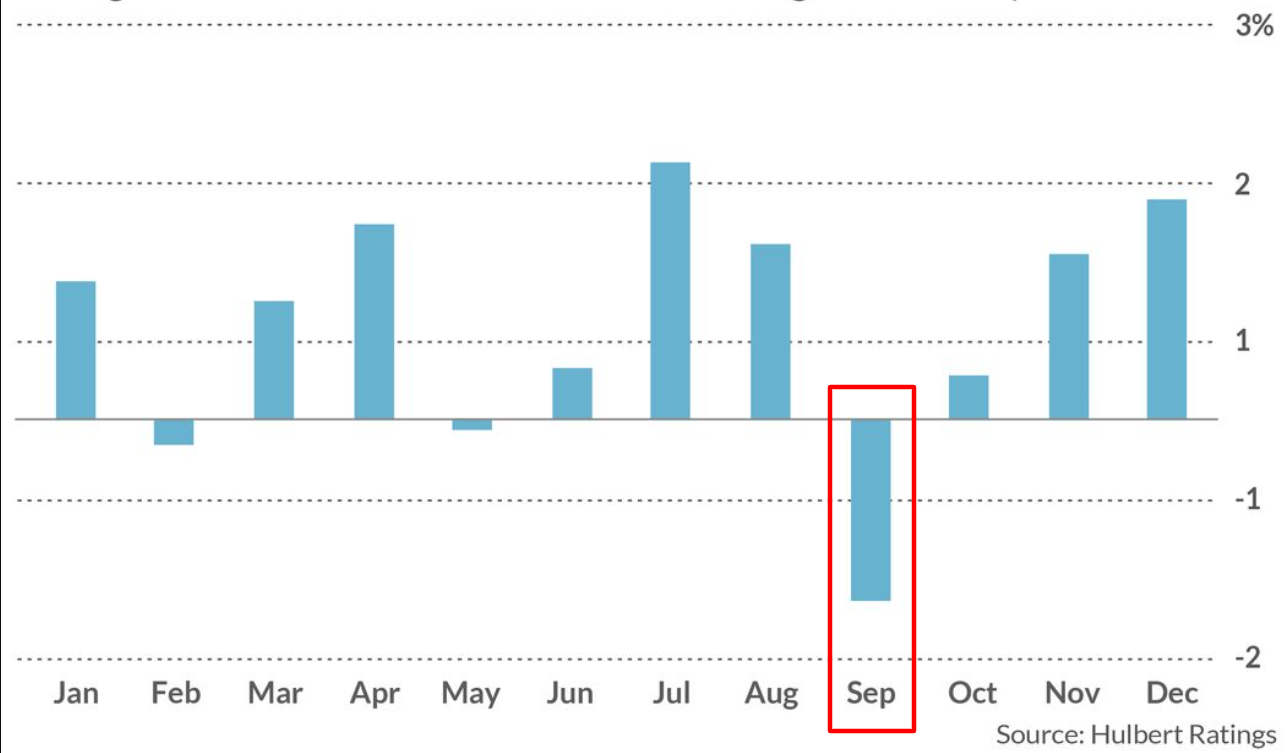

Judging by recent history, investors should brace for further turmoil as September is historically the worst month of the year for markets. Since 1897—the first full year of the Dow Jones Industrial Average’s existence—the blue-chip index has suffered an average loss of -1.13% in September compared to an average gain of 0.77% for the other months of the year.

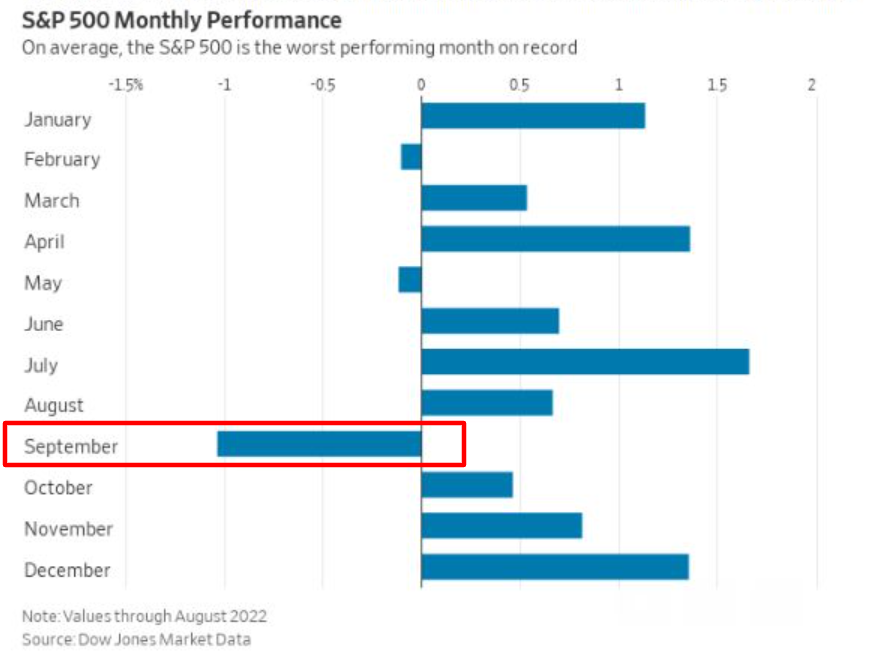

The same is true for the S&P 500. Its average September return dating back to 1928 is negative 1.03%.

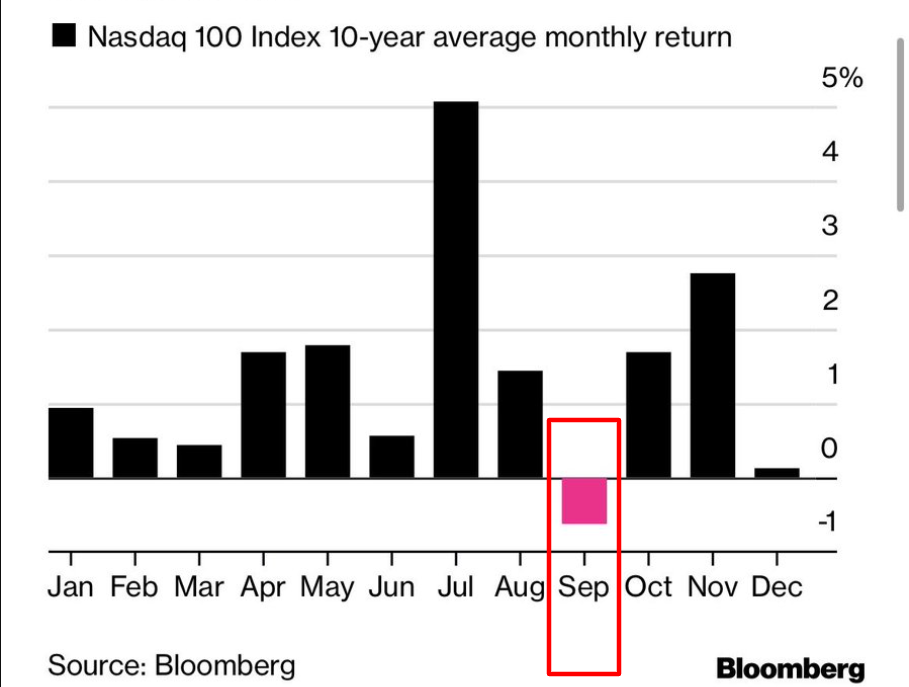

Over the last decade, the tech-heavy Nasdaq 100 has declined by an average of 0.6% in September—the only month of the year with a negative return.

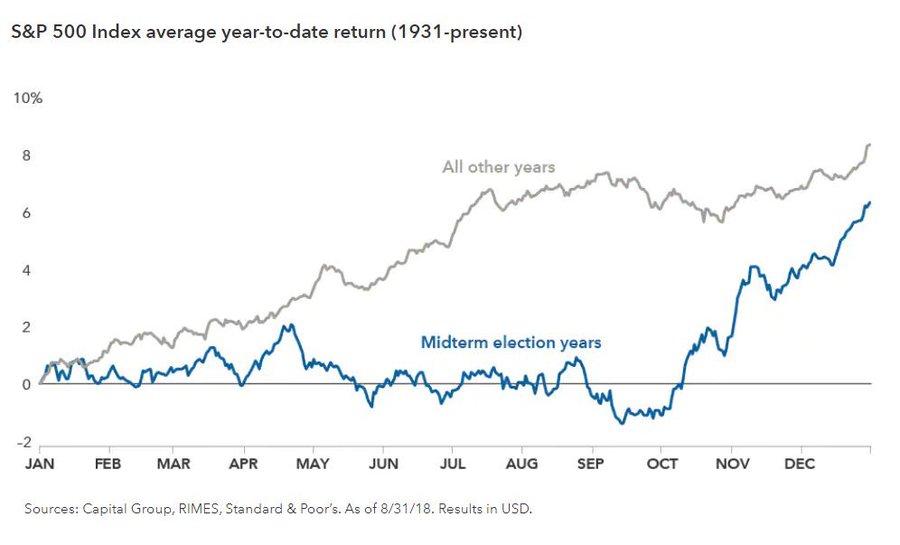

September has historically provided even more of a seasonal headwind during a midterm election year. The Dow has dropped in 11 out of the last 18 pre-midterm Septembers going back to 1950, according to data from the Stock Trader's Almanac.

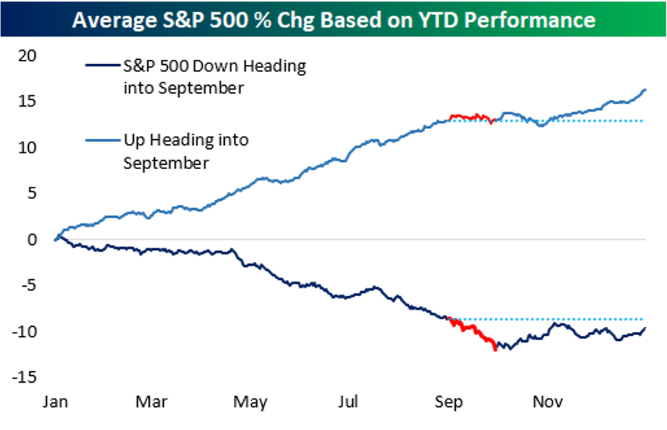

When the S&P 500 has been down ytd heading into September —as it is this year—the index has averaged a loss of 3.4% during the month. Whereas, when the S&P was up ytd going into September, it has been flat for the month, according to Bespoke Investment Group, citing S&P 500 market performance dating back to 1928. It added:

“For the remainder of the year, the index has averaged a loss of 1.2% when coming into September with ytd losses and a gain of 3.3% when coming into September up ytd.”

Moves in the options market also seem to indicate more pain ahead. The number of outstanding bearish options contracts on the QQQ ETF—which tracks the Nasdaq 100—is currently near its highest level since the 2000 dotcom crash.

Until we get further clarity on the Fed’s rate hike trajectory, as well as its plans to shrink its massive $9 trillion balance sheet, I have a hard time seeing how risk assets can make a sustainable rally.

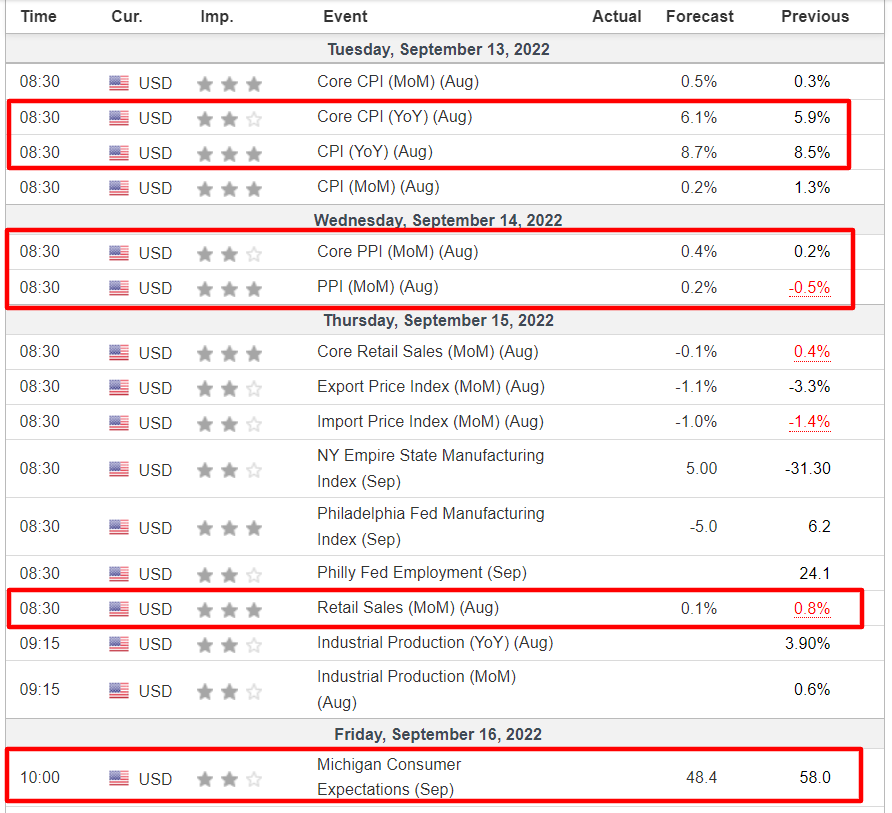

There are a plethora of market-moving events coming up this month, particularly the August consumer price index (CPI) report and of course the Fed’s key policy meeting. Analysts expect CPI could be hotter than July’s 8.5% year-over-year (yoy) pace.

Fed Chair Jerome Powell signaled in his Jackson Hole speech in late August that there will be no pivot to a looser policy stance until inflation is tamed.

The probability of a 75-basis-point rate hike has jumped in the past week from 64% to 75% and a half-point increase is now seen as less likely. The Fed has already raised its benchmark interest rate by 225 basis points this year.

I expect Powell to reiterate his Jackson Hole “pain” message, so investors should be prepared for the S&P 500 retesting its June 16 low—a decline of approximately 8% from current levels.

As the old Wall Street market adage says, don’t fight the Fed.

Disclosure: At the time of writing, Jesse has no position in any stocks mentioned. The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.