Warren Buffett (Trades, Portfolio), arguably the greatest investor of all time, has said, It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price.

Meta Platforms Inc. (NASDAQ:META) is a wonderful company that I believe is trading at a fair price. It operates a highly profitable, capital-light business with a wide moat around it. Moreover, the company has a number of potential growth drivers which should allow it to grow earnings per share at an above-market rate over the next decade.

The world's leading social media companyAs the world's leading social media company in terms of reach and profitability, its key platforms include Facebook (NASDAQ:META), Instagram, Messenger and WhatsApp. In total, Meta's platforms have a total daily active people count of 3.27 billion. The company's primary revenue source is advertising sales and it generates roughly $11.89 of revenue each quarter per daily active person on its platforms. The business is not highly capital intensive and has delivered very strong returns on invested capital historically.

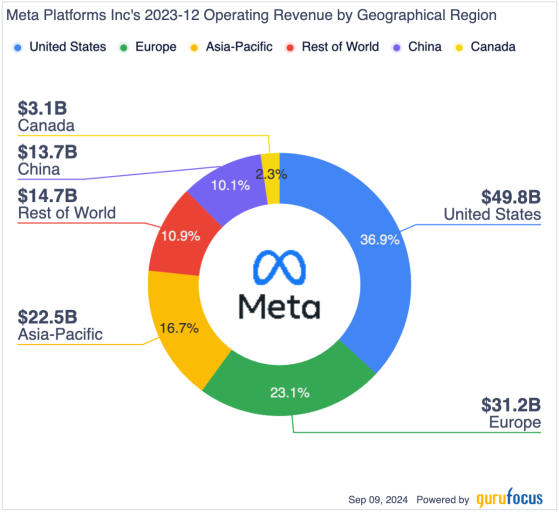

Meta Platforms is a global business which derives roughly 37% of its revenue from the U.S. Europe accounts for roughly 23% of total revenue. Key international markets outside the U.S. and Europe include India, Brazil, Indonesia and Mexico.

Network effects create a wide moatMeta Platforms has a wide moat around its business, driven by network effects and data. People tend to be active on social media platforms as it allows them to engage with the world around them. Its main platforms have massive scale, making them attractive for individuals who are new to social media and want to engage with people they know as well as build new connections. Comparably, smaller platforms do not offer individuals the same level of reach and often struggle to grow as they do not have the critical mass that existing platforms already have.

The company's large number of users also gives it a massive amount of data, which it then uses to sell targeted advertising. The value proposition of a smaller network is more challenging to advertisers as they simply have less data and users to target. Meta's significant advertising revenue provides strong cash flows that can be reinvested into the business to enhance its offerings.

For these reasons, it is very hard to new entrants to emerge in the social media space. A key exception has been TikTok, which was launched in 2016 and has grown to have an estimated 1.50 billion monthly active users. However, it should be noted the platform is somewhat complementary to Meta's offerings as TikTok content is often shared on Instagram. Moreover, its emergence as a leading competitor (though one with significantly fewer users) has not hurt Meta Platforms much as the company continues to deliver solid user expansion and revenue growth. Over the past decade, the social media giant has grown revenue and earnings per share at annual rates of roughly 33% and 36%.

Significant growth opportunitiesMeta Platforms has a number of key growth drivers that will allow it to continue generating solid earnings growth. Perhaps the most significant growth opportunity for the company is to expand its average revenue per user outside of the U.S. and Canada. As of the most recently disclosed figures, on a quarterly basis, the company generates roughly $68 per user in the U.S. and Canada compared to just $23.10 per user in Europe, $5.50 per user in Asia and $4.50 per user in the rest of world. Given the low revenue per user outside of the U.S., Canada and Europe, I believe Meta is well positioned to benefit from growth in emerging economies such as India, which has the most Facebook users of any country.

Another key growth driver for the company is artificial intelligence, an opportunity of which CEO Mark Zuckerberg discussed on the second-quarter earnings call:

Across Facebook and Instagram, advances in AI continue to improve the quality of recommendations and drive engagementIn this quarter, we rolled out our full screen video player and unified video recommendation service across Facebook, bringing Reels, longer videos, and live into a single experience. And this has allowed us to extend our unified AI systems, which had already increased engagement on Facebook Reels more than our initial move from CPUs to GPUs didValuation is reasonable Meta Platforms currently trades at 23.50 times consensus 2024 earnings per share and 20.50 times consensus 2025 earnings per share. Comparably, the S&P 500 trades at roughly 22.50 times consensus one-year forward earnings. Thus, on a relative basis, Meta is trading at a modest discount to the broader market. I do not believe this discount is warranted given the wide moat around Meta's business and significant long-term growth prospects.AI is also going to significantly evolve our services for advertisers in some exciting ways. It used to be that advertisers came to us with a specific audience they wanted to reach, like a certain age group, geography, or interests. Eventually, we got to the point where our ad systems could better predict who would be interested than the advertisers could themselves. But today, advertisers still need to develop creative themselves. And in the coming years, AI will be able to generate creative for advertisers as well. And we'll also be able to personalize it as people see it

Moving on to some of the brand new experiences that AI enables, last quarter we started broadly rolling out our assistant Meta AI, and it is on track to achieve our goal of becoming the most used AI assistant by the end of the year.

In addition to being reasonably priced relative the broader market, I also find Meta to be reasonably priced compared to peers. Perhaps the closest peer company is Alphabet (NASDAQ:GOOGL) (NASDAQ:GOOG) given the fact it is the other dominant player in the online advertising business. Currently, Alphabet trades at roughly 20 times full-year earnings per share and 17.50 times consensus 2025 earnings per share. I believe Meta deserves to trade at a premium to Alphabet due to its stronger position in AI and lower degree of regulatory risk. Moreover, the technology represents a key threat to the search business as services such as ChatGPT could result in a reduction in search traffic in the future.

Another relevant peer comparison is Snap (NYSE:NYSE:SNAP), which trades at 23 times consensus 2025 earnings per share. While Snap is expected to experience faster near-term earnings growth than Meta, the company has a historically struggled to meet analyst estimates and deliver profitability.

Meta is also trading at a discount to its historical median valuation over the past 10 years of roughly 31 times earnings per share and thus is reasonably valued versus its own historical valuation norms. Consensus estimates currently call for the company to deliver earnings per share growth of 14.40% for 2025, 15% for 2026 and 8.70% for 2027. I view these estimates as too conservative given the strong potential growth tailwinds the company has due to AI and international monetization.

Regulatory risksOne key risk to the Meta Platforms bull case is regulatory risk. As the leading social media platform globally with limited competition, Meta is exposed to potential antitrust litigation due to its strong market power. Thus far, regulations in Europe have been the most aggressive in terms forcing Meta to change how it operates as it was forced to roll out an option for users to pay and use its platforms ad free. European Union regulators have recently accused the company of failing to comply with the recently enacted Digital Markets Act regulations. If Meta is found to have violated the law, it could be subject to a fine of up to 10% of its global revenue.

Meta Platforms also faces ongoing regulatory challenges in the U.S. from the Federal Trade Commission as it has been accused of monopolizing the social networking market via the acquisitions of Instagram and WhatsApp. The company has responded by arguing there is no evidence to support FTC claims and has asked the court to dismiss the case. The outcome of the case remains to be seen and thus, represents a significant risk for Meta. That said, even in the unlikely scenario in which Meta was forced to break itself up, I do not believe shareholders would suffer substantial losses as Facebook, Instagram and WhatsApp would each be highly valuable standalone businesses due to their scale and user data.

Conclusion Meta Platforms is a wonderful company with a bright future. The company enjoys a wide moat around its business due to network effects and the vast amount of user data it has access to. Despite posting more than 30% annual earnings growth over the past decade, the company continues to have significant growth potential related to increased monetization in developing markets as well as AI.

The stock trades at a modest valuation discount to the broader market and at a discount relative to its median historical valuation. Moreover, I also believe the stock is trading at a reasonable valuation relative to peers such as Alphabet and Snap. Thus, investors currently have an opportunity to buy a wonderful company at a fair price.

Regulatory risks remain key a concern that investors should monitor, but the strength of each of Meta's platforms on their own suggests shareholders would not experience a significant erosion of value in the unlikely event of a forced breakup of the company.

This content was originally published on Gurufocus.com