Yesterday's economic data generated a sizable gap down across indices which carried into the open and for the morning session.

At this point, bears had all the momentum until buyers made their appearance and kept buying pressure right into the close.

The net result was to leave large bullish candlesticks that offer bulls something to work with for the rest of the week.

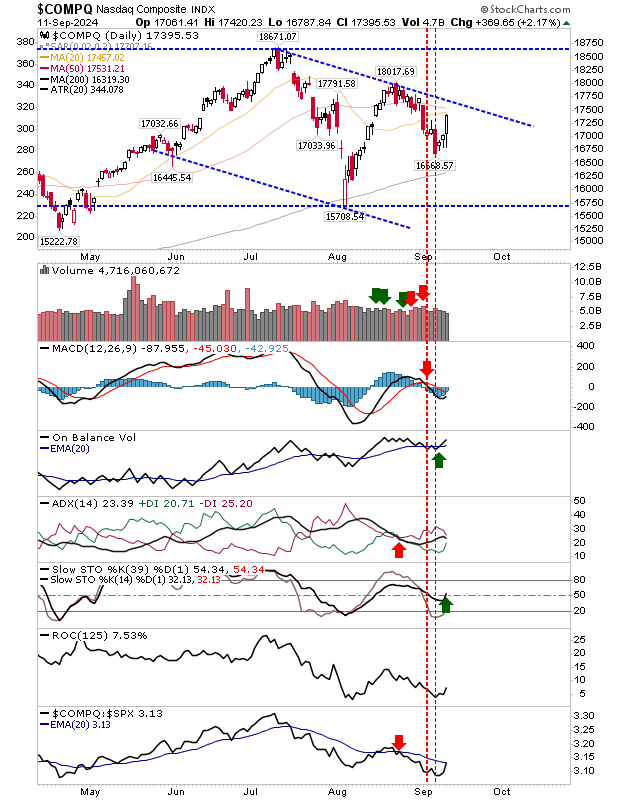

The Nasdaq enjoyed a more traditional response to Monday's bullish harami, not undercutting the lows and negating Friday's sizable bearish candlestick. It will have to contend with the convergence of 20-day and 50-day MA overhead supply.

There was a return above the mid-line of stochastics, suggesting the recent decline is a pullback in a new bullish trend, to go with the earlier 'buy' trigger in On-Balance-Volume.

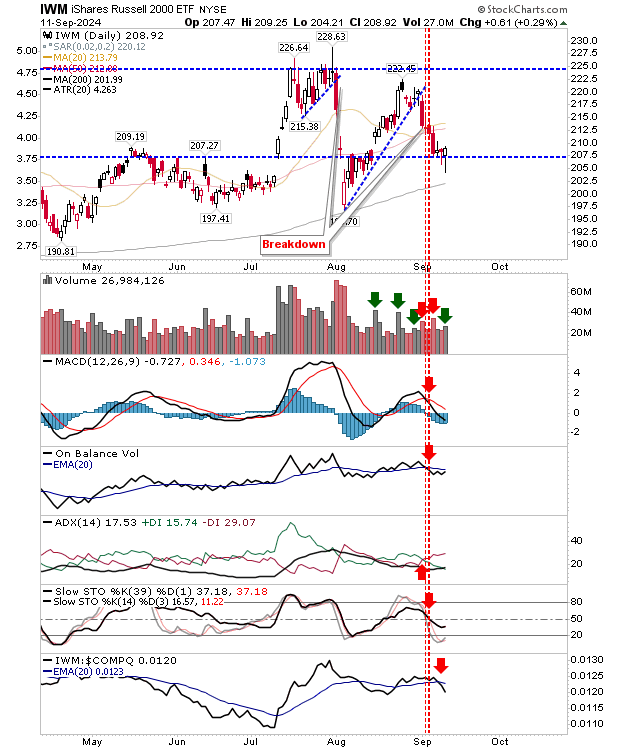

Starting with the Russell 2000 (IWM). The bullish 'hammer' occurred at $207.50 support, although the low didn't quite tag the 200-day MA.

Technicals are net bearish and the index expanded in its relative underperformance to the Nasdaq and S&P, so we may need to see a retest of yesterday's lows before the challenge of prior highs can commence.

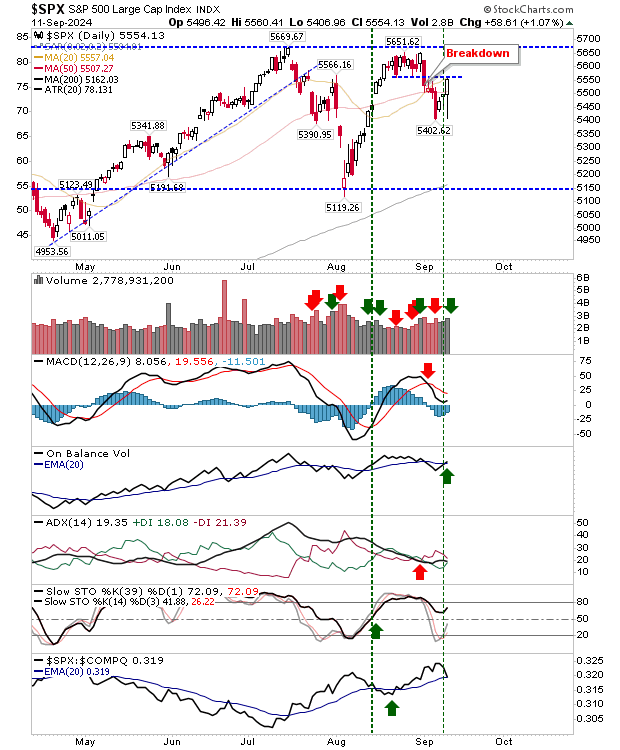

The S&P made it back to the lows of August price 'handle' of former support, turned resistance.

It was an impressive day, but it's hard to see this generating another big upside day tommorrow, but if the S&P can hold at or above its opening price - near yesterday's close - then the index will be well positioned to challenge all-time highs.

Technicals saw a fresh 'buy' signal in On-Balance-Volume to add to bullish stochastics (momentum) and relative outperformance to the Nasdaq and Russell 2000.

For today, there will likely be consolidation. As long as indices don't give up too much ground relative to yesterday's close then bulls can look forward to the challenge of highs in the coming weeks.