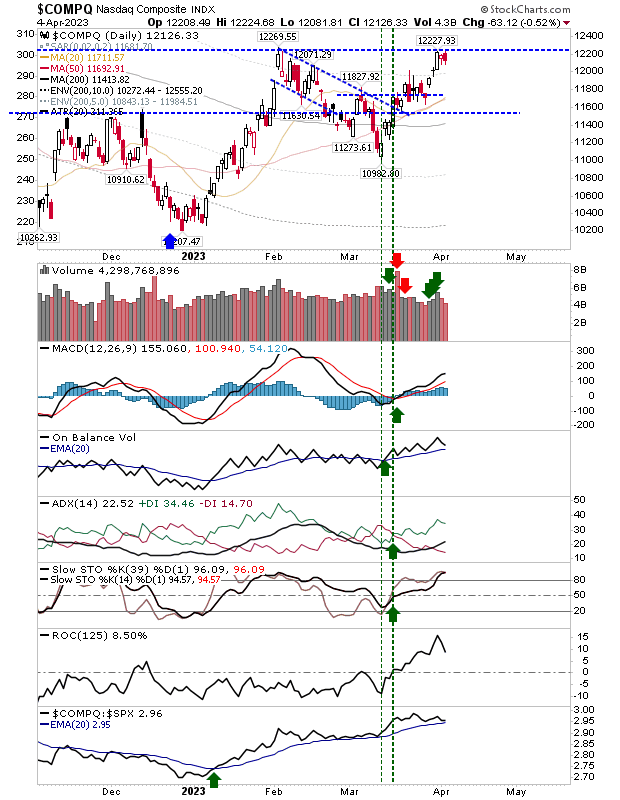

Markets experienced modest losses, but the market still has underlying strength. The Nasdaq is primed to break to a new swing high, helped by the relatively light volume associated with today's selling. Technicals remain net bullish, although the index did lose some relative performance against the S&P 500. However, I remain optimistic about the Nasdaq going forward.

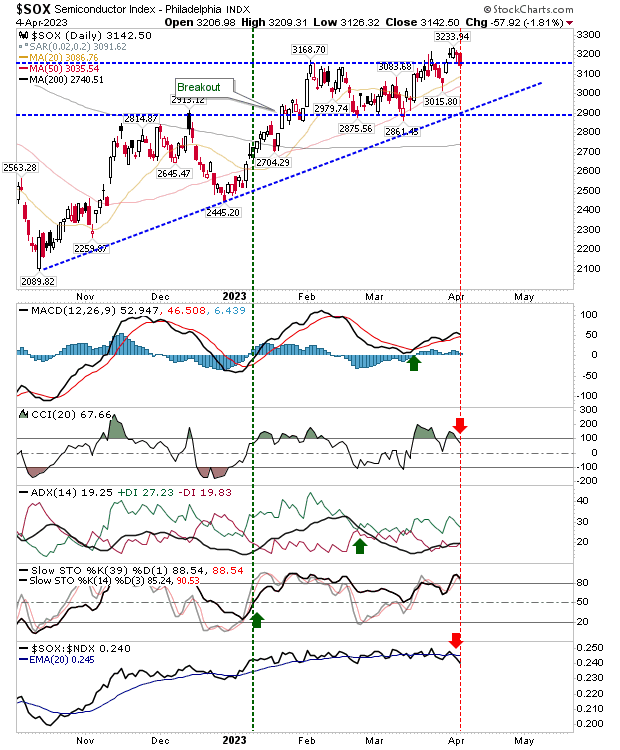

The index fueling strength in the Nasdaq is the Semiconductor Index. But where the Nasdaq is getting ready to break, the Semiconductor index has drifted below its early breakout to the point it's now underperforming relative to the Nasdaq 100. The index trades above key moving averages, with only the CCI on a 'sell' signal.

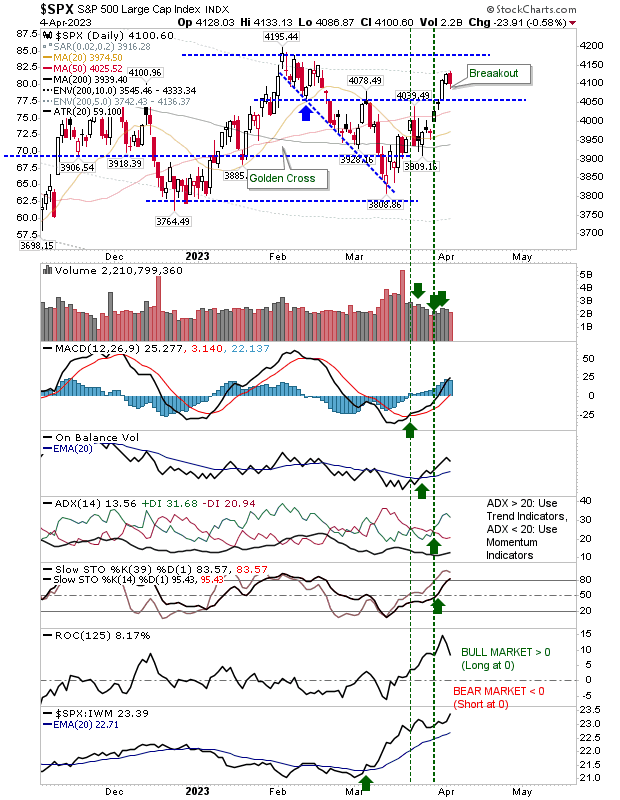

The S&P 500 hasn't yet challenged the February high but has at least taken out the March swing high. While the index isn't performing as strong as the Nasdaq, it does have strong supporting technicals. Strength in technicals helps offset some of the weakness in price; look for an intraday spike low down to 4,050, but it would be important for the real-body (open & close price) of the candlestick to stay above 4,050.

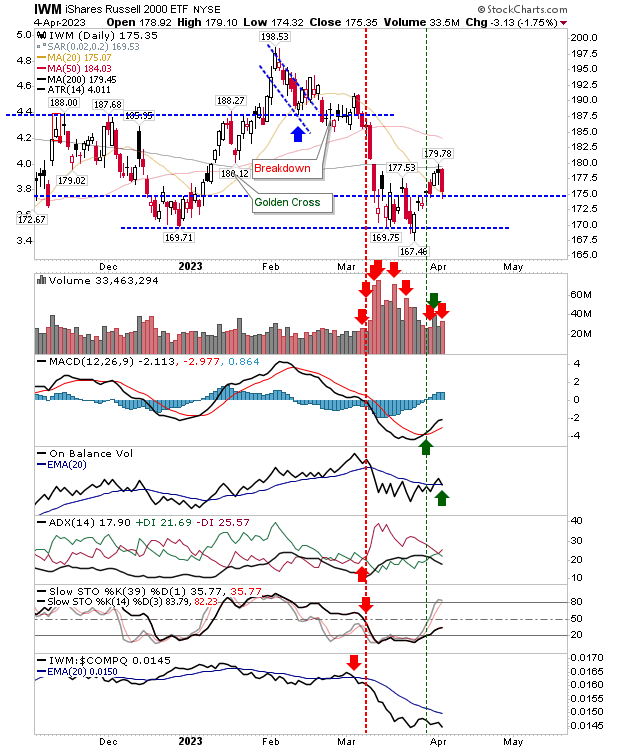

The index which is struggling the most is the Russell 2000 (IWM). And an index that is down will feel the most pain when markets are experiencing selling. Momentum for the Russell 2000 is firmly bearish with stochastics [39,1] below the mid-line and a negative trend in ADX, not to mention the sharp relative underperformance to the Nasdaq and S&P.

On-Balance-Volume is on the verge of a 'sell' signal, and the 'buy' signal in the MACD is undermined by its trigger below the bullish zero line. There isn't much to like here - and if bears were to get their crash - then the Russell 2000 would be the index to deliver on this first. As long as the real-body candlestick remains above $170 ($IWM), the development of a double bottom remains in play.

Going forward, we have the Nasdaq ready to break key resistance and a Russell 2000 toying with crucial support. If you are a long, you are looking at trading the former, but shorts have reason to work the latter index. Shorts in the Russell 2000 ($IWM) would assess risk above $179.78, also its 200-day MA. Longs in the Nasdaq can trail a stop with a close below its 50-day MA.