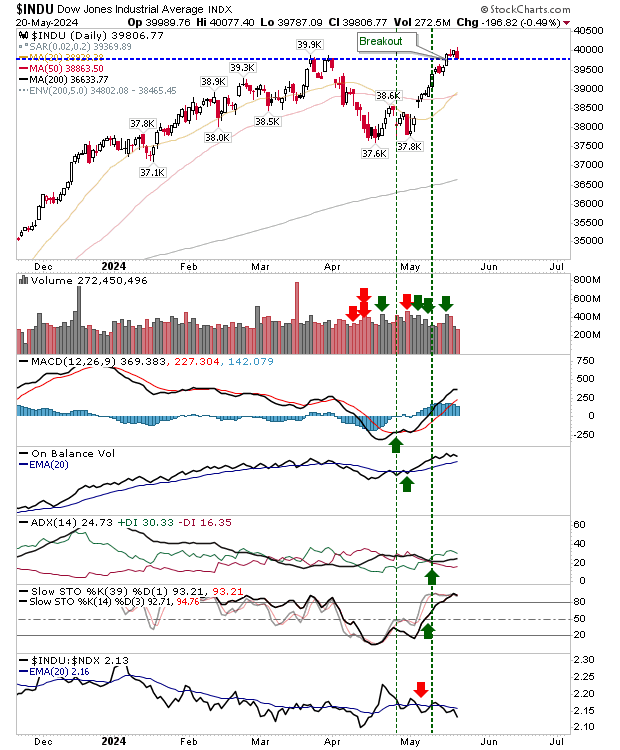

It was perhaps a little premature to pop the champagne on the Dow Jones Industrial Average break of 40,000, but it looks like it will be a few more days before the psychological 40K level in the rear view mirror.

Yesterday's losses were not excessive, and didn't reverse the breakout, but there is the potential for a longer move back to its converged 20-day/50-day MAs.

The index is underperforming the Nasdaq 100, which is bullish for the broader market, but not great for the Dow; if there are traders looking at a value entry, 38,500 would be a good place to start (if it gets there).

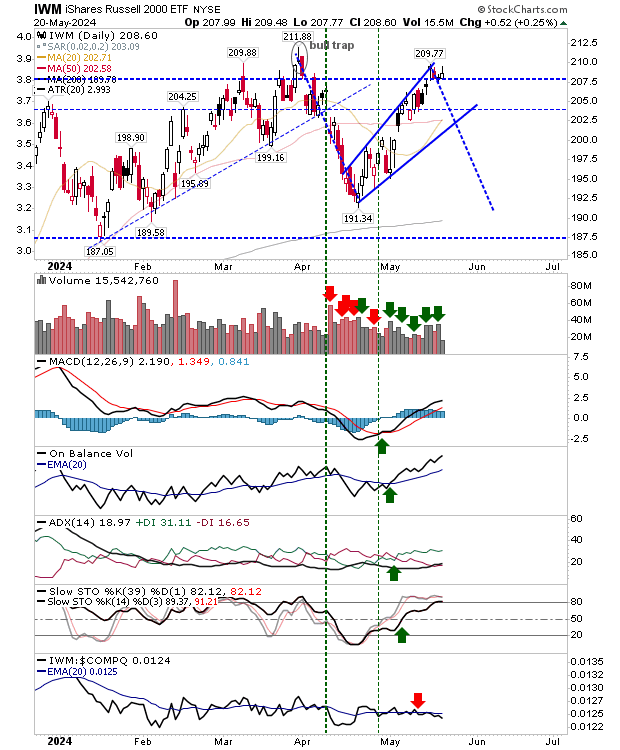

The Russell 2000 (IWM) continues to struggle a little to get past its 'bull trap'.

Yesterday's buying was light, and was pegged back on the challenge of last week's highs. The longer it stays above $207.50, the greater the chance of new all-time highs; it should be noted, broad wedge support will tag $207.50 by the end of June. It may take a move down and off its 20-day MA, before the all-time high challenge can begin.

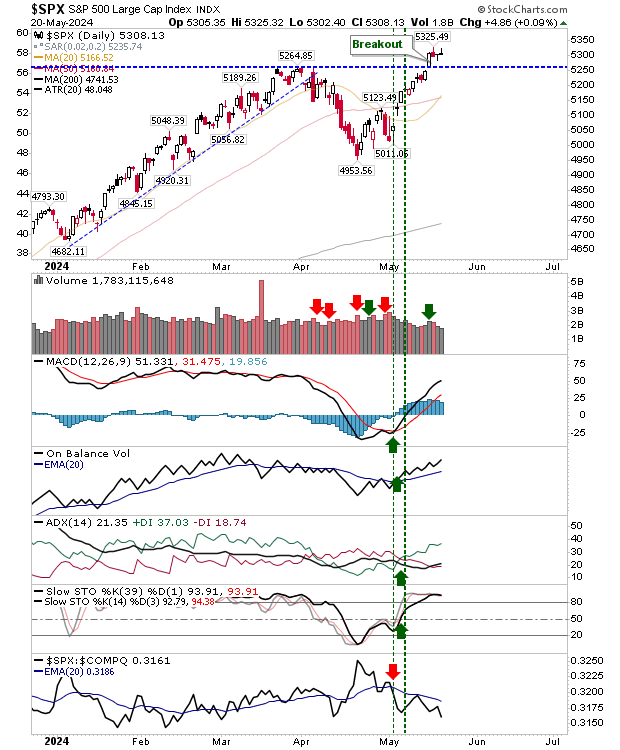

The S&P 500 closed with a small doji that wasn't able to cash-in as a gain, but didn't drop into Friday's trading that could signal a reversal. Technicals remain net bullish.

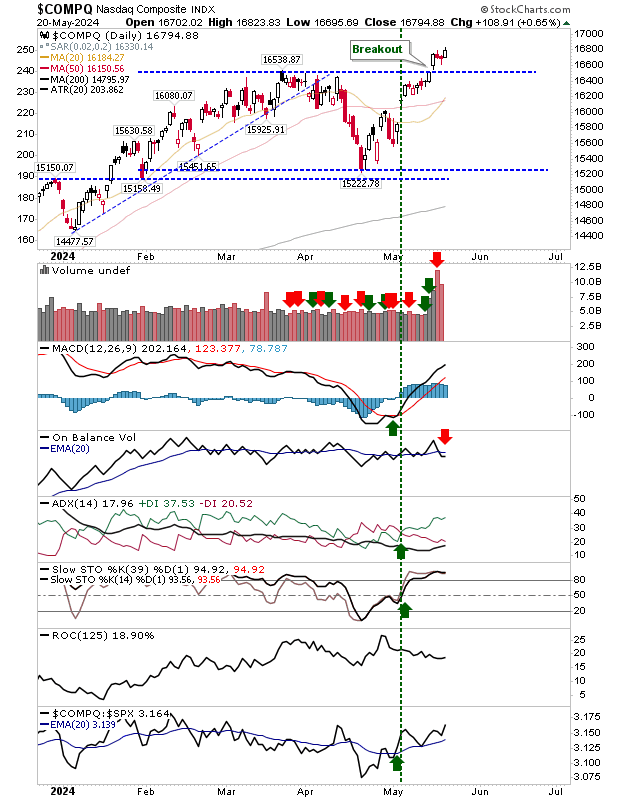

The Nasdaq was the only index to post a gain and is the index most likely to accelerate higher. Ironically, it's the only index that isn't technically net bullish, but is outperforming its peers.

For the coming days, we would like to see the breakouts hold, but if it's going to take longer to get the upside acceleration, then low volume, narrow day losses would be tolerable.

If the latter action emerges, look to 20-day MAs to provide the rallying point.