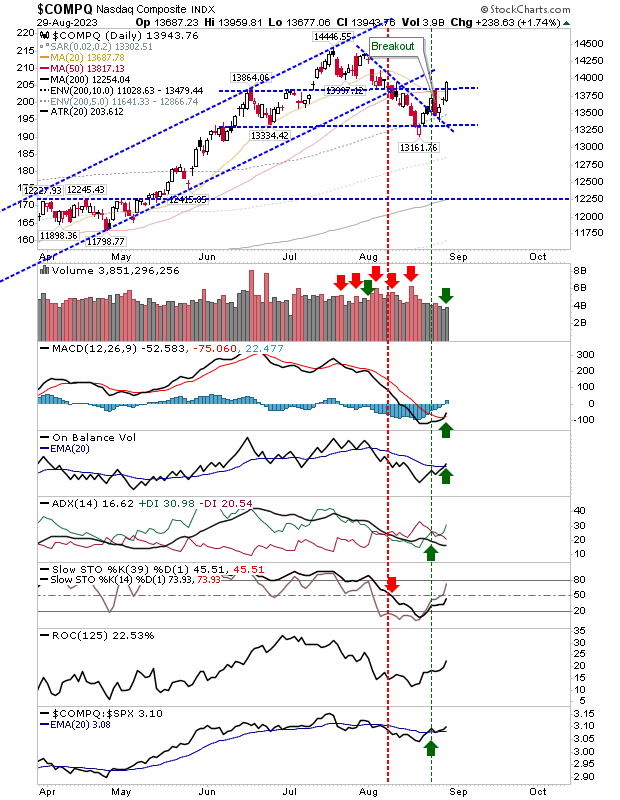

Today was a good day for bulls, but there is still work to do before technicals turn net bullish. For the Nasdaq, what was particularly gratifying was the close above the high of the bearish engulfing pattern from last week, along with key moving averages.

This came on the back of new 'buy' signals for the MACD, On-Balance-Volume, and ADX - along with net accumulation for volume. It was a solid day, with the sort of candlestick that often represents the anchor for a swing low, but let's not get ahead of ourselves.

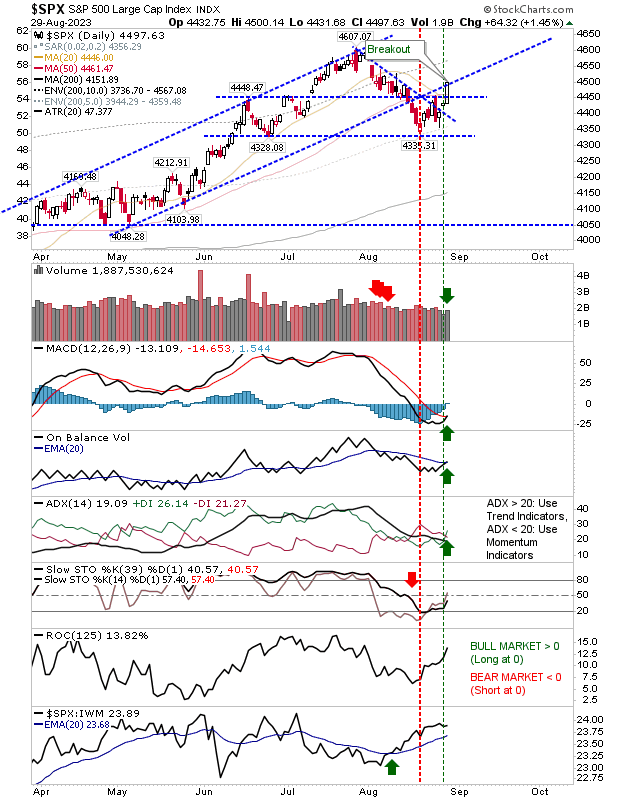

The S&P 500 had a similar kind of day as the Nasdaq, packing gains on higher volume accumulation from a start at converged 20-day and 50-day MAs. ADX, On-Balance-Volume, and the MACD are all on 'buy' signals with only stochastics left to turn bullish.

The S&P 500 is outperforming the Russell 2000, but not the Nasdaq. One thing to watch for tomorrow is if today's buying will act on resistance derived from the former rising channel.

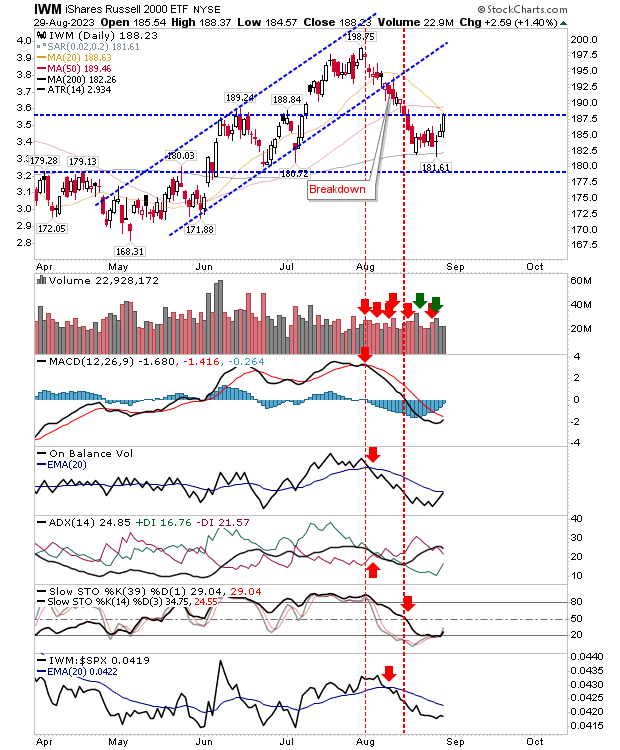

The Russell 2000 (IWM) had experienced the largest sell-off from the July high, bringing it well inside the prior consolidation, leaving it with the most work to do to get out of it.

There was no confirmed accumulation, and neither was there a bullish turn in technicals. Also, 20-day and 50-day MAs remain as potential resistance. So while the S&P 500 and Nasdaq flourish, the Russell 2000 has a tonne of work to do.

Up until today, everything was pointing to a bear-style bounce. Today's action was the first indication that there may be stronger buying behind the day's gain. While I consider market action a 'hold' for those looking for a long-side trade, today is one such chance.