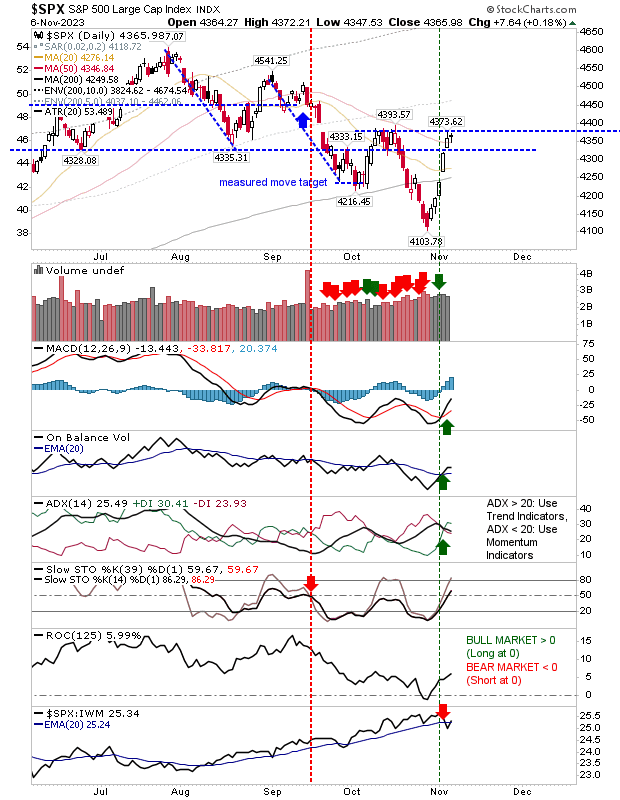

No surprise to see sellers come in after last week's solid gains. The good news is that selling volume was well down on last week's buying, and price action was relatively stable in the Nasdaq and S&P 500.

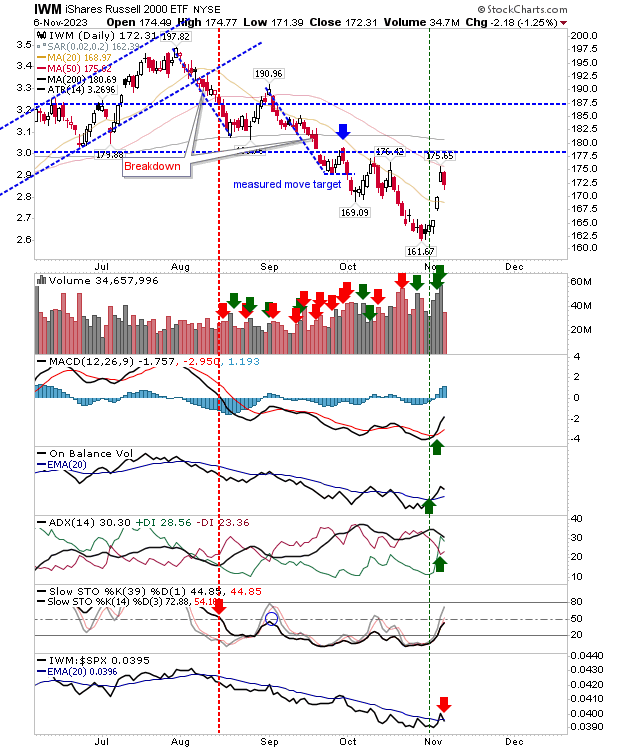

The Russell 2000 (IWM) was rebuffed by its 50-day MA, but it's going to take a few days of selling before this could be viewed as a concern.

The worry for bulls is that all of last week's buying was unable to push intermediate stochastics above the bullish midline, and yesterday's selling registered as a relative loss against the S&P 500.

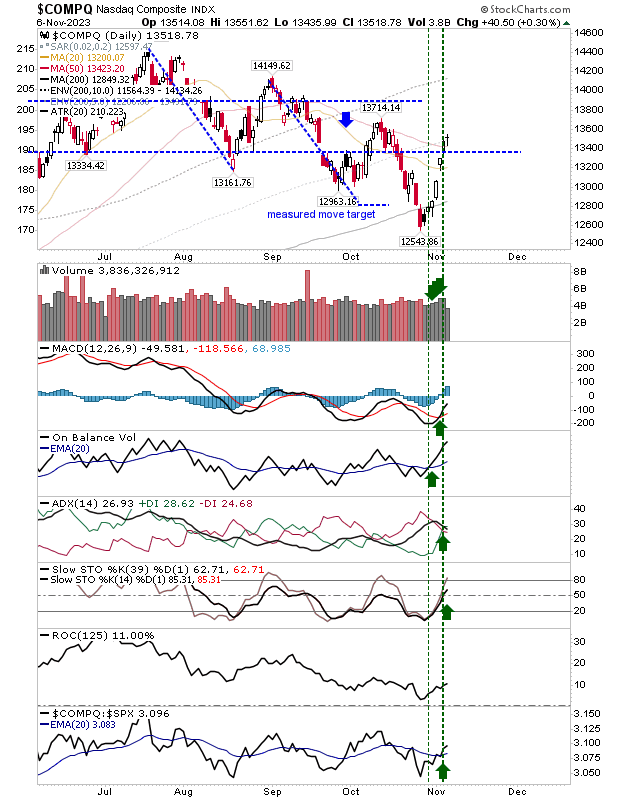

The Nasdaq closed with a neutral 'doji' just above its 50-day MA. While not a "down" day, the doji often marks the end of a rally (or decline). Volume was down on the previous buying. Relative performance to the S&P 500 remains mixed with sideways zig-zagging.

The S&P 500 is in a similar predicament to the Nasdaq, closing with a doji above its 50-day MA. It just so happens that the reversal coincides with the October peak in what would be an ideal place to place a short position; a close above this price level would be a time to cover.

As we head into the rest of the week we will want to see how resilient last week's buying is. If the S&P 500 and Nasdaq can hold on to the 50-day MAs (intraday breaks allowed), it will help support the weaker Russell 2000 ($IWM).