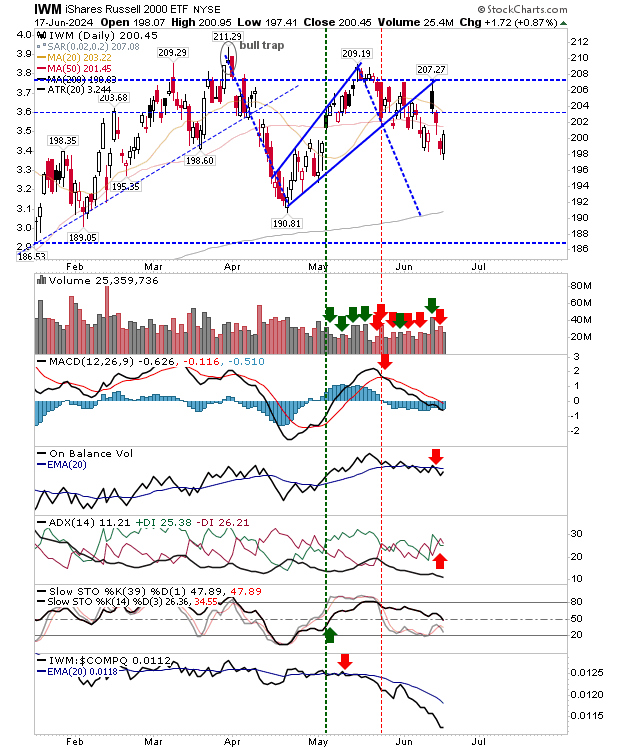

A strong day for markets stretched as far as the beleaguered Russell 2000 (IWM). The Small Caps index enjoyed a bullish engulfing pattern on the bullish mid-line of stochastics.

It should be noted that the mid-line of stochastics [39,1] is the "oversold" state for a bullish market and yesterday's action matched this thesis (for a bull market reversal).

Supporting technicals like the ADX, On-Balance-Volume, and MACD are still bearish, but I suspect this won't remain the case for long.

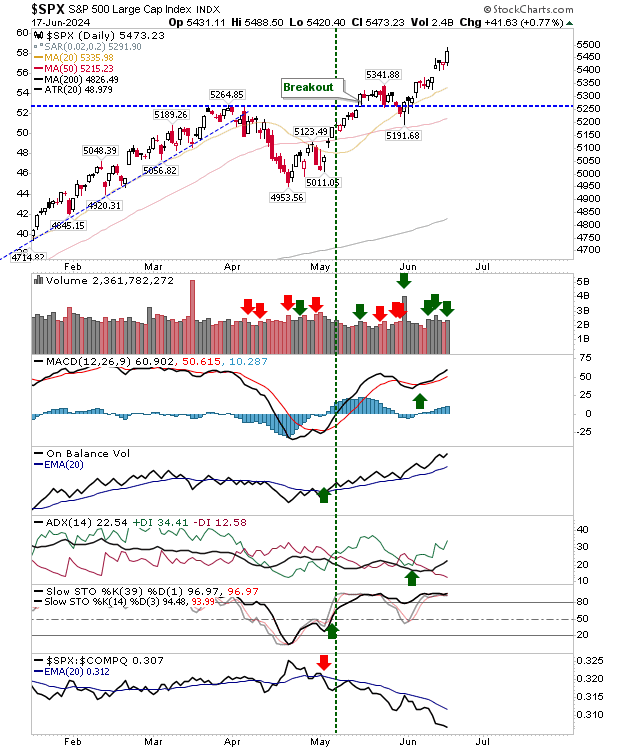

The S&P 500 was clearer in its intentions. Increased volume buying to new highs on positive net technicals leaves little to the imagination. Only its relative underperformance to the Nasdaq is the "concern" - but not really

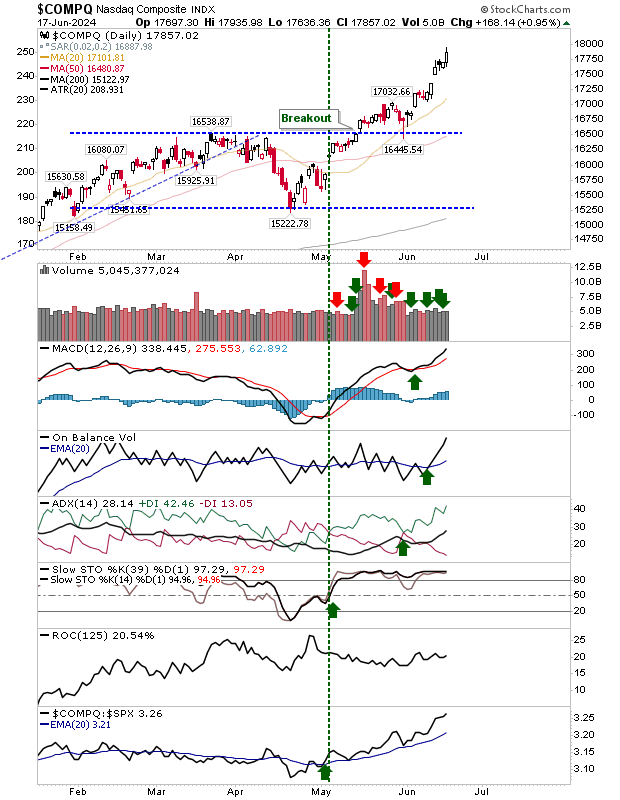

The Nasdaq ticked all the boxes, with just one exception, it didn't manage to post its gain on higher volume accumulation. It does have a relative performance advantage over its peers, which will help.

Nasdaq breadth metrics don't point to an oversold condition but if they do generate a 'buy' signal from here then there will be a significant upside available.

The Russell 2000 ($IWM) offers the best of the long trades with clear support and resistance to work with (see aforementioned chart) if you are looking for something more defined.