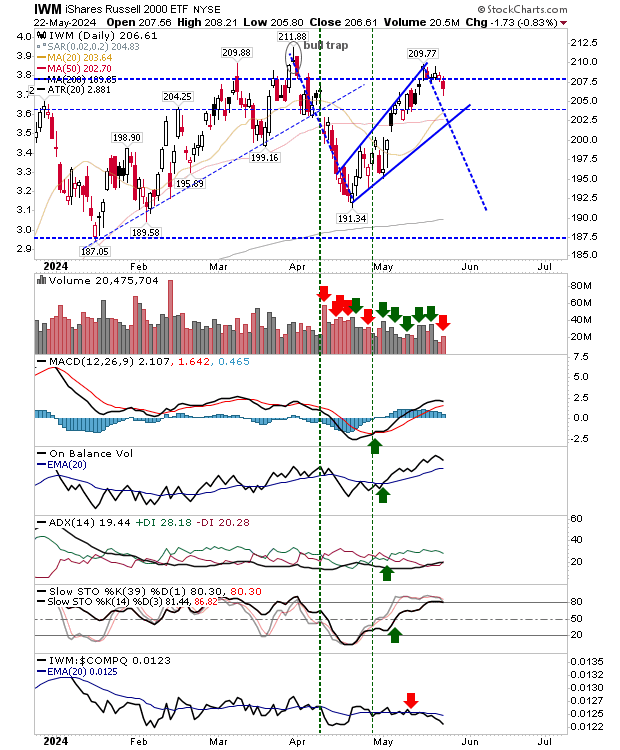

Sellers made more of an impression on the markets yesterday. The Russell 2000 (IWM) dropped out of its 'bull trap' challenge and into its prior base. In doing so, the underperformance relative to the Nasdaq accelerated, although other technicals are net positive. After yesterday, the move to test the 20-day MA looks like the most likely outcome over the coming days.

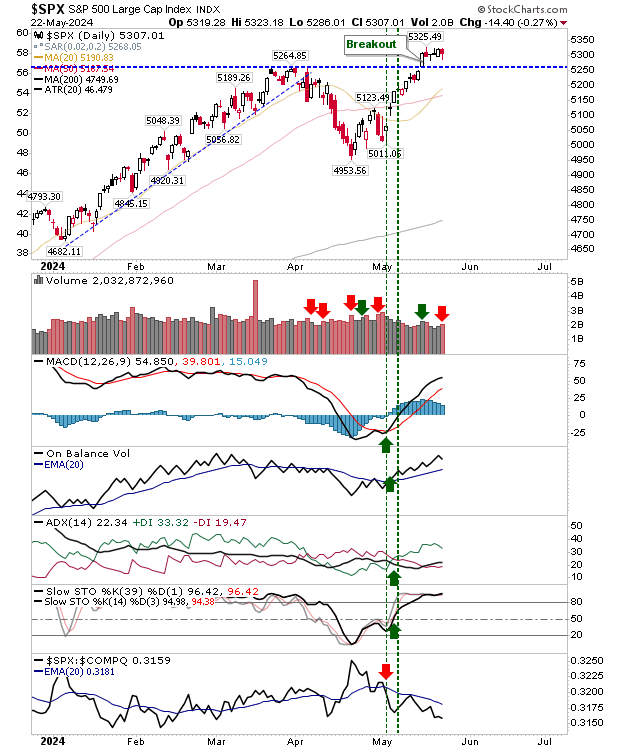

The S&P 500 managed to hold on to its breakout. Yesterday's losses were relatively minor, and the index finished with a 'bullish hammer'. However, the significance of this candle requires an oversold momentum state for it to act as a rallying point. Volume rose to rank as confirmed distribution, but until the breakout reverses the volume selling is not so relevant.

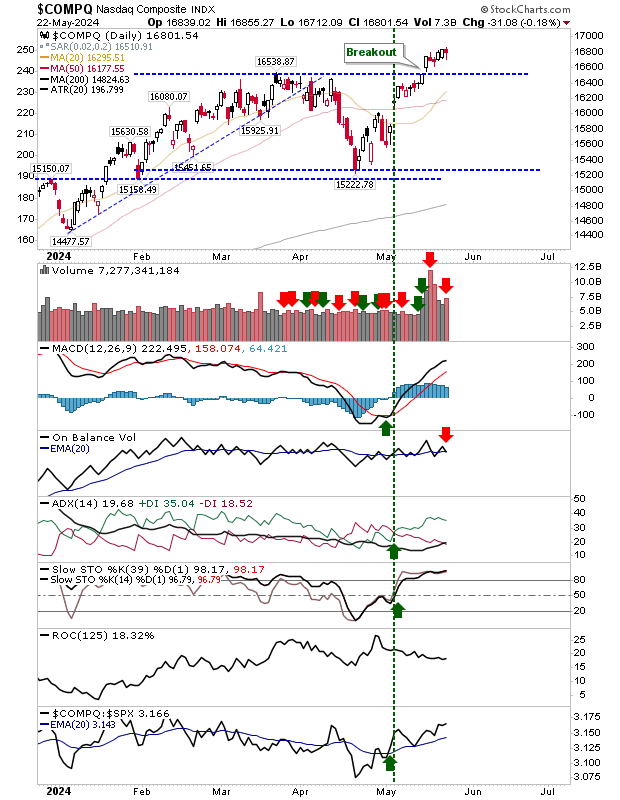

The Nasdaq experienced a similar level of selling as the S&P 500. Unlike the S&P 500, the Nasdaq registered a 'sell' in On-Balance-Volume. This index's key advantage over its peers is that it's the relative outperformer, and therefore the market leader. What goes here should go for other indexes.

For today, bears will be watching the Russell 2000 ($IWM) and bulls the Nasdaq. Sellers tend to get the early advantage, so what happens pre-market may give a better indication of what may come. A test of the 20-day MA for the Russell 2000 would be the most likely trade to look for.