Among the fifty-one consumer cyclical companies in the S&P 500, a blue chip such as Nike (NYSE:NKE) has experienced the second-worst performance in the past twelve months. Since November of 2021, the stock has traded downwards, accumulating a dropdown of approximately -59% and sitting at stock price levels of 2018.

Nike's lackluster situation mainly resulted from internal mistakes, which will be discussed later in the article. From the macro perspective, there have been enormous tailwinds, such as relaxed global inflation in key markets, lower interest rates in the US, Europe, and China, and economies that didn't turn into a recession in 2024 despite concerns. Yet, none of these were able to counter the internal headwinds.

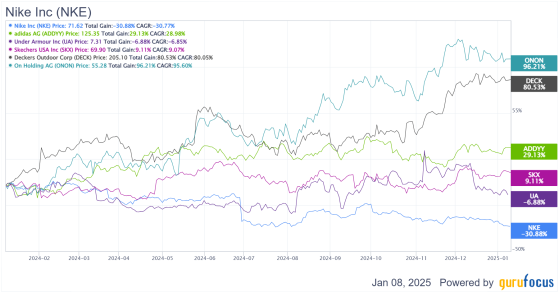

NKE Data by GuruFocus

There is a clear divergence when comparing Nike's performance to that of its peers in the apparel industry. Most of them had great returns, while Nike significantly underperformed the group. At the same time, high-growth companies such as Deckers Outdoor (NYSE:DECK) and On Holdings (ONON) have significantly increased their market share and exhibited strong performances.

Nike's Internal Mistake

In 2020, former CEO John Donahoe became Nike's CEO and switched to a direct-to-consumer strategy to pursue higher gross margins. As a result, some of Nike's products were removed from third-party channels and started to be directly sold by Nike to remove steps in the supply chain.

NKE Data by GuruFocus

This strategy was initially successful, with gross margins expanding from 43.42% to 45.98% and gross profits growing yearly by up to 22.91%. However, these extra gains were enjoyed momentarily, as Nike later started to lose its share against competitors while navigating turbulent times due to elevated inflation, which affected consumers and supply chains.

Although the situation has been improving, the past three-quarters of Nike in terms of top-line have all been mediocre, with revenue declining year over year by -1.71%, -10.43%, and -7.72%, respectively. Among the categories that have dropped the most are footwear and apparel, which are the primary revenue contributors. Equipment has been experiencing substantial growth, but its contribution to the overall revenue is insufficient to counter the drops of other segments.

Nike New CEO

In October, the old CEO stepped away and was replaced by company veteran Elliott Hill. Hill started as an intern and spent over 30 years in the company, returning as CEO after retirement. His focus now is to improve the company in three key areas where he believes Nike was making mistakes.1. Reduce discounts:

At some point before his tenure, Nike's website had a 50/50 split between full-price and promotional products, which affected the brand's perceived value and profitability. He intends to reduce this markdown split and focus on offering promotions mainly during traditional retail discount events.

2. Emphasis on sports:

Nike's numerous business lines lacked focus, and according to the CEO, they lost their obsession with sports. To reshape the focus, Nike plans to lead sports and put the athletes at the center of every decision based on product creation and marketing storytelling insights.

3. Regain relationship with retailers:

With an old strategy of cutting ties with small retailers and reducing shelf space on retail giants such as Foot Locker (NYSE:FL) and Dick's Sporting (DKS), the plan now is to revert these actions and regain the trust and relationship with these retailers to stop competition from gaining more recognition.

Valuation

NKE Data by GuruFocus

With the company's challenges, its valuation is considerably cheaper than it used to be. For example, the trailing PE ratio is now 22.3x, which is -22.8 % more inexpensive than Nike's five-year mean. At the same time, the dividend yield, at 2.12%, is at its highest since the great financial crisis.

Nonetheless, if Nike's growth prospects and competitive positions have deteriorated, it is justifiable that the stock will trade at a multiple lower than its history. Yet, the PEG ratio of 2.28x is also considerably inferior compared to the past 10 years, when the medium PEG has been 3.55x. So, in conclusion, the stock sits undervalued even after considering growth estimates.

This is also confirmed by the consensus price targets of sell-side analysts who, on average, have a one-year price target of $87, comfortably above the current price.

Risks

Although the new CEO has sound intentions to restore the company's strategy to its roots, some risk factors arise from the accelerated growth of competitor shoe brands such as On and Hoka, which have gained recognition and could be more than just a fad, making Nike to continue reducing its market share.At the same time, the intended policies of higher tariffs on China could affect the margins from US sales depending on how the currency markets evolve. Simultaneously, approximately 60% of Nike's revenues come from outside North America, and the proposed tariffs and a more hawkish Fed have made the US dollar significantly appreciated against other currencies. A stronger dollar affects Nike's bottom line from the profits received overseas.

Takeaway

After all, Nike is a globally recognized brand with strong benefits from economies of scale. Even though competitive pressures have affected the company's growth, with new leadership, the tone is positive to correct past mistakes and allow Nike to regain the lost market share.Currently, the stock's undervaluation becomes secondary if the growth acceleration from competing brands such as On and Hoka is sustained throughout the future. If that's the case, the stock will continue to experience some pressure. On the other hand, if corporate actions go as expected, the valuation is an excellent opportunity to add Nike's stock to a portfolio and potentially enjoy appealing returns.

This content was originally published on Gurufocus.com