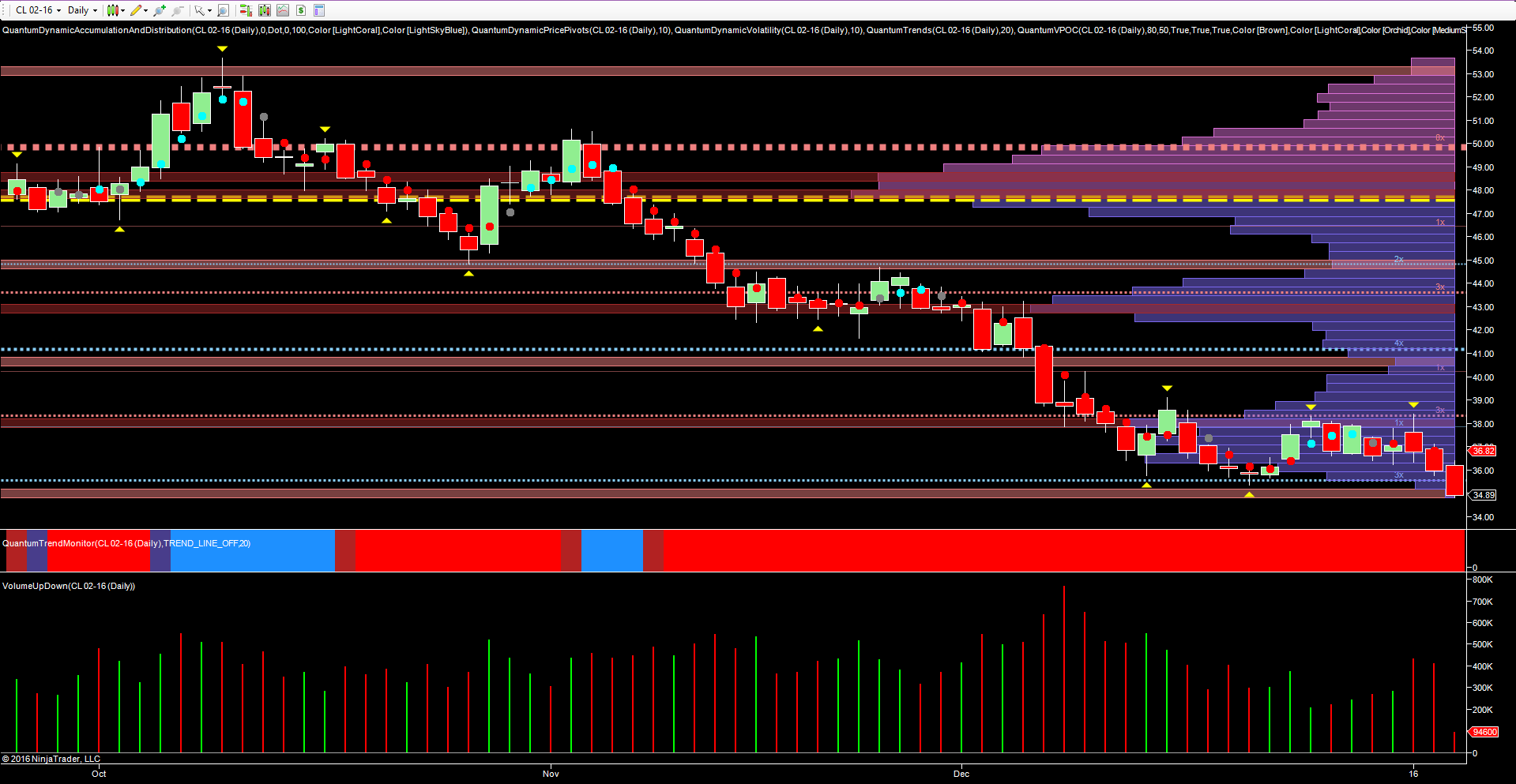

For oil, the new year could hardly be described as happy, as the relentless decline in prices continues. December’s pause is now starting to fracture as February’s WTI contract picks up downside momentum. Monday’s price action confirmed this weakness as the 2016 trading year got underway, with the high of the session testing the $38.30 per barrel region, an area tested earlier in December.

The failure to follow through, and associated above average volume signaled the weakness to come, which was duly delivered in yesterday’s and this morning’s trading sessions, with prices moving firmly through the platform of potential support in the $35.40 per barrel area, and lower, to test the low volume node now waiting in the $34.90 per barrel area. If this is taken out—which looks increasingly likely—oil looks set to continue to fall. Should that happen, it will likely test the lows of 2009 at $32.38 per barrel, a price point now firmly on the horizon.

From a fundamental perspective the world oil glut continues to dominate the supply and demand dynamic, with OPEC (ie Saudia Arabia) continuing its dual policy of driving oil prices lower, both to combat the alternative markets whilst also making Iran’s reserves increasingly uneconomic as we head closer to sanctions being lifted. Today’s oil inventories kick off the new year, with a forecast of a build of 0.7mbbls against a previous 2.6mbbls, but as with previous weekly reports, any intra day volatility is unlikely to reverse the weight of supply that is continuing to submerge an already waterlogged market.