Due to its stellar price appreciation, Nu Holdings (NYSE:NU) has been a financial stock that caught investors' attention in 2024. Before Q3 earnings, the largest non-Asian neobank in the world was close to achieving a YTD performance of roughly 100%. Nonetheless, after releasing Q3 earnings, the bank accumulated a drop of approximately -25.5%, and at $12, the stock has trimmed the performance to roughly 44% YTD.

NU Data by GuruFocus

Many risk-averse investors ask whether this drop is an opportunity to buy the stock, whether this large correction is justified, or even whether it has the potential to continue dropping. This article will analyze the company's backdrop based on internal and external factors that could affect the Brazilian bank, and it will provide a valuation and a conclusion of the stock concerning 2025.

Nu's Q3: Revenue and Earnings Beat

Although the stock price started dropping after Q3 earnings, these appeared optimistic, with an EPS and revenue beat compared to what sell-side analysts expected. For example, Nu Holdings achieved in Q3 an EPS of 11 cents and $2.94 billion in revenue. This increase in revenue represented a solid forex-neutral 56% growth YoY, in addition to growing their customer base to roughly 110 million, rising 23% YoY. Simultaneously, items such as monthly average revenue per active customer ("ARPAC") remained stable, and the monthly average cost to serve per active customer saw a slight decrease.Nonetheless, not all the line items were positive. For instance, net interest income decreased slightly from the previous quarter due to a higher funding cost and lower credit card yields, which reduced the net interest margin. One year ago, Nu's deposit costs were 80% of the interbank rate of its respective markets. Now, their funding costs are more expensive at 89% of the interbank rate.

The bull case for Nu is that it is an emerging bank with a stunning 110 million customer base, a relatively low market share in terms of loans, and the potential to expand net interest income from cross-selling its large customer base. In addition, the bank is investing in future gains in Mexico and Colombia, markets that combined have an adult population of over 120 million, where Nu has already obtained 10.9 million customers.

NU: External Factors Are Weighing on the Stock Price

As illustrated, it is hard to justify a -25.5% drop in a stock price based on Q3 earnings, as these were actually positive. In this case, external factors from the Brazilian economy have been the main contributors to the drop in price. Nu's most identical peer, Inter & Co (INTR), has also dropped significantly since November 12th, and the drops are a systematic situation among Brazilian Equities.Contrary to most developed economies, since July of 2023, Brazil's inflation stopped dropping and began rising. This caused the central bank to revert its dovish monetary policy, switch to a hawkish, and start raising short-term interest rates again. All of this has been in addition to a fiscal crisis, with a budgetary deficit rising above pandemic levels due to uncontrolled fiscal spending and resulting in a currency exchange rate severely depreciating in 2024.

Through 2024, the Brazilian real has depreciated by roughly -19% against the US dollar. This harms Nu's financials, which are tied to the US dollar, as a low conversion per Brazilian real translates into lower dollar revenue. Although Nu also operates in Mexico and Colombia, these markets do not represent more than 8% of the current revenues, making Nu highly concentrated in a single market.

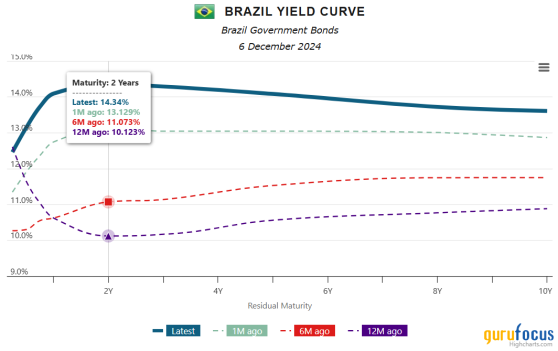

Source: Highcharts

At the same time, this macro situation has inverted the Brazilian yield curve. As the image above shows, 2-year bonds yield 14.34%, higher than the 13.6% of 10-year bonds. For banks, an inverted curve is the worst scenario for achieving higher net interest margins. This is because banks earn through maturity transformation, borrowing at cheaper short-term rates and lending at higher long-term rates. When the yield curve is inverted, the opportunity to gain from net interest income is still open, but it certainly decreases compared to a steep yield curve.

Nu's Stock is Cheaper Than Ever

Valuing the stock of Nu Holdings is complicated. On one side, they are a neobank growing net income at triple digits, and on the other hand, they are still a bank; therefore, growth in tangible book value is the key valuation metric. Yet, since Nu doesn't have many years of profitability, the retained earnings on the shareholder's equity are insignificant compared to other classical banks. Therefore, a price to tangible book value is not yet a reliable valuation metric for Nu. In addition, it provides an unjustifiable ratio of 8.42x.Based on this, I consider the PEG ratio, price-to-earnings divided by expected EPS growth, the best multiple to value Nu Holdings' stock. In theory, any PEG ratio below 1 means a potential undervaluation of the stock since the expected EPS growth is higher than the trailing price-to-earnings multiple.

For Nu, the PEG ratio is not only attractive at 0.34x but also cheaper than its historical average due to the recent stock drop. The same is true for the trailing PE ratio, which is 32.8x, the lowest multiple since the company's IPO three years ago.

Conclusion of a Bullish Thesis on Nu

Nu is perhaps one of the few companies in LatAm that trade in the US and are in the growth stage of business. The success of this neobank has been phenomenal to the point that 56% of the Brazilian adult population are clients of Nu. The growth opportunity and prospects remain strong and have a solid thesis.Unfortunately, the macro situation in Brazil has affected the stock price but not materially Nu's financials. Over time, the currency devaluation and change in monetary policy might affect their growth. Yet, at their cheapest PE and PEG multiples since going public, Nu's stock represents a clear bullish opportunity in 2025 despite the macro headwinds.

This content was originally published on Gurufocus.com