Investment Thesis

Nvidia (NASDAQ:NVDA) Corporation(NASDAQ: NVDA), the Santa Clara-based chip maker that became the third-ever American company to hit the $3 trillion mark now faces some rather grave questions as the dynamics of AI integration evolve. With AI applications beginning to proliferate, former Principal Engineer of IBM (NYSE:IBM) Frank Palermo expects the future of AI to revolve around inference-oriented workloads. This casts doubts over Nvidia’s high-octane, power-hungry GPUs, as inference generally does not require such GPUs. Additionally, the development of cost-effective options better suited for inference workloads by hyperscalers and startups has picked up momentum lately.

Investment Downsides

Search for Alternatives

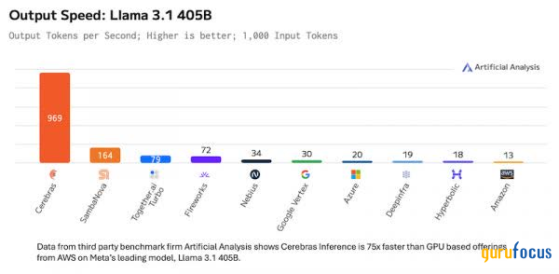

Nvidia has a staggering TTM EBIT margin of nearly 62%. However, such incredible margin figures come at a hefty price for enterprises and start-ups. Any company intending to buy H100 GPU should expect to spend 30 grand a piece upfront. And to lease those GPUs, the total bill comes at almost 48 grand a year for a single piece for 24/7, 365 days. Such astronomic ballpark figures may be trivial for startups with piles of cash at their disposal. However, companies who do not have such a privilege but want to incorporate state-of-the-art generative AI in their products and services have begun a simmering search for alternative options. Additionally, a material design flaw in B200 had caused major disruptions in the supply chain. Hence, diversifying chip suppliers would mitigate such supply chain interruptions and also help enterprises bring the costs down. AMD (NASDAQ:AMD) stands as the most credible alternative to Nvidia, having spent more than two decades competing against its consumer-grade GPU business. AMD’s latest device for AI, the Instinct MI325X, was launched in October 2024 and has started shipping to customers, ahead of Nvidia’s delayed B100 and B200 GPUs. AMD is seemingly adopting a strategy that has worked before while it cannot match Nvidia’s products in terms of absolute performance, it aims to offer a more attractive price-to-performance ratio. Unlike Nvidia, AMD does not dabble in server and rack designs or mandate specific levels of rack power its reference designs call for anything from one to sixteen compute nodes per rack. The MI325X became the fastest-ramping product in AMD’s history, adopted by customers including OpenAI, Meta (NASDAQ:META), Microsoft (NASDAQ:MSFT), and Google (NASDAQ:GOOGL). Its successor, the Instinct MI350, is expected to ship in the second half of 2025.Furthermore, Hyperscalers have already produced several generations of AI silicon for both training and inference, positioning their chips as low-cost alternatives to GPUs. Notable examples include Trainium2 from AWS, Trillium from Google Cloud, and Maia 100 from Microsoft Azure all launched in 2024. Furthermore, Beatriz Valle of Global Data has noted in her report that numerous startups including Cerebras, Groq, Mythic, Graphcore, Cambricon, and Horizon Robotics are focused on creating custom AI chips that operate faster, consume less power, and can be optimized for training neural nets and making inferences more effectively. For instance, Cerebras, a US-based hardware design startup, provides an example of a radically different, non-GPU architecture for AI. Its wafer-scale engine is an integrated processor that includes compute, memory, and interconnect fabric on a single piece of silicon that measures eight by nine inches. The third generation of the platform set a world record for inference performance in November 2024 while consuming just 15 kW per system. Cerebras’ customers include four national laboratories in the US and several pharmaceutical companies.

Artificial Analysis

The Paradigm of Inference Management

NVIDIA

The difference between inference and training is explained in simple words by Donald Farmer, First, in the training phase, the model looks at an existing data set to discover patterns and relationships within it. Next, in the inference phase, the trained model applies these learned patterns to create predictions, generate content, or make decisions when it encounters new, previously unseen data.The future battleground for any aspiring AI chip designer is inference. While training AI models can be compared to software development an expensive process requiring specialist skills and infrastructure inference resembles software delivery, requiring little skill and priced at a fraction of the development cost. Inference is going to be the largest component of the AI workload landscape as per Adam Clark of Barron’s.Lower-performance, less power-hungry GPUs are growing in demand as does not require cutting-edge manufacturing, making them more affordable. Furthermore, startups including Groq, Enflame, SambaNova, Untether, Blaize, FuriosaAI, Recogni, Etched, and many others have developed low-cost products for inference. Additionally, both Intel (NASDAQ:INTC) and AMD have enhanced their processors to support the delivery of inference without requiring additional hardware, hence catering server CPUs to enterprises with lower budget and power needs. This essentially paints a rather dim and gloom picture of Nvidia’s growth prospects, something that would worry Nvidia’s shareholders

Valuation

Seeking Alpha

In the Valuation factor, Seeking Alpha has graded Nvidia’s stock an F, the lowest possible grade. This signifies how overvalued Nvidia’s stock is fundamentally and has little to offer to portfolio managers in terms of valuations. However, as a minor sign of relief, the forward PEG of Nvidia is currently at almost 33% discount compared to the sector median, highlighting the formidable future growth expectations investors have in Nvidia albeit the forward PEG ratio is 1.22, above the border mark of 1, which is usually a signal of an overvalued stock.

Investment Upsides

GB300 GPUs

Taiwanese media outlet Economic Daily News leaked in December 2024 that NVIDIA is expected to unveil its new version of GPU GB300 at the GTC (GPU Technology Conference) in March 2025. SemiAnalysis, the data center-focused news outlet has reported the new line of GB300 to have 200W additional power with TDP going to 1.4KW from 1.2KW for GB200. The B300 GPU is a brand-new tape out on the TSMC 4NP process node, i.e. it is a tweaked design, for the compute die. This enables the GPU to deliver 50% higher FLOPS versus the B200 on the product level. Some of this performance gain will come from 200W additional power with TDP going to 1.4KW and 1.2KW for the GB300 and B300 HGX respectively (compared to 1.2KW and 1KW for GB200 and B200). GB300 will once again prove Nvidia’s might in delivering GPUs with surreal computational power and speed. However, the question remains whether enterprises would be able to afford it and perhaps a bigger question is whether enterprises need such high power-hungry GPUs.

NVIDIA

RTX (NYSE:RTX) 50 Series GPUs

The RTX 50 Series launched at the CES 2025 was the biggest highlight of the entire event. RTX 50 series is the most updated generation of Nvidia’s consumer GPUs which is built on the architecture of Blackwell. Blackwell architecture harnesses TSMC’s custom 4NP process node and achieves 30% more power efficiency over its predecessor. represents Nvidia’s latest generation of consumer GPUs, built on Blackwell architecture, and was a highlight at CES 2025, held from January 7-10, 2025. Models like the RTX 5090, 5080, 5070 Ti, and 5070, have already been launched and RTX 5060 is expected to be launched in the latter half of 2025.

NVIDIA

RTX 50 series represent an incredible opportunity for Nvidia in the gaming industry. The advent of DLSS 4 with Multi Frame Generation can generate up to three frames per rendered frame, and this ramps up performance by eight times. The boost in performance in gaming, content creation activities like video editing even at a grand scale would help Nvidia to diversify its revenue channels. The market intelligence firm Mordor forecasts the gaming market to grow at a CAGR of 10.17% in the next five years through 2030. Additionally, Boston Consulting Group in their report on the gaming industry had highlighted the fact game budget across board

Additionally, Boston Consulting Group in their report on the gaming industry highlighted the fact that game development budget across board is projected to outpace gaming revenue by 5% through 2028. Either of these projections depict that the gaming industry braced itself for rapid expansion in the next few years and Nvidia would benefit the most from it.

Portfolio Management

Although there is not the slightest doubt about Nvidia’s ability to come up with GPUs with record-level power and speed, based on the simmering shift in the AI workload landscape, where a focus on cheaper and less power-consuming alternatives is paramount for nascent enterprises, along with an F grade for valuation factor, Nvidia’s stock is believed to have little to offer to portfolio managers who tend to prioritize economic moat and undervaluation in their investment decisions.

This content was originally published on Gurufocus.com