Chip giant Nvidia (NVDA) saw its stocks jump 24.57% over the course of last week. The company's stellar performance came on the back of beating earnings expectations and raising revenue projections - up 64% year over year. With demand for AI-related processors booming, Nvidia has positioned itself as a key player in the market: A remarkable year-to-date performance of 166.50% and a market capitalization of approximately $950 billion, means Nvidia now ranks as the fifth most valuable company on Wall Street.

The NVDA stock’s impressive rally has provided a significant boost to semiconductor ETFs, driving gains in the broader tech sector. The S&P IT sector index gained 5.12% for the week while the S&P 500 index edged up 0.32%. After a tough year in 2022, tech is the best performing sector in 2023 (33.97%).

Overall, ETFs investing in chipmakers rose by 10% over the week, with those having a significant allocation to Nvidia clearly emerging as the top gainers. The VanEck Semiconductor ETF thus saw a gain of 10.66%, while the iShares Semiconductor ETF was up 10.65%.

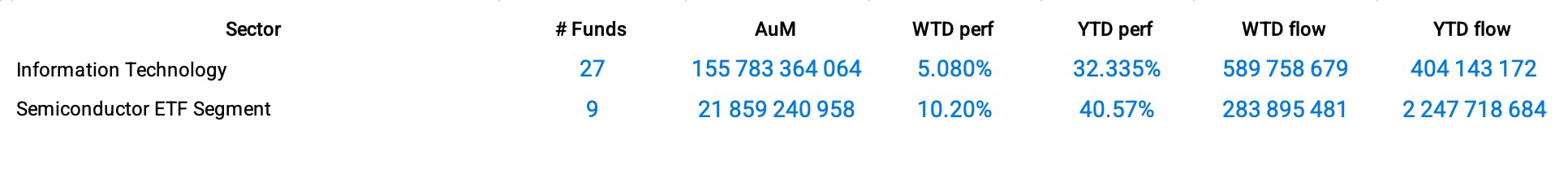

Group Data

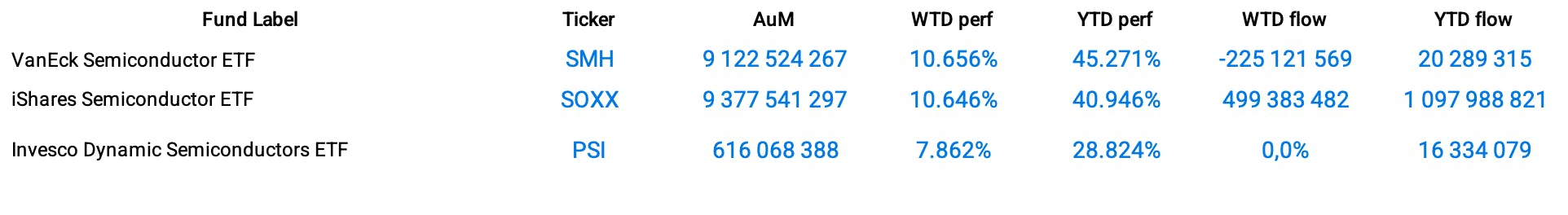

Funds Specific Data

This content was originally published by our partners at ETF Central.