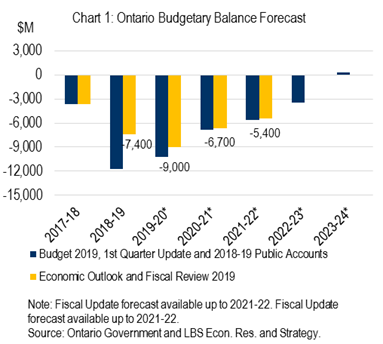

The Ontario Finance Minister Rod Phillips released the 2019 Ontario Economic Outlook and Fiscal Review yesterday. The government reiterates its commitment to balance the books by FY 2023-24. Furthermore, the government builds on stronger-than-expected fiscal results for FY 2018-19. According to the Public Accounts published earlier this fall, the combination of stronger revenues (+$2.9 billion) and lower spending (-$1.4 billion) resulted in a smaller deficit for FY 2018-19 (from $11.7 billion, 1.4% of GDP to $7.4 billion, 0.9% of GDP, chart 1 below). Accordingly, the deficit for FY 2019-20 in this update was also revised down (to $9.0 billion, 1.0% of GDP) from the 2019 budget estimate of $10.3 billion (1.2% of GDP).

Some fiscal room to spend a little more

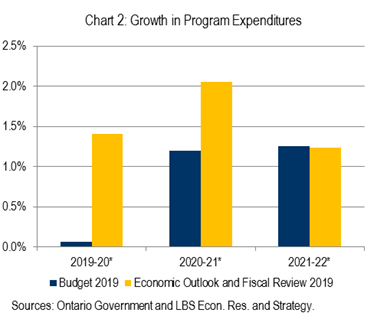

Taking advantage of stronger personal income taxes, higher corporate income taxes and lower interest costs (-$430M in FY 2019-20), the government decided to allocate more funding (+$1.3 billion) to the delivery of public services. About $0.5 billion of this amount will come from unallocated contingency funds, which will mitigate the net impact on the deficit to $0.8 billion in FY 2019-20. Program expenditures are now expected to increase by 1.4% this year, up from an initial 0.1% estimate in budget 2019 (chart 2 below).

Program spending is projected to rise at a relatively faster pace in FY 2020-21 (chart 2). Overall, the pace of increase in program spending will remain below the 3% annual average growth rate registered between 2010 and 2017. The province will add $637 million to the Children’s and Social Services sector, including $279 million to the autism program. Also, the province will add close to $0.6 billion to the health care and education sectors. Regarding tax policy, the government reinforces its “Open for Business” message by announcing a modest reduction in the small business tax rate for next January (from 3.5% to 3.2%).

Modest real GDP growth forecasts, very strong labour market conditions

The economic outlook has not materially changed. Real GDP growth forecasts are modest at 1.4% in 2019, 1.5% in 2020 and 1.5% in 2021, reflecting a normalization of U.S. economic growth. Slightly below the private sector average forecasts, the government’s real GDP projections incorporate a moderate level of prudence. Vibrant activity in services-oriented industries has more than compensated for the waning momentum in construction and manufacturing industries, affected in part by the global trade war and the recent U.S. GM strike. Labour market indicators are particularly standing out from the pack of economic indicators. Job creation in the province is on track to reach almost 200,000 this year, led by the Toronto area (+169K year-over-year).

Also, Ontario’s unemployment rate has been consistently below 6% since 2017 for the first time since the early 2000s, strengthening household income growth (close to 4%). The improvement in consumer confidence is expected to support household spending, particularly MLS residential resale transactions. The fiscal reserve was kept at $1.0 billion per year, a modest financial cushion in the event of an unexpected negative economic shock. Furthermore, the current contingency fund level stands at $0.5 billion with a little less than 5 months remaining in FY 2019-20.

Borrowing requirements revised down

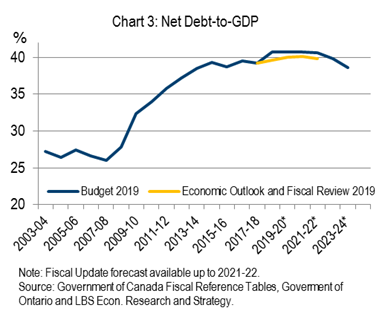

Thanks to smaller deficits, the outlook for the net debt-to-GDP ratio improves. This key financial metric is expected to reach 40.0% in FY 2019-20, a notch below the 2019 budget estimate of 40.7% (chart 3). Granted, 40.0% marks the highest debt-to-GDP ratio figure in the province’s history. However, it is projected to gently overtime. Finally, borrowing requirements have been revised down from $36.0 billion to $31.9 billion in FY 2019-20 in tandem with the lower deficit expectation and a decrease in cash and cash equivalents. During the following two years, financing requirements are poised to stay in the same ballpark ($31.7 billion in FY 2020-21 and $31.2 billion in FY 2021-22) due to debt maturities/redemptions and capital requirements.