- Dollar and gold rally for opposing reasons

- Inflation worries persist

- Oil rises despite speculation of US intervention

Key Events

Despite the underlying indices sliding yesterday, contracts on the Dow, S&P, NASDAQ and Russell 2000 all advanced in trading on Thursday morning. It seems the market's concerns yesterday following the publication of higher than expected US inflation figures have failed to dampen positive sentiment in the US futures market or on European exchanges with equities there also advancing.

Bitcoin recovered and has been heading higher.

Global Financial Affairs

Bonds and technology stocks sold off after the release of yesterday's US CPI figures as traders have started worrying that price pressures may bring the timeframe for interest rate hikes forward. It also cemented the likelihood of persistent inflation.

Although all four contracts on the major indices are in the green, NASDAQ 100 futures have been outperforming after the underlying benchmark's worst selloff on Wednesday in over a month.

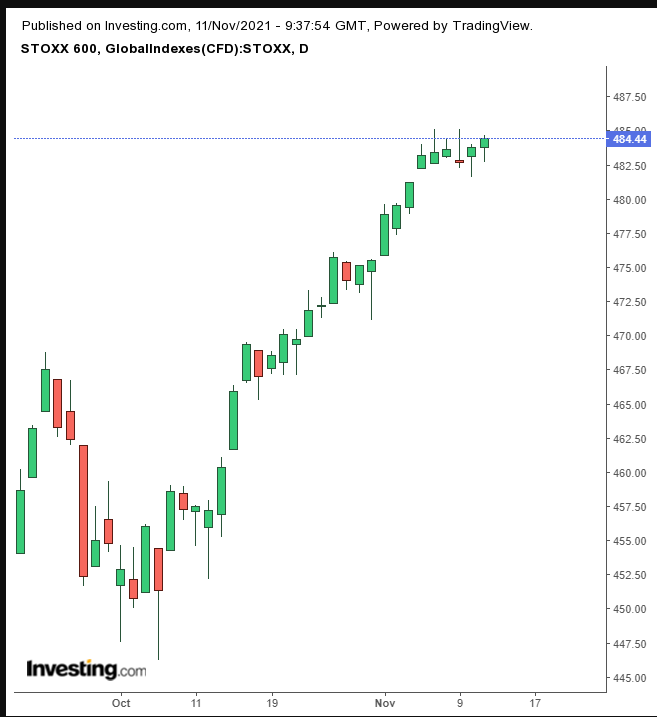

In Europe, the STOXX 600 Index climbed for the second day, with construction shares overshadowing a drop in energy and travel stocks. It was the pan-European gauge's tenth daily advance out of 11 days.

However, despite the ascent, the price has been churning for the sixth session. When such a sideways move develops after a rising gap, as was seen last Thursday, it opens up the possibility for an Island Reversal, complete with a falling gap.

In Asia, China's Shanghai Composite advanced on speculation policymakers will support the struggling property sector.

While the US Treasury market is closed for Veterans Day, most European yields dropped.

The dollar extended a rally to a second day on speculation the Fed will tighten its policy sooner than anticipated.

The greenback completed a small H&S continuation pattern, supporting the earlier completed massive double bottom.

Gold jumped for the sixth straight day, supported by its value as an inflation hedge.

The yellow metal extended the upside breakout of an H&S bottom.

It's curious to see how both the USD and gold advance in unison due to opposing market themes. The dollar rises on speculation of tighter monetary policy, while gold rallies as it is considered to be an inflation hedge. For now, however, both opposing assets are rising in unison.

Bitcoin rebounded as an inflation hedge.

The cryptocurrency found its footing with the support of a pennant.

Oil rose despite speculation earlier in the week that the White House would intervene to try and cool prices. There is no actual indication that the Biden White House will do anything effective to lower energy prices over the remaining three years of its term

The price may be forming an H&S continuation pattern.

Up Ahead

- European industrial production is reported on Friday.

- Michigan consumer sentiment numbers are released on Friday.

- On Friday US JOLTS Job Openings numbers are published.

Market Moves

Stocks

- The STOXX 600 was little changed as of 8:28 a.m. London time

- Futures on the NASDAQ 100 rose 0.3%

- Futures on the Dow Jones Industrial Average were little changed

- The MSCI Asia Pacific Index was little changed

- The MSCI Emerging Markets Index fell 0.1%

Currencies

- The Bloomberg Dollar Spot Index rose 0.2%

- The euro fell 0.1% to $1.1462

- The Japanese yen fell 0.2% to 114.09 per dollar

- The offshore yuan was little changed at 6.4036 per dollar

- The British pound fell 0.2% to $1.3377

Bonds

- Germany's 10-year yield advanced one basis point to -0.23%

- Britain's 10-year yield was little changed at 0.93%

Commodities

- Brent crude rose 0.1% to $82.76 a barrel

- Spot gold rose 0.4% to $1,857.59 an ounce