- Traders reduce bets on the next rate hike

- Remember it is still a bear market

- Dollar slides

On Monday, traders bid up futures on the Dow Jones, S&P 500, NASDAQ 100, and Russell 2000 as well as European shares on reduced expectations of aggressive interest rate hikes by the US Federal Reserve,

The STOXX 600 jumped at 1.2% by 4:18 AM EST with the pan-European gauge reaching its highest since June 10.

The global rally survived the weekend despite the flood of recession warnings with some market watchers suggesting investors were "staying cautious ahead of a European Central bank policy meeting and a scheduled resumption of Russian gas flows via the Nord Stream 1 pipeline. On the face of it, the rally doesn't seem to be cautious. However, I think the trend will continue lower.

The STOXX 600 has been testing the top of a range since June 13 and the May lows.

We see here the technical principle of how broken support turns to resistance as market dynamics flip. The benchmark also found help from the Mar. 7 low. Although the index could bottom, I expect the downtrend line since the Jan. 4 all-time high to overcome the support since Mar. 7.

Asia found its own tailwind: positive news from China with the Banking and Insurance Regulatory Commission vowing to manage risks associated with five rural banks in the Henan and Anhui provinces.

Hong Kong's Hang Seng surged 2.7%, ending a five-day losing streak and outperforming the region.

The rebound didn't come a moment too soon.

The index confirmed its uptrend line since the Mar. 15 low, reinforcing the possibility of a bullish Ascending Triangle, as buyers are willing to buy at ever-rising prices, while sellers appear more tempered, ready to sell only at the same high price. An upside breakout will cement the pattern, creating a technical domino effect, propelling the price to retest February highs. Naturally, a downside breakout will flip market mechanics to the downside. Note that the inherently bullish triangle is developing at the infamous March 2020 bottom level.

While the rally in the stock market appears bullish, remember bear markets have rallies too. Some of the strongest market rallies occur during bear markets but stocks remain biased to the downside.

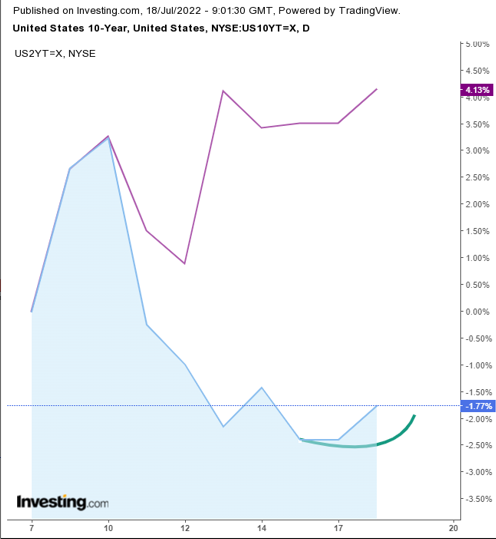

Comments from Atlanta Fed President Raphael Bostic and St. Louis's James Bullard that they did not support a full 1% interest rate hike, as well as consumers' long-term inflation anticipation dropping to 2.8% from last month's 3.1% means traders are now expecting a 75 basis point hike at the next FOMC meeting. We can see the reduced hike expectations reflected in the inverted yield.

Although inverted, which increases the risk of a recession, the curve flattened. After Friday's negative divergence, the 10-year yield joined its 2-year counterpart in a rally.

The dollar fell for the second day as traders rushed to capitalize on the wrongly priced 100 basis points hike. There is also the technical impetus for a decline at this time.

The greenback has risen well above its uptrend lines. Note how different major MAs align with other trendlines. The 200 with the trendline tracking the uptrend since the May 2021 low, the 100 with the one rising from this year's early Feb low, and the 50 with the one since the Mar. 31 low.

The RSI has hit overbought conditions and has fallen back, triggering a sell signal. Aggressive traders will short, while cautious traders may wait for a long position to trade with the primary trend. Each of the trendlines represents deescalating buying risk levels.

Gold climbed for the first time in three sessions on dollar weakness.

The RSI reached the most oversold condition since August 2018 and climbed back to provide a buy signal in the short term. Conversely, the 50 DMA crossed below the 200 DMA early in the month, providing a long-term bearish signal. The $1,670 level is strong support that could justify a rebound. However, if the price falls below it, it will create a massive top with dramatic downside implications. Gold could remain volatile ahead of the upcoming Fed meeting.

The lower expectation for rates and the relative weakness in the dollar combined with reduced market risk drove Bitcoin higher.

The cryptocurrency is reaching the top of its range. An upside breakout will probably push the digital coin to retest the $30K level. A downside breakout will extend the crash I've been long expecting. Note, the 200-week MA holds down the price.

Up Ahead

- Eurozone CPI is released on Tuesday.

- On Tuesday US building permits are published.

- Bank of England Governor Bailey speaks on Tuesday.

Disclaimer: The author currently does not own any of the securities mentioned in this article.