Palladium prices had a second winning month in February, after a blockbuster January. At Monday’s settlement in New York futures trade, an ounce of the autocatalyst metal was just over $300 short of a new record high. Charts suggest it could get there. But auto fundamentals may suggest otherwise.

Palladium has soared month after month since the end of November, rising a cumulative 43% over the past three months and 30% this year alone.

The rally has been underpinned by concerns over top palladium producer Russia’s political and financial future after a raft of sanctions piled on Moscow in recent days by Western states responding to President Vladimir Putin’s invasion of Ukraine.

Longs in the metal are betting there will either be disruption in Russia’s palladium production due to the conflict or that the sanctions will squeeze exports—along with other commodities—out of Russia.

But a continued slowdown in automobile production since the 2020 COVID-19 outbreak will likely limit some of the upsides for palladium, the purification agent to reduce emission from gasoline engines.

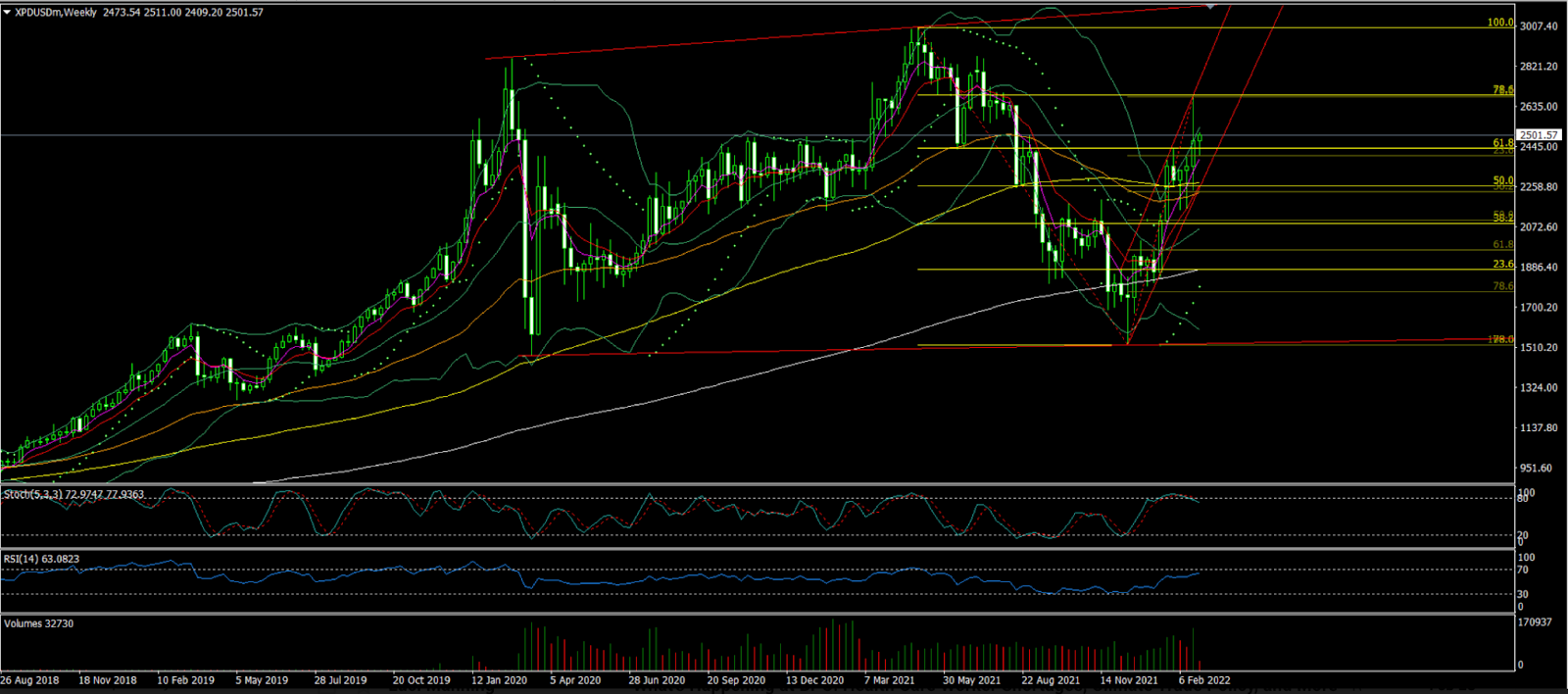

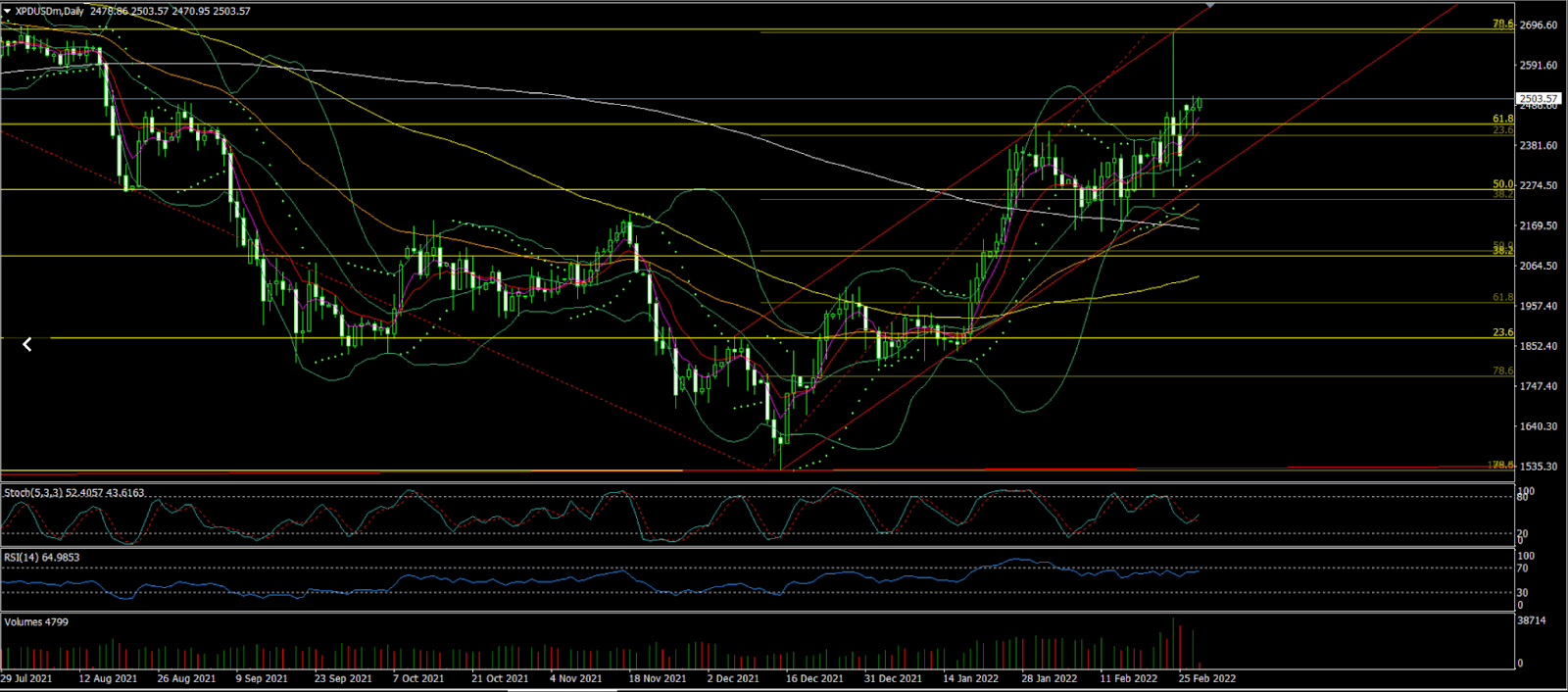

Charts courtesy of skcharting.com

Cox Automotive, in a projection issued last week, forecast that new-vehicle sales in February would probably be at 1.08 million units, constituting an 11% drop from February 2021.

On a seasonally adjusted annual rate (SAAR) the February pace of US auto sales is forecast to show a market still significantly constrained by lack of new-vehicle supply and finish near 14.4 million, down from January’s 15 million pace, and down from last February’s 15.9 million level.

There were 24 selling days in February, the same as last year, so the decline was not due to seasonal adjustments, but rather a tight supply situation that continues to hold back the market.

New-vehicle sales volume has been averaging just over 1.05 million each month since last August, and this February is not expected to buck the trend. Inventory levels are not showing significant improvement. New-vehicle inventory is now 62% below last year, and Auto Available Inventory data show that available supply declined last week after rising for many weeks.

“The market is heading into a very interesting period,” said Charlie Chesbrough, senior economist at Cox Automotive. Adding:

“With low supply and low sales volume, and no tangible market change expected, a big decrease in the sales pace—a sizable drop in the SAAR—is likely in the offing for next month. In the winter, when low sales volumes are expected, seasonal adjustments can result in a relatively strong SAAR, as we have in January and February. But come spring, when sales are expected to be much higher, the SAAR will look particularly weak. Without a big jump in inventory, March’s SAAR is going to show a significant decline.”

Bruce Ikemizu of ICBC Standard Bank, however, has an alternate theory.

“We cannot expect palladium supply and demand situation changes in near future. That is either we have sharply more supply or sharply lower demand,” Ikemizu said in his outlook for the Singapore Bullion Market Association.

With automobiles running on fossil fuel still dominating the sector, Ikemizu does not expect the situation to change soon. Palladium prices will rule higher as long as the supply-demand situation does not change, he said.

In 2021, Russia accounted for 40% (2.6 million ounces) of the total production across the world. Last year, the metal performed badly since the automobiles sector faced a shortage of semiconductors due to the COVID-19 pandemic.

This, in turn, was seen as a factor affecting palladium demand. The metal’s prices had declined during the second half of 2021.

With the number of hydrogen peroxide plants increasing in China, industrial demand for palladium, used as a catalyst as well in chemical production, is expected to increase too, the Hindu Business Line said last week.

According to an end-2021 market report by specialty metals refiner Johnson Matthey, palladium demand is likely to rise faster than supply with the market deficit estimated to have widened to 829,000 ounces in 2021.

So, how much higher can prices technically go if they maintain their present upward momentum?

At Monday’s settlement, the front-month June palladium contract on New York’s COMEX stood at $2,504.60, after hitting a seven-month high at $2,712.27.

Palladium hit an all-time high of $3,019 on May 4, 2021.

“As for the extended targets, palladium, breaking and sustaining above $2,678 can test channel resistance at $2,747, before a retest of the May 2021 high of $3,019,” said Sunil Kumar Dixit of skcharting.com.

Analyzing palladium’s recent moves, Dixit said the metal jumped to $2,678 only to find resistance that pushed it down to $2,473, some $200 below the high.

“The $2,678 point is a 78.6% Fibonacci-level retracement measured from the $3,019 top of May 2021 to the $1,525 low of December 2021,” Dixit added.

He said prices were likely to consolidate with sideways correctional moves as palladium’s weekly chart showed a cluster of important support levels.

Breaking below the 5-week Exponential Moving Average of $2,386 makes for a short term correction to the 100-week Simple Moving Average of $2,278 and the 50-week EMA at $2,230, Dixit said.

“Major support area is at the $2,100 handle which launched the breakout,” he added.

Disclaimer: Barani Krishnan uses a range of views outside his own to bring diversity to his analysis of any market. For neutrality, he sometimes presents contrarian views and market variables. He does not hold a position in the commodities and securities he writes about.