Wall St futures steady after weekly gains as Fed meeting looms

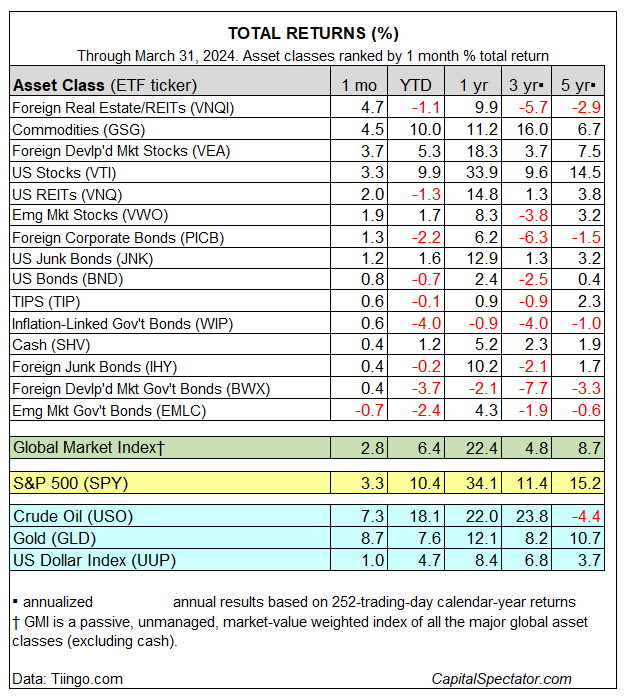

The rally in global assets broadened in March, lifting nearly every slice of the major asset classes. The downside outlier: bonds in emerging markets. Otherwise, last month delivered a clean sweep of gains, based on a set of ETFs.

Global real estate ex-US (VNQI) topped the long list of winners in March, rising 4.7%. The strong advance marks a rebound for the Vanguard ETF after two monthly declines.

Commodities (GSG) and stocks in developed markets ex-US (VEA) and America (VTI) enjoyed strong gains in March too. The lone loser: bonds issued by governments in emerging markets (EMLC), which shed 0.7%, the third straight monthly loss for the fund.

Year-to-date results, by contrast, reflect a mixed profile for global assets. Commodities (GSG) and US stocks (VTI) are reporting strong gains so far in 2024, but there’s plenty of red ink for the year, led by a 4.0% decline in inflation-linked government bonds ex-US (WIP).

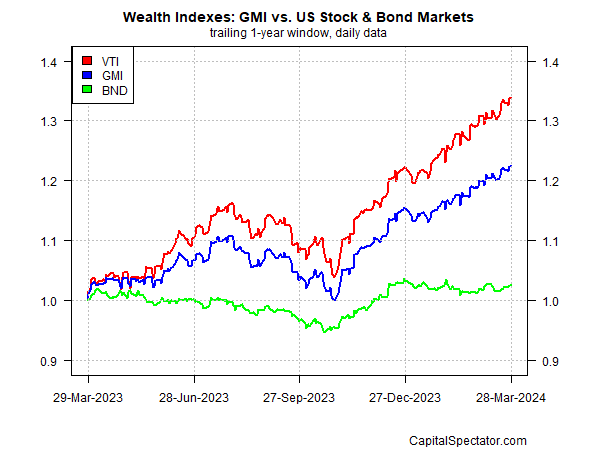

The Global Market Index (GMI) extended its winning streak for a fifth straight month in March, rising 2.8%. GMI is an unmanaged benchmark (maintained by CapitalSpectator.com) that holds all the major asset classes (except cash) in market-value weights via ETFs and represents a competitive benchmark for multi-asset-class portfolios. Year to date, GMI is proving to be a tough act to beat and is currently outperforming everything except commodities (GSG) and US stocks (VTI).

GMI’s one-year performance is also strong, topping 22% through the end of March. US stocks (VTI) are even hotter, rising nearly 34% over the past year. Meanwhile, the US bond market (BND) continues to hold on to a modest 2.4% rise over the past 12 months.