The recent proposal by the U.S. Department of Health and Human Services (HHS) to reclassify cannabis from Schedule I to Schedule III status under the Controlled Substances Act (CSA) saw cannabis funds enjoy a performance gain of +30% over the course of last week. Despite its continued classification as a substance with a high potential for abuse, this proposed reclassification indicates a growing acknowledgment of its lower risk in terms of physical and psychological dependence.

The Biden administration is firmly committed to advocating for the legalization of medical marijuana, a stance confirmed by the President's press secretary during a briefing last week. In response to questions about this matter, White House Press Secretary Karine Jean-Pierre said that “the President has always supported the legalization of marijuana for medical purposes – he’s been very clear about that – where appropriate, consistent with medical and scientific evidence.”

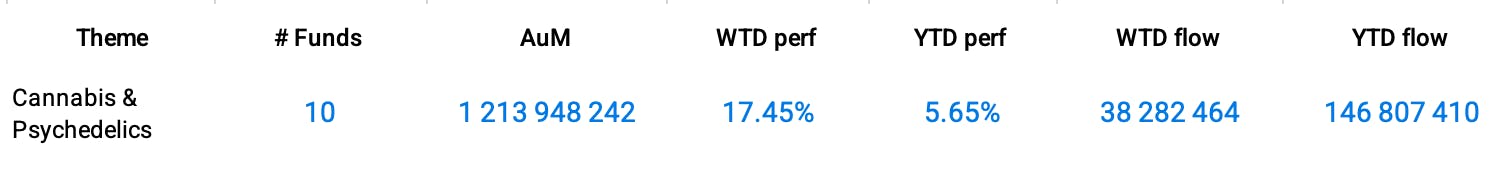

Investors in Cannabis ETFs are getting their hopes up very high on the news, finding it to be a refreshing change after experiencing recurring episodes of disappointing performance in their investments. ETFs centered on companies in the cannabis industry have witnessed substantial gains, with shares surging by double digits and averaging a weekly performance increase of +17.45%. Consequently, they have shifted into positive territory for their year-to-date returns, reaching +5.65%. Despite encountering initial setbacks at the beginning of 2023, the Cannabis & Psychedelics theme has orchestrated significant turnaround efforts, culminating in positive year-to-date results.

As an illustration, the AdvisorShares Pure US Cannabis ETF (MSOS) gained +23.16% over the week with inflows of more than $36 million and a year-to-date performance of +20.22%.

Group Data: Cannabis & Psychedelics

Funds Specific Data: MSOS, MJ, MJUS

This content was originally published by our partners at ETF Central.