It has been a rough summer for investors, with markets pushing losses for the last few months. It's not all doom and gloom, with markets more range-bound than permanently damaged.

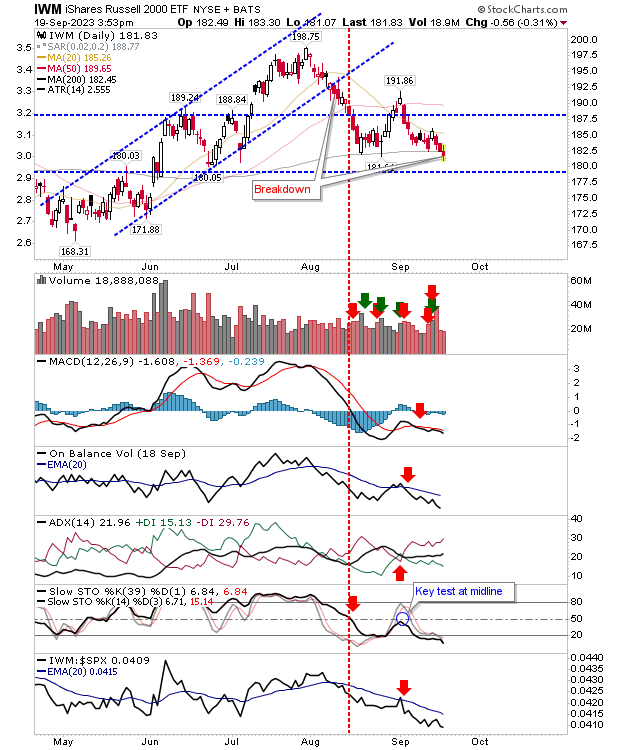

The Russell 2000 (IWM) got the pillorying yesterday as it undercut its 200-day MA on distribution volume. Technicals are net bearish with momentum oversold, but there is another nearby price support level around $178 to lean on.

While yesterday's action sits firmly in the bearish camp, it will take a lot more selling to reverse the June 'Golden Cross' between the 50-day and 200-day MAs, and in its current oversold state, there is a good chance for a bounce of merit.

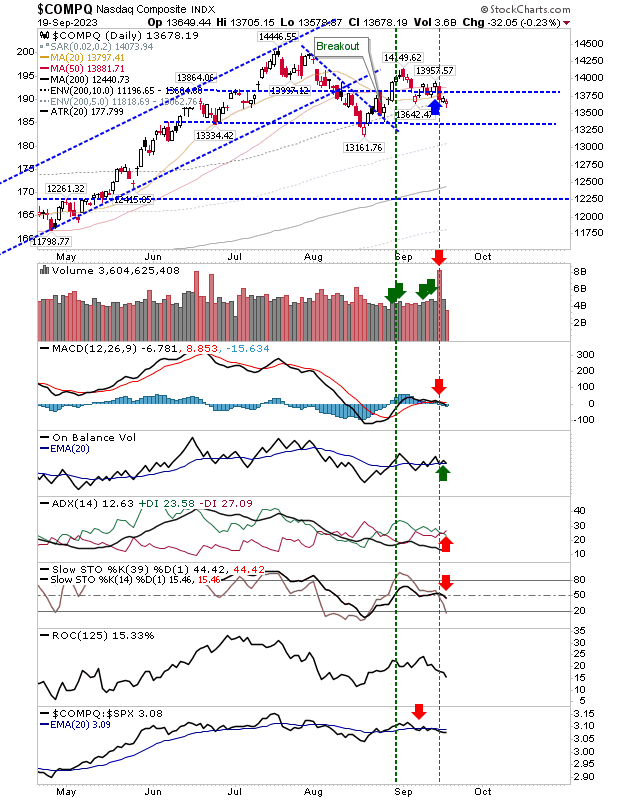

The Nasdaq is still feeling the hangover from Friday's selling as it struggles to deal with the loss of its 50-day MA. Aside from On-Balance-Volume, technicals are bearish, and the index is underperforming relative to the S&P 500.

Volume remains light. Monday and yesterday's candlestick did feel like some attempt to rectify these losses, but this trading action lacked conviction.

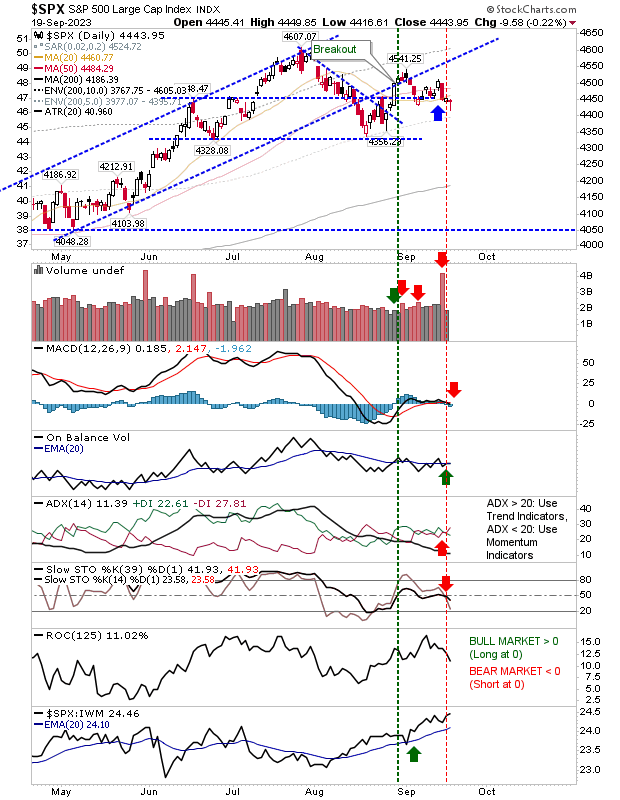

The S&P 500 performed a little better with a 'dragonfly' doji, this candlestick is traditionally seen as a strong reversal candidate, but momentum isn't oversold. Reversal candlesticks perform best when they occur at an oversold state.

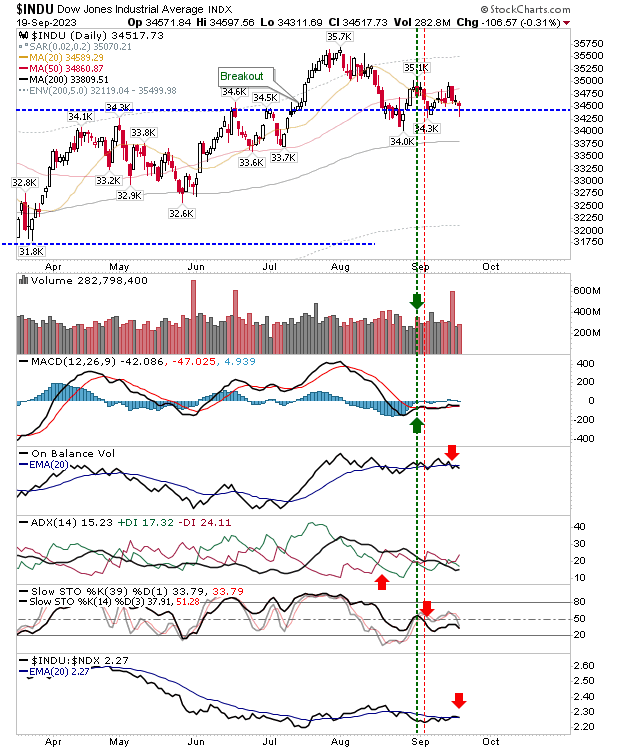

One index that is an interesting juncture is the Dow Jones Industrial Average. It, too, finished with a bullish doji, but a doji bang on key price support. Volume did rise to mark distribution, but by holding support, such volume is better seen as buying.

An aggressive trader could be a buyer here, although it would be bucking the technical picture.

For the coming week, bulls, we want to see the 'dragonfly' doji for large-cap indexes hold, building out to a return above the 50-day MA for the Russell 2000 ($IWM).

The other chart I'm watching is the Russell 2000 ($IWM) weekly chart. It's marking a key test of the 200-week MA; a loss of this moving average in this time frame would be far more serious, but we need to wait until next week to find out.