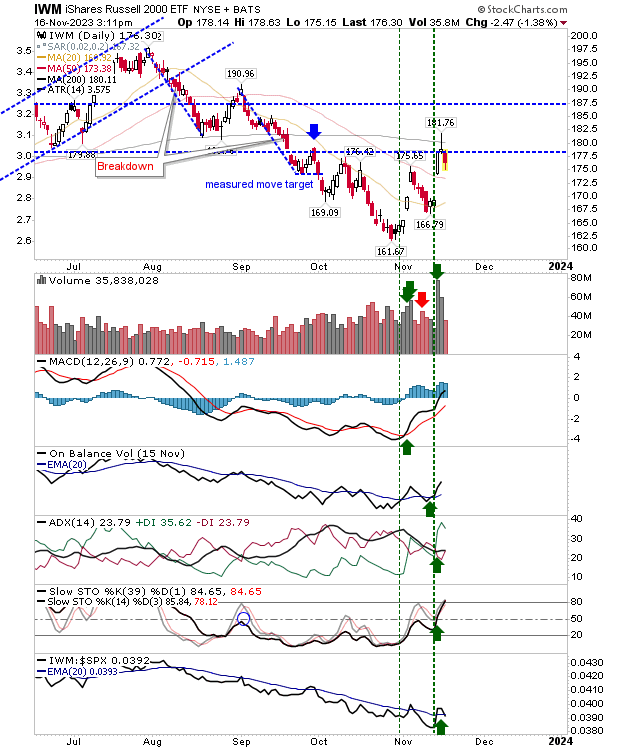

It was inevitable that markets were going to slow down after the recent surge during the week. The biggest reversal came from the Russell 2000 (IWM) which posted a classic inverse reversal hammer, intersecting the 200-day MA, followed by a down-day today to complete a "bearish evening star".

As in any candlestick pattern, the significance of the reversal pattern is increased at momentum extremes, and the Russell 2000 is overbought. Other support technicals are net positive, so I would be looking to the 20-day MA as an area where buyers might step back in.

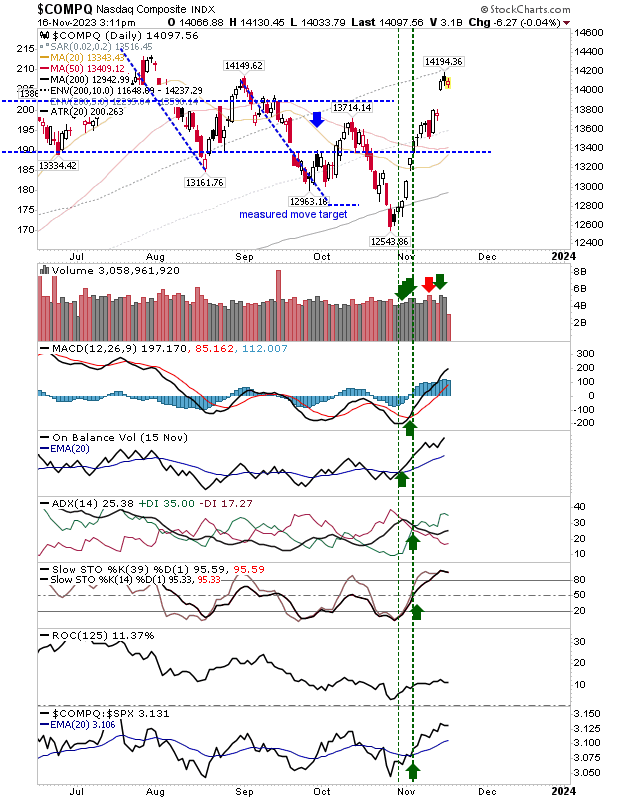

The Nasdaq experienced a small loss as the Tuesday breakout gap remains an enticing area to fill on upcoming weakness. Short-term traders may try for an aggressive short into the gap closure, but more likely is for the trend to continue higher. I would look to this week's gap as a measuring gap with a potential target of 15,400; let's see how bulls deal with the current pause in advance.

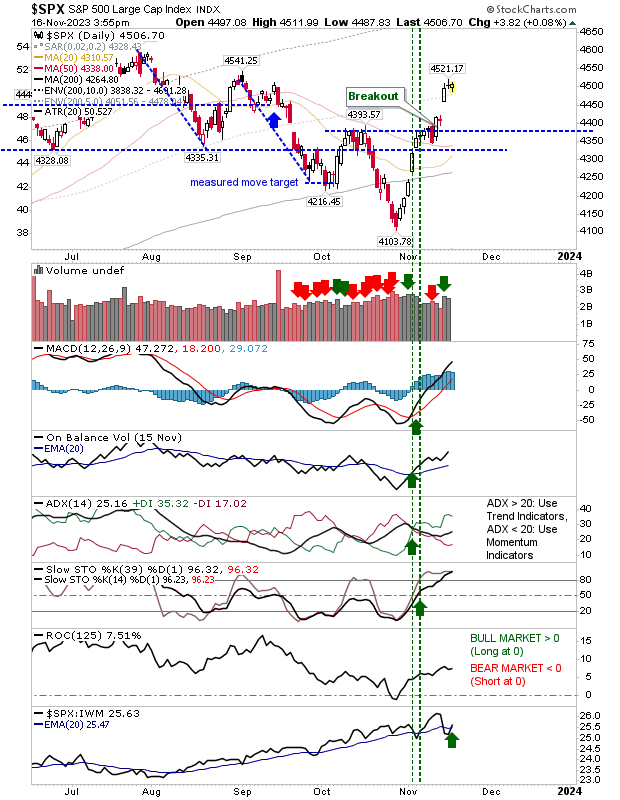

The S&P 500 had a similar finish as the Nasdaq and the potential for a measured move is the same, this time with a target of 4,700.

We will see what the next few days bring. If the Russell 2000 is able to regain its 200-day MA it will be the nail in the coffin for the bear case, or at least, the risk for a crash. We are coming into the seasonal strong period, so there is reason for optimism.