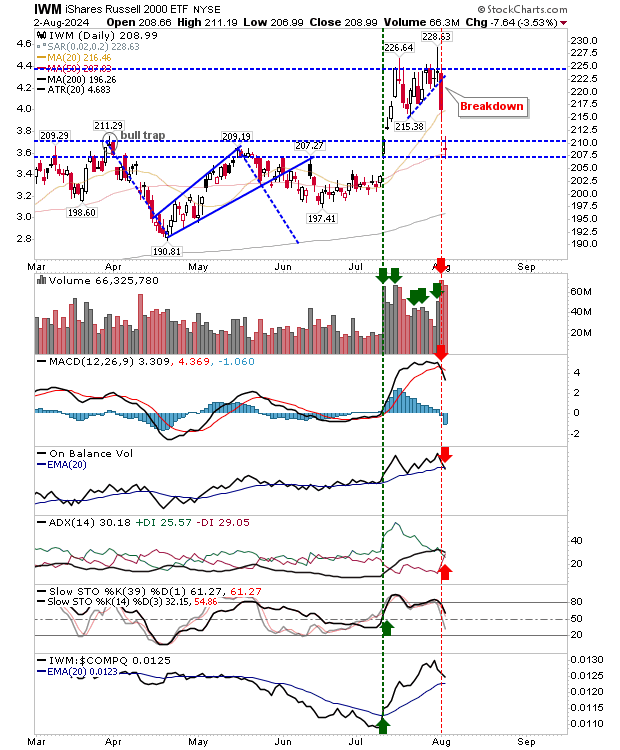

Friday's big gaps lower have the potential to become breakdown gaps, but for now, the near-term oversell has for a possible move into the gap price vacuum. The index most likely to achieve this in the coming days is the Russell 2000 ($IWM).

The Russell 2000 (IWM) finished with a neutral doji, just above its 50-day MA and in a thick band of support between $207.50 and $210 marked by the summer swing highs. Technicals have followed price action with new 'sell' triggers in On-Balance-Volume and ADX, but intermediate-term stochastics haven't reached the mid-line that is typical support in bull markets. Aggressive bulls can look for a move to test the underside of the 20-day MA.

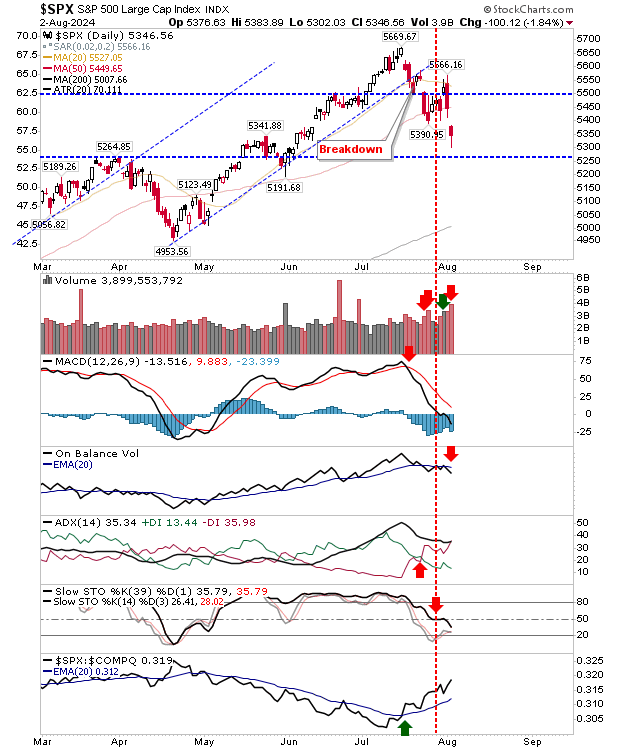

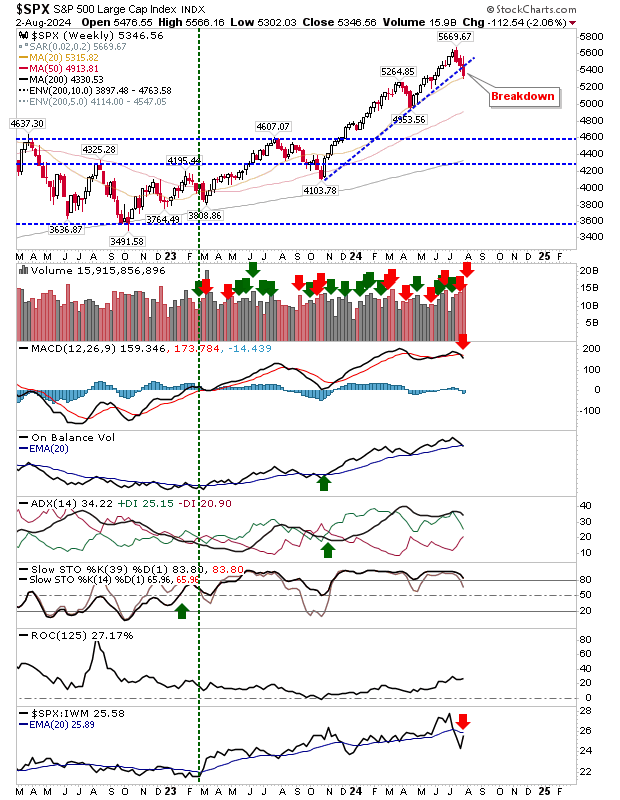

The S&P was unable to hold its 50-day MA on Friday's open, and instead found itself toying with the May swing high. More significant support is likely to be found around 5,265, so if there is an undercut of Friday's low then this will be the next port of call. More concerning for bulls is that intermediate-term stochatics gave up mid-line support, and are a long way from oversold. Technicals are net bearish, and Friday's selling ranked as confirmed distributions. Things stacked against bulls in the near term.

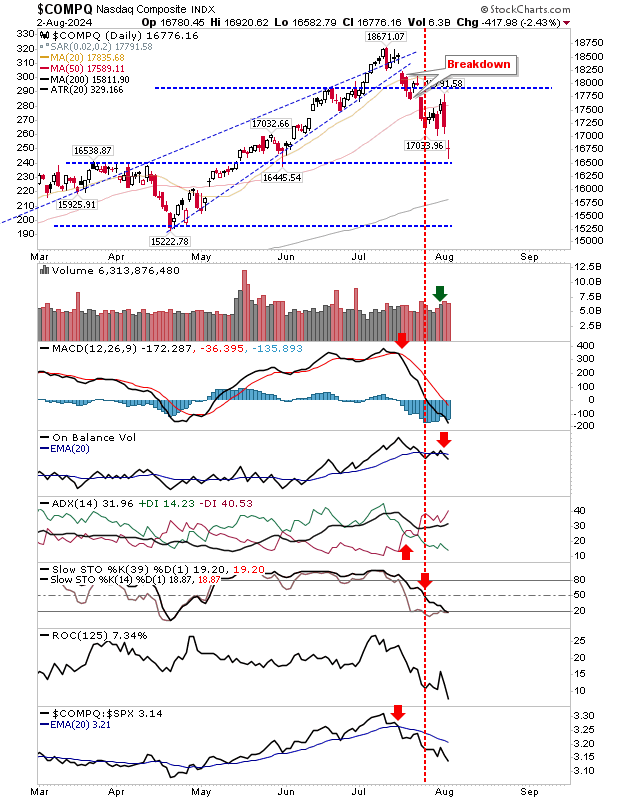

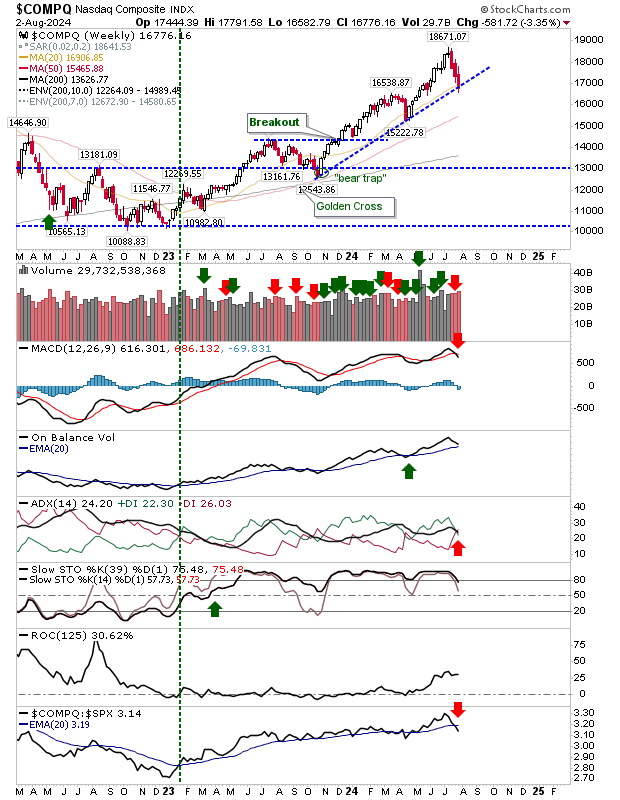

The Nasdaq went seeking for support of the March swing high at 15,540s, with Friday's lows just holding above this level.

Unlike the S&P, there was no confirmed distribution and intermediate-term stochastics are oversold, so like the Russell 2000 ($IWM) there is potential for a move into Friday's gap; watch for a rally into an 20-day/50-day MA crossover.

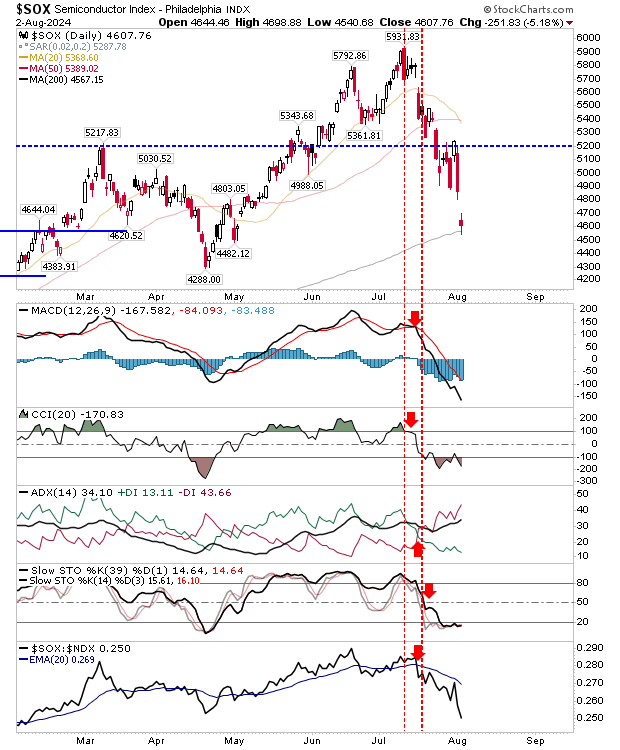

The index to watch week is the Semiconductor Index. It gapped down to its 200-day MA and managed to trade a tight intraday range above this key moving average. Technicals are net bearish (not surprisingly), but don't discount the possibility of a v-shaped reversal.

Long term, things get a little more uncertain. For example, the S&P has lost trend support from late 2023, but is holding 50-week MA support.

The MACD is on a 'sell' trigger but other technicals remain positive. At best, it will be a slowdown in the bullish trend, although a move sideways would seem more likely.

Meanwhile, the Nasdaq did finish on weekly support, and could rally from here, although there was a bearish creep in technicals with 'sell' triggers in the MACD and ADX, along with a relative performance shift against it to the S&P.

For next week, look for some near-term relief with a move back inside Friday's breakdown gap. However, as the gap edges closer to closure I suspect bears will make their return. We are approaching a period of season weakness in September and October, and the U.S. election in November will have markets on edge. The next major rally might not happen until after November's election, so until then, things will likely stay scrappy.