After the long weekend markets continued to sell off, bringing the S&P 500 and Nasdaq back to breakout support while the Russell 2000 (IWM) shaped a potential double top.

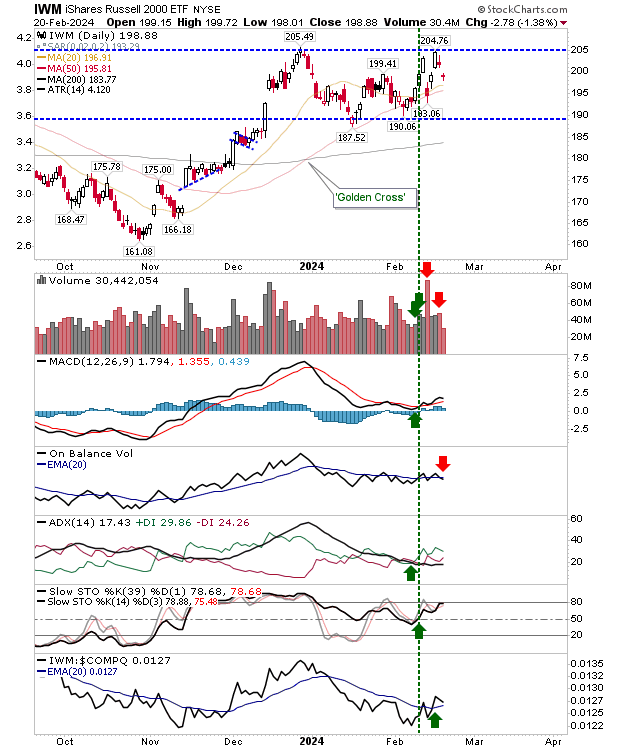

The Russell 2000 ($IWM) has an On-Balance-Volume 'sell' trigger while other technicals are net bullish. However, the reversal from the $205 level marks a potential double top, one that would be confirmed on a loss of $190.

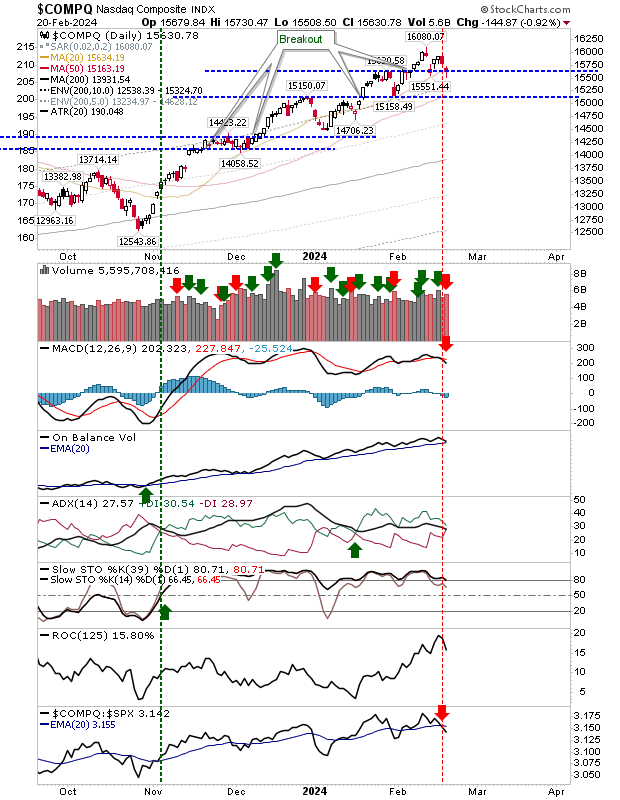

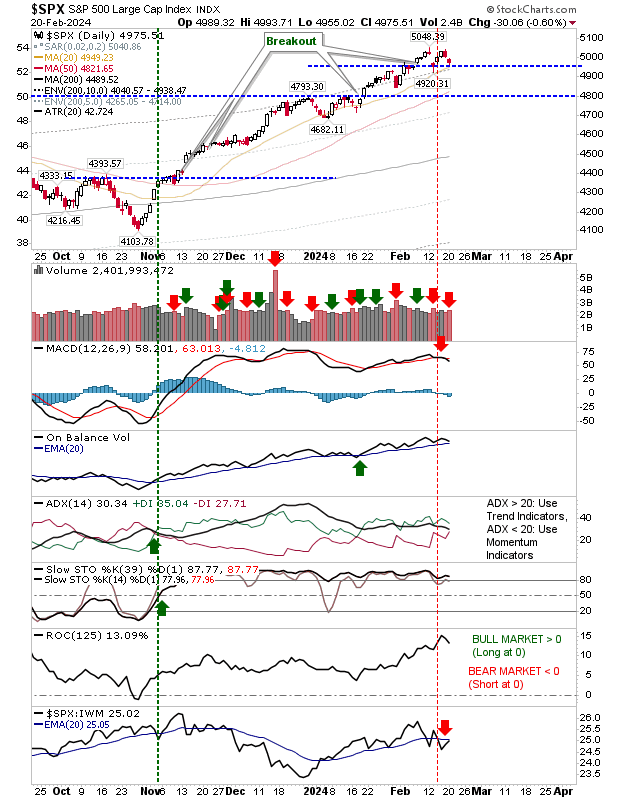

Both the Nasdaq and S&P 500 eased back to breakout support, doing so on higher volume selling distribution.

The Nasdaq is underperforming both the Russell 2000 ($IWM) and S&P 500 ($SPX) and is the index to likely retreat first back to its 50-day MA. As it stands, it's defending 15,550 breakout support.

Likewise, we have the S&P 500 nestled against a micro-support level of 4,950 with good technical strength, barring the earlier MACD trigger 'sell'. As with the Nasdaq, yesterday's trading volume registered as confirmed distribution.

For today, bulls will need to show some resolve if this selling is not to become something more. I would still like the indexes to move back to 50-day MAs, but today will be a chance for the first level of support to come into play and attract buyers.