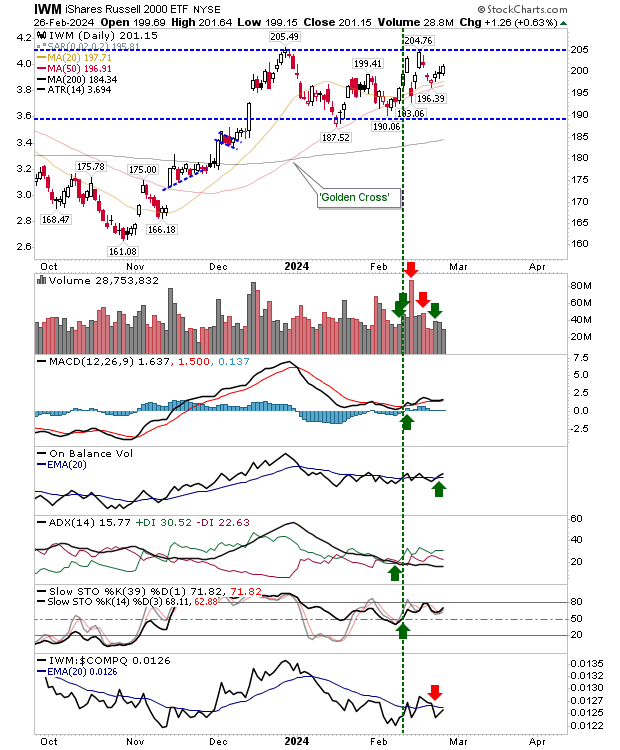

While the Russell 2000 (IWM) is not the leading index in the market, it performed the best yesterday and is building a nice base after its initial failure to break to new highs in early February.

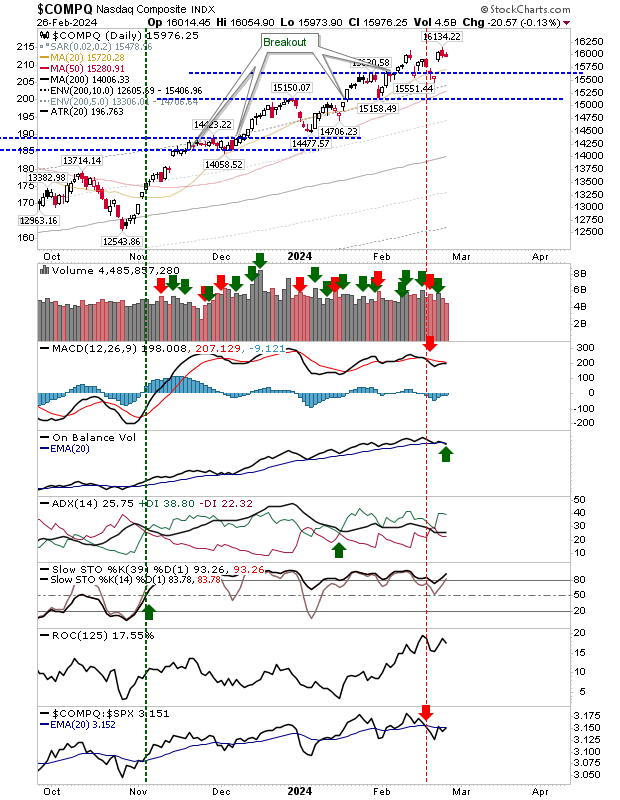

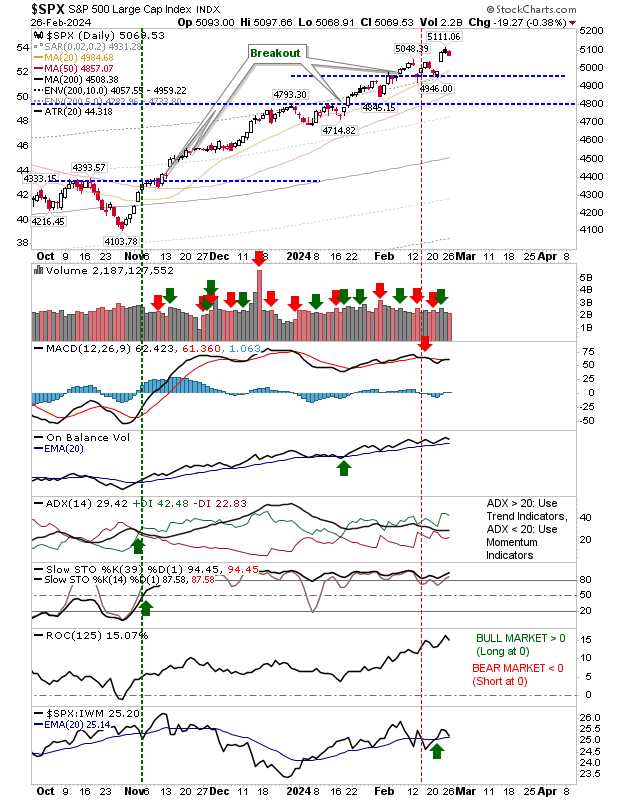

The Nasdaq and S&P 500 didn't do a whole lot yesterday, but breakouts from February are intact for both of these indices.

Technicals for the Russell 2000 ($IWM) returned net bullish with on-balance-volume on a new 'buy' signal. That said, the index is underperforming relative to both the Nasdaq and S&P 500.

While yesterday finished higher, the trading range neutralizes the significance of the gain, and only when the range high or low is breached will we have a return to the November-January rally or a shift towards a more bearish stance.

With the Russell 2000 doing most of the leg work yesterday there wasn't a whole lot going on with either the Nasdaq or S&P 500.

The Nasdaq posted a small loss, extending from Friday's loss. The breakout from February remains intact but there is a substantial breakout gap to close.

The S&P 500 closed Friday with a bearish black candlestick that followed up with losses on Monday. Technicals are a little muddled with a flatlined MACD but a generally bullish accumulation.

For the coming week, it will be down to the S&P 500 and the Nasdaq to hang on to their breakouts while the Russell 2000 continues to build the right-hand side of its base.

Nasdaq breadth remains negative and it will take time before this recovers, but price leads in all respects.