Canada’s trade deficit widens even as U.S. trade surplus grows

In today's financial landscape, it's easy to be dazzled by the plethora of ETF options available to Canadians. From liquid alternatives and actively managed covered call ETFs to intriguing cryptocurrency-focused funds, the market seems awash in innovative investment vehicles.

Yet, as we navigate this exciting array of choices, there's merit in remembering the adage: sometimes, less is more.

Over the long haul, fundamentals like broad diversification, minimal fees, and straightforward investment strategies might take precedence over trendy offerings. While the siren song of active management can be hard to resist, the evidence often leans in favor of passive indexing.

Take, for instance, the latest results of the SPIVA (S&P Indices Versus Active) report which revealed a staggering 93.4% of all U.S. large cap funds underperformed the S&P 500 over the past 15 years. Such findings underscore the challenges active managers face in consistently outpacing their benchmarks.

For those who adhere to the KISS (Keep It Simple, Stupid) methodology in investments, the allure of Scotia's Index Tracker ETF lineup becomes crystal clear. These low-cost, Cboe Canada listed ETFs offer a straightforward approach to investing, without the bells and whistles that can sometimes cloud one's financial judgment.

So, how would I harness these ETFs to craft a portfolio tailored to my personal risk tolerance and investment horizon? Let's take a look.

Setting some ground rules

Before diving into the intricacies of constructing a portfolio, it's important to set some fundamental guardrails. A portfolio is more than just a collection of assets; it's a carefully constructed blueprint tailored to an individual's unique financial picture.

This means that while I'll be sharing my own portfolio construction based on my risk appetite and investment horizon, it's imperative to note that your circumstances, risk tolerance, and financial goals may paint a different picture. Personalization is key.

At the heart of my portfolio is an 80/20 equity/bond split. This decision is rooted in my comfort with taking on a moderately aggressive stance, as I'm seeking growth while still maintaining a buffer for market downturns.

On the equity front, my goal is to approximate the current global market geography. By basing my investments on market capitalization weight, I can tap into the organic growth of economies around the world without betting on a single country outperforming.

However, I've chosen to incorporate a Canadian home country bias. This isn't just a nod to patriotism; it’s a strategic move to balance currency risks, benefit from the familiarity of the Canadian market, and potentially gain from tax efficiencies.

Switching gears to the bond side, my focus is clear: the aggregate Canadian bond market. This approach provides a broad exposure covering both government and investment-grade corporate bonds spanning all maturities. It's a simple one-size-fits-all pick I'm comfortable with.

U.S. equity ETF choice

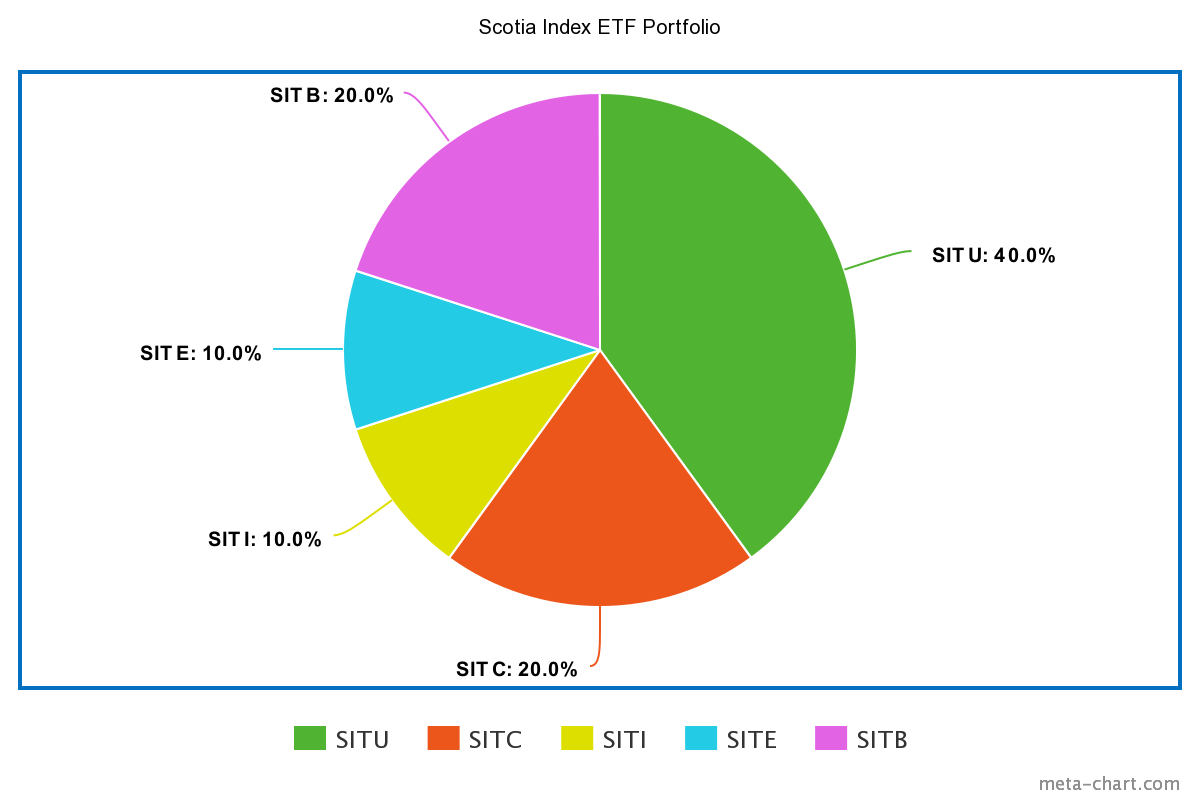

The colossal influence of the U.S. market is hard to bypass. This is evident in my 40% allocation to U.S. stocks, a testament to the U.S. equity market's commanding presence, which makes up approximately 60% of the global market by weight.

Such an allocation isn't merely about percentages; it's about capturing the growth and dynamism of influential companies, from tech behemoths to pioneering biotech entities.

In line with this strategy, the Scotia US Equity Index Tracker ETF (NLB:SITU) emerges as an apt choice. It not only offers an entry into the U.S. market at a wallet-friendly 0.09% expense ratio but also provides exposure to the top 500 U.S. companies.

This means, that with a singular investment in SITU, one gains a stake in the U.S.'s corporate juggernauts. What's more, by tracking the Solactive GBS United States 500 CAD Index, SITU ensures minimal turnover, cutting down on transaction costs, while offering transparency.

Canadian equity ETF choice

When we look at the world's financial stage, Canada might not be the biggest player, taking up just 3% of the global market. But for my portfolio, I've chosen to give Canadian equities a more significant role, dedicating 20% of my capital.

Why the extra attention? Two main reasons: tax efficiency and currency stability. Investing closer to home can offer better tax benefits, and there's also the advantage of not having to worry as much about currency fluctuations affecting returns.

This leads me to the Scotia Canadian Equity Index Tracker ETF (SITC). This ETF zeroes in on the 60 biggest and most traded Canadian companies by following the Solactive Canada Large Cap Index. And the cherry on top? It does all this with a super low fee of just 0.06%.

International equity ETF choices

While North America holds a special place in the investment landscape, casting our net globally can provide some enticing opportunities. Specifically, there's a world beyond Canada and the U.S. that beckons with potential—international developed markets and emerging markets.

For the former, think about countries like Japan, the UK, Australia, and Germany. These nations have mature economies and stable financial systems, yet they offer distinct valuations and yields that differ from North America.

For the latter, we're looking at countries on the rise—places like China, India, Brazil, and South Africa. These markets are budding with potential, offering rapid growth and the chance to invest in economies that could be the powerhouses of tomorrow.

For my portfolio, I'm eyeing a 10% allocation each to the Scotia Emerging Markets Equity Index Tracker ETF (SITE)and the Scotia International Equity Index Tracker ETF (NLB:SITI). Their respective expense ratios are 0.34% and 0.22%.

But the real magic lies in their coverage: SITE provides access to 978 developed stocks, and SITI offers a doorway to 1,366 emerging stocks. With such a vast array, I don't have to spend time researching individual international companies or worry about converting currencies—it's all conveniently bundled.

Bond ETF choice

Bonds are the quiet, steady players in the investment game, and I've set aside 20% for bonds. There's good reasoning behind this. Historically, introducing bonds into a portfolio has been a strategy to boost risk-adjusted returns.

This allocation doesn't just serve as a placeholder; it's a stabilizing force. By reducing the wild ups and downs (volatility) and the occasional sharp declines (drawdowns) in portfolio value, bonds can act as a buffer, especially when they are coupled with regular rebalancing.

Now, while the idea of bonds sounds reassuring, getting your hands on individual ones can be a bit tricky. The over-the-counter market, where these bonds are often bought and sold, can sometimes be a maze, especially for individual investors.

Challenges around pricing transparency, liquidity, or even just getting the right bond at the right time can be daunting. This is where bond ETFs come into play, offering unparalleled convenience.

Enter the Scotia Bond Index Tracker ETF (SITB). SITB follows the Solactive Broad Canadian Bond Universe Liquid Index. In simpler terms, with this ETF, you're investing into hundreds of Canadian government and high-quality corporate bonds, all under one umbrella. And the cost for this convenience? A minimal 0.09% expense ratio.

With an intermediate duration of 8.47 years, it fits snugly into a wide array of investment plans, catering to both short-term and long-term goals as sort of a "Goldilocks" option.

Moreover, with a weighted average yield to maturity currently sitting at a juicy 4.46%, it becomes a reliable source of income. What makes it even sweeter is the frequency – the ETF pays out monthly, making it a consistent contributor to your cash flow.

This content was originally published by our partners at the Canadian ETF Marketplace.

Which stock to consider in your next trade?

AI computing powers are changing the Canadian stock market. Investing.com’s ProPicks AI are winning stock portfolios chosen by our advanced AI for Canada, the US, and other exciting markets around the globe. Our top strategy, Tech Titans, nearly doubled the S&P 500 in 2024 - one of the most bullish years in history. And Beat the TSX, designed for broad market exposure, is showing +878% gains with 10 years’ back-tested performance. Which Canadian stock will be the next to soar?

Unlock ProPicks AI