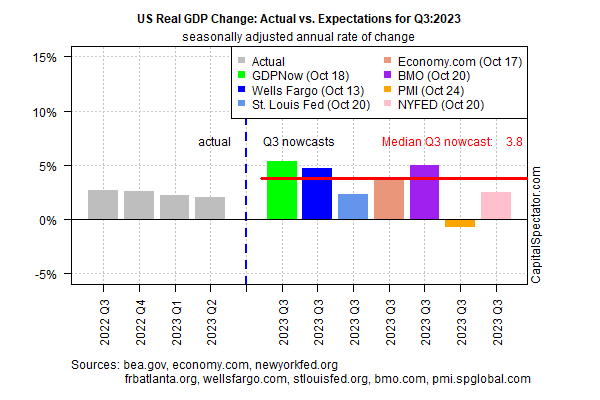

Tomorrow’s release of third-quarter economic data is expected to show that US output accelerated, based on GDP nowcasts from several sources compiled by CapitalSpectator.com.

The Bureau of Economic Analysis looks set to report on Thursday, Oct. 26, that US economic output rose 3.8%, based on the median estimate. If correct, the gain will mark a strong improvement over Q2’s 2.1% increase.

Today’s updated nowcast also marks a fractionally higher gain vs. last week’s estimate.

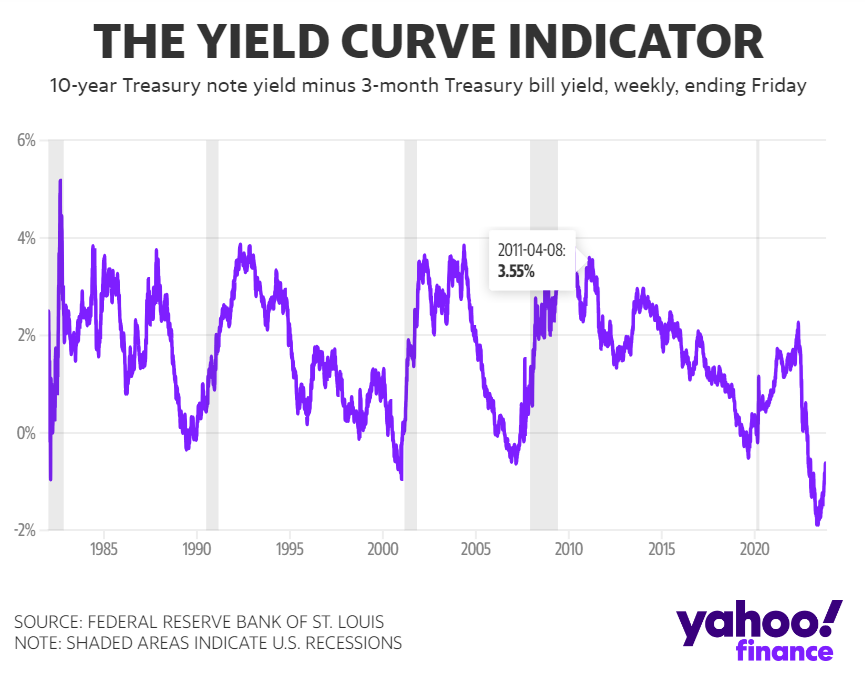

The inverted Treasury yield curve, however, implies that recession risk is still lurking. Economist Campbell Harvey, a professor at Duke, says that

"Monetary tightening from the Fed operates with a lag and we just don’t see it right now.”

He adds, however, that

“I’ve become a bit more pessimistic since August.”

The source of Harvey’s wary outlook is the history of the spread for the 10-year yield less the 3-month bill. As Yahoo Finance points out, “The past four recessions occurred when the spread between the two yields narrowed and came close to reverting back to normal. That is what is happening now.”

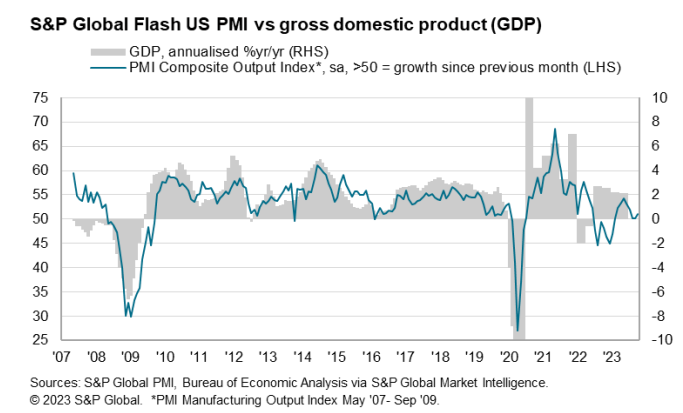

But the latest PMI survey data for October offer a counterpoint. The US PMI Composite Output Index, a GDP proxy, rose to 51.0 this month, modestly above the neutral 50 mark.

“Hopes of a soft landing for the US economy will be encouraged by the improved situation seen in October,” says Chris Williamson, chief business economist at S&P Global (NYSE:SPGI) Market Intelligence.

“The S&P Global PMI survey has been among the most downbeat economic indicators in recent months, so the upturn in US output growth signaled at the start of the fourth quarter is good news. Future output expectations have also turned up despite rising geopolitical concerns and domestic political tensions, climbing to the joint highest for nearly one-and-a-half years.”

One reason for the firmer outlook he explains:

“Sentiment has improved in part due to hopes of interest rates having peaked, something which looks increasingly likely given the further cooling of inflationary pressures witnessed in October.”