The biggest event of the week may not be the Fed meeting but the BOJ, which is set to conclude on Tuesday. There have been rumors that the BOJ plans to raise rates for the first time in over a decade.

Whether the move is priced in or not is unclear because we have seen these rumors before, and nothing has happened. So, it seems possible that the market is somewhat skeptical about another supposed BOJ rate hike.

Yen Strengthens Against the Dollar

We have seen the yen strengthen some against the dollar recently, but much of those gains have also been returned.

The yen has returned to its 61.8% retracement level at around 149.20 to the dollar, so it seems more likely than not that the yen will strengthen further against the dollar in the coming days once the initial retracement is over.

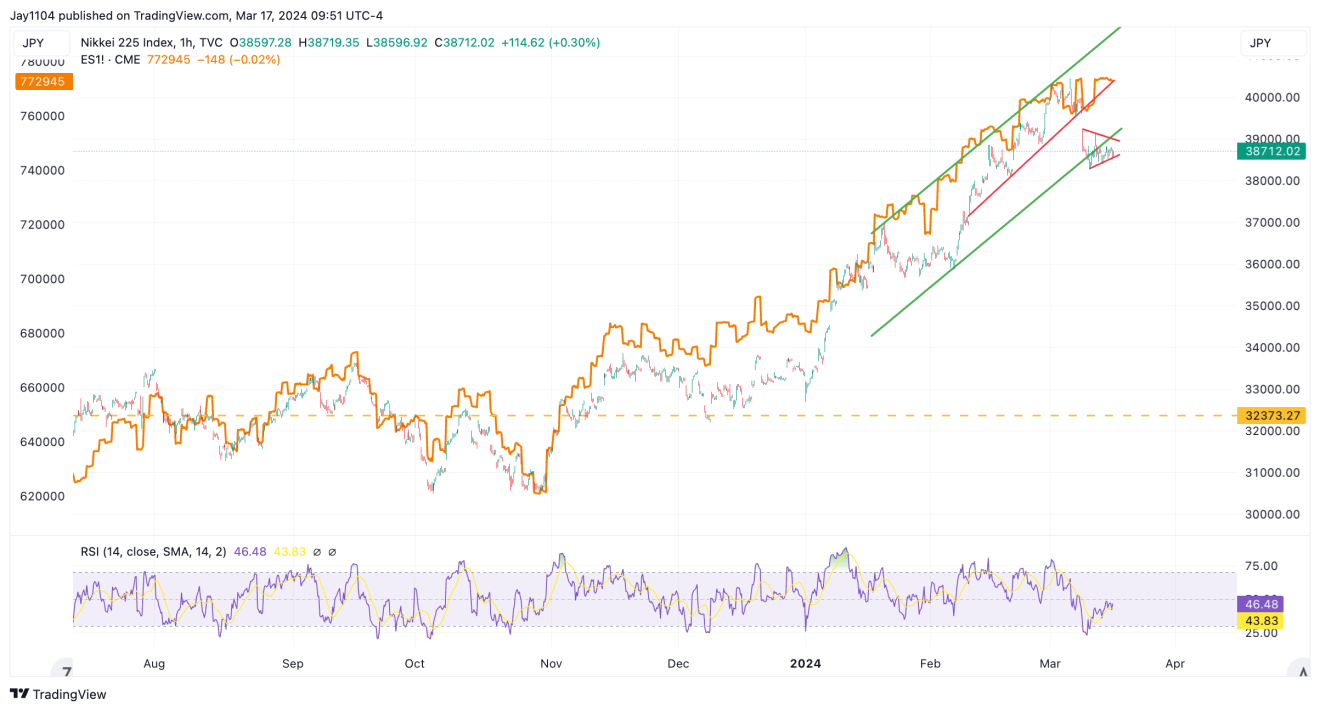

Nikkei Drops on Rate Hike Talks

The Nikkei 225 has recently fallen victim to the rate hike talks and a stronger yen. The index gapped below a critical uptrend on March 10 while falling out of a rising channel on March 12 and now appears to have formed a pennant.

A stronger yen and higher rates won’t be good for the Nikkei going forward, and the technical chart seems to confirm that the Nikkei could be heading lower over the near term.

S&P 500 Vs. Nikkei

When comparing the Nikkei to the S&P 500, priced in Japanese yen, one can see that they match up perfectly.

So, if we were to conclude that some of the benefits we have seen in the US markets have been driven by easy monetary policy and a weaker yen, then it seems possible that a stronger yen and weaker Nikkei could negatively impact US markets as well, and this one would need to be closely monitored.

S&P 500 to Test the 5,050 Level

Indeed, the more robust inflation data this past week did not help the US equities market either, as rates rose, the dollar strengthened and spreads widened, pushing the VIX higher and stocks lower.

An uptrend was broken this past week, but the S&P 500 did find support around 5,100, which does create an opportunity for the S&P 500 to test the 5,050 level. But until 5,050 can be breached, there is not much else to say.

NASDAQ 100 May Fall Out of the Rising Megaphone Pattern

The NASDAQ 100 appears to be in worse technical shape than the S&P 500 thus far. The NASDAQ falling below support at 17,850 does open a potential gap fill to 17,450, which would erase that Nvidia (NASDAQ:NVDA) post-earning gap rally witnessed in mid-February.

Completing the gap fill at 17,450 would likely mean that the NASDAQ 100 also falls out of the rising megaphone pattern.

10-Year Rise Back Above the 4.3% Level

Meanwhile, this past week, we saw the 10-year rate rise back above the 4.3% level, and that has been a level to watch for because resistance around 4.35% has been strong, with rates failing multiple times to get beyond that resistance. A push beyond 4.35% likely opens up a pathway for the 10-year rate to push higher to 4.5% and possibly back to 4.75%.

Much of this will depend on what the Fed says and the dot plot they provide. A Fed that takes rate cuts away suggests the neutral rate may be higher than previously thought; this would be the fuel needed to push the 10-year rate higher from current levels and above 4.35%.

2-Year Rate Pushing Higher

The same can be said about the 2-year rate, which finished last week at 4.73% and is also closing in on breaking out. It is pushing higher towards 4.85% and potentially returning to 5%.

Yield Curve Likely to Steepen

If the rate cuts aren’t going to be deep, the neutral rate is higher than previously thought. If the BOJ delivers a first-rate hike, then it would make sense for the yield curve to steepen, meaning that the 10-year would rise to the 2-year, similar to what was seen in August and September.

So what comes out of the Fed and the BOJ this week could be consequentially for markets because both events could trigger tight financial conditions globally.

Given the inflation reports here in the US last week, it’s tough to say that financial conditions are tight. Given just how much both US and Japanese markets have rallied, it would seem to suggest that financial conditions have gotten too easy, and some policy adjustments are needed.