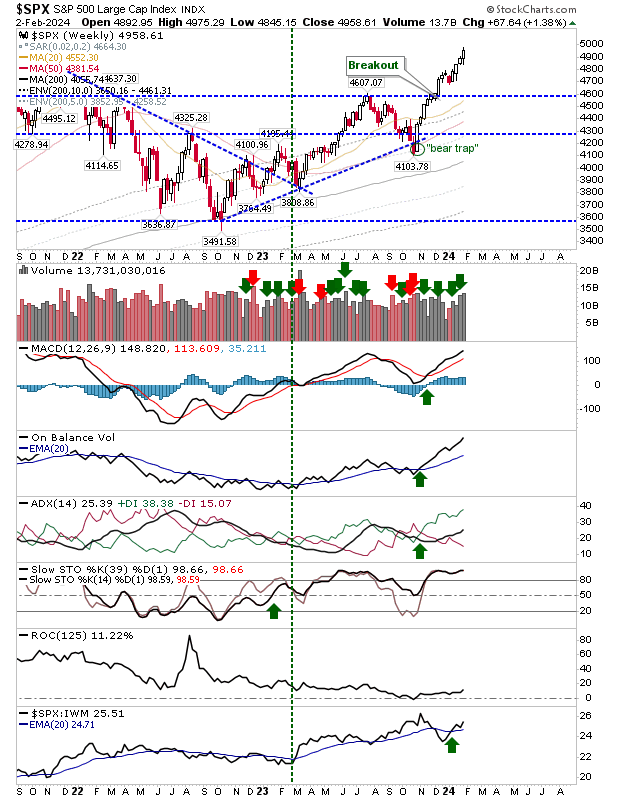

I got burned badly on my day trade expectations for Friday, but it was another solid end-of-week for market bulls.

For the S&P 500, this meant further gains in relative performance over the Russell 2000 (IWM) on overbought stochastics.

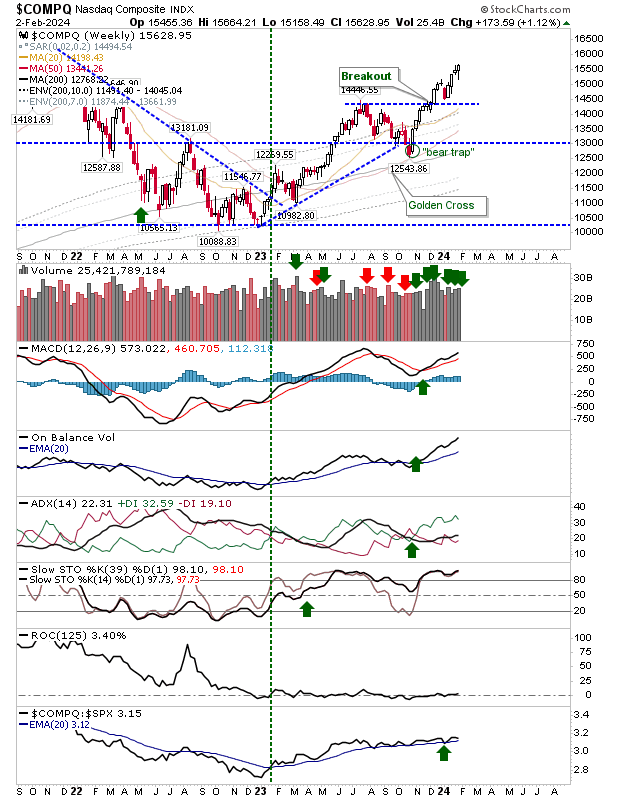

The Nasdaq took a slightly longer route to banking its weekly gain, experiencing a weekly intraday spike low.

The Nasdaq is outperforming the S&P 500 (outperforming the Russell 2000) and like the S&P 500, it enjoys solid technical strength.

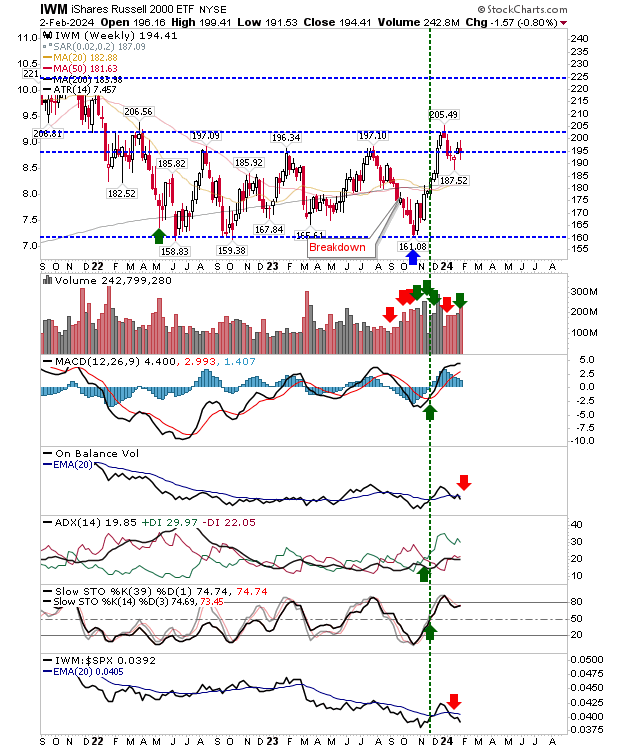

I had expected more from the Russell 2000 ($IWM) but it spent another week experiencing further indecisiveness, closing with a "spinning top".

However, the end-of-week finish is close enough to $195 support to consider support as holding.

Technicals are a little more mixed with On-Balance-Volume switching to a 'sell' trigger as the index underperforms relative to peer indexes.

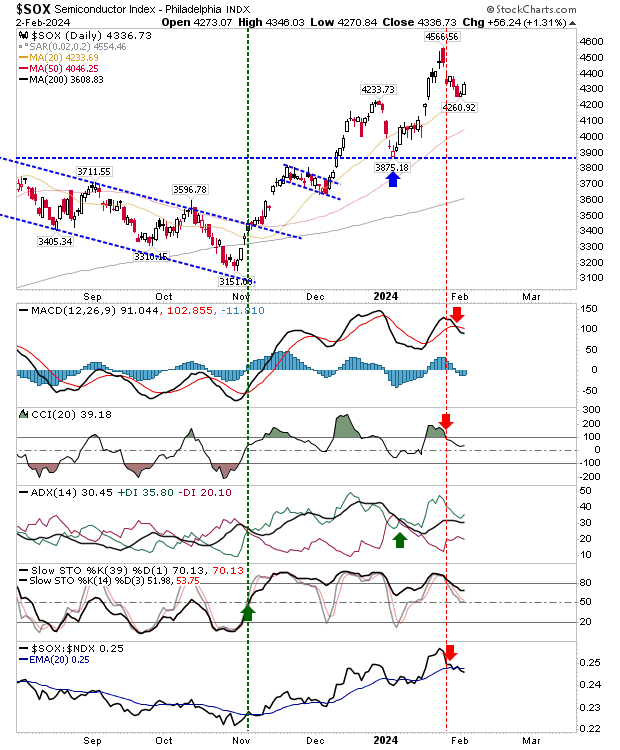

As a final note, one index performing well is the Semiconductor Index. It has defended its 20-day MA with considerable ease since October and should have enough momentum to return to a challenge of its January high at 4,566.

For the coming week, we may see a slowdown in the weekly advance, but bulls have the edge.

The post-COVID hangover bear market is near an end, but it may be a case of three steps forward, and two steps back.