The divergence between the S&P 500, Nasdaq and Russell 2000 continues to grow. The former indexes are accelerating in their bullish trend while the Russell 2000 wallows in itself.

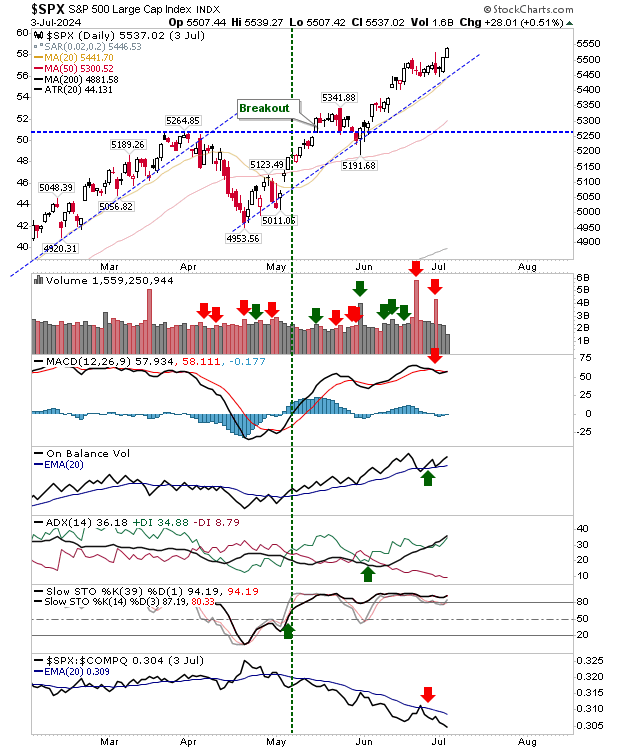

Having said that, it's not all plain sailing. The S&P 500 hasn't yet reversed the 'sell' trigger in the MACD, but it's getting there.

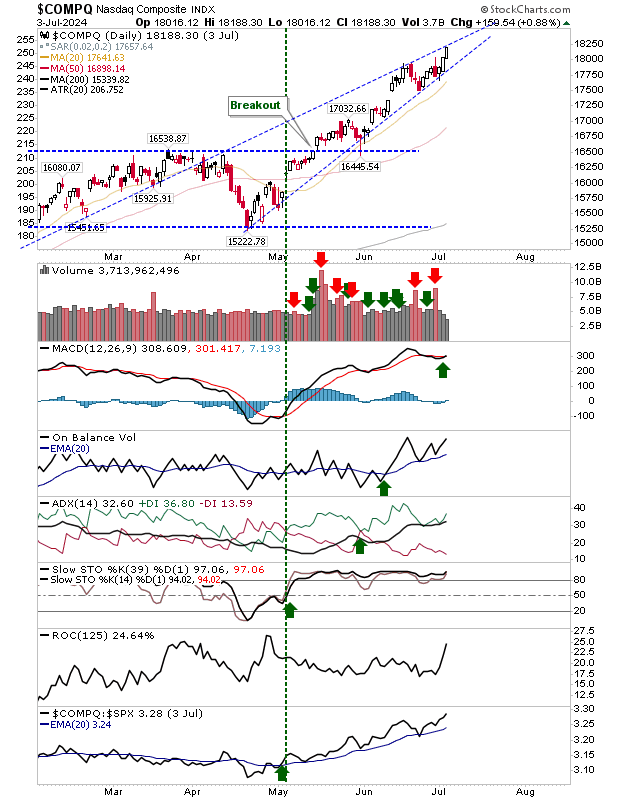

The Nasdaq went a step better with a return of the 'buy' signal in the MACD. On a cautionary note, there is a convergence of a possible bearish wedge, which if true, should have sellers make an appearance today.

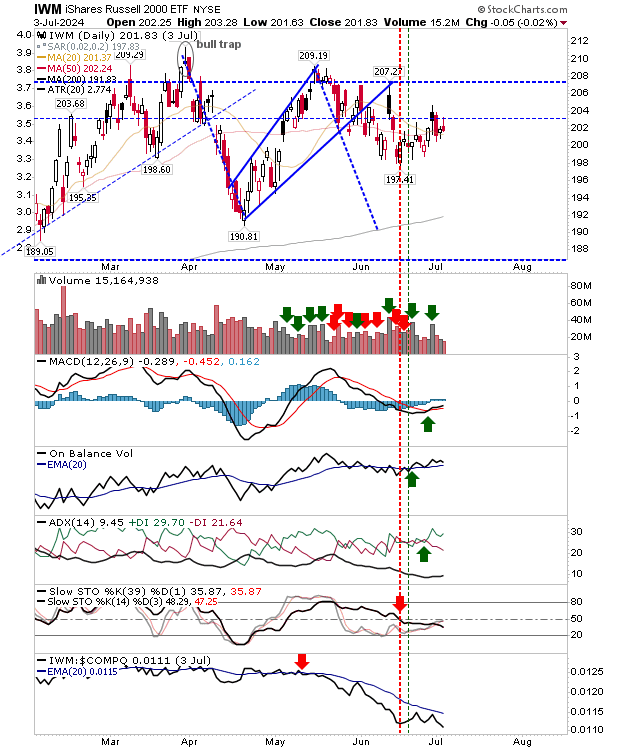

The Russell 2000 (IWM) remains in a rut. For an investor, this isn't a problem, but for a trader it's a bit of a mess.

I think it needs to test its 200-day MA, if only to offer a catalyst for a reaction. Interestingly, stochastics have consistently remained below the midline, even as the index staged a small rally inside its trading range.

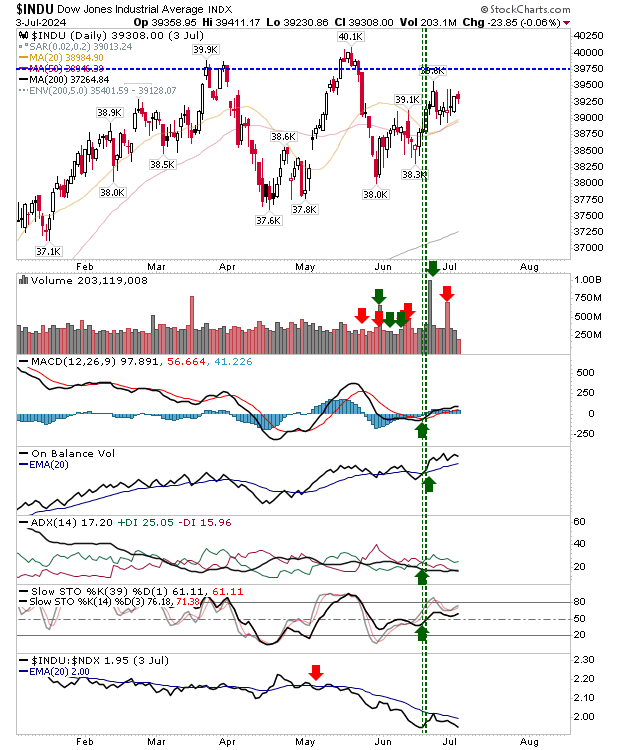

The Dow Industrial Average ($INDU) is running a pattern similar to the Russell 2000 ($IWM), but does at least have the benefit of net bullish technicals.

It's interesting to see it run closer to Small Caps than Large Caps, but I would give it a greater chance of challenging all-time highs than the Russell 2000.

For today, look for a pause in the Nasdaq with perhaps a neutral doji or narrow-range day candlestick. If sellers do come in, the Russell 2000 ($IWM) would be the most vulnerable to take a hit, but given its trading range, it may end up been a scrappy loss.