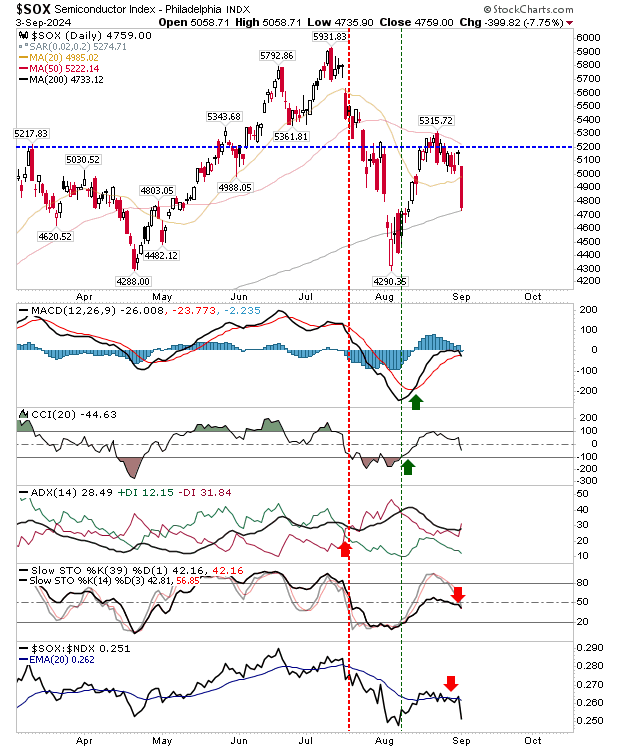

So much for the bullish outlook as bears made their presence felt. The biggest loss was in the Semiconductor Index as it lost nearly 8% to close just above the 200-day MA.

In addition, the latter index dropped below the stochastic mid-line, having struggled to return above the key divide between bullish and bearish markets.

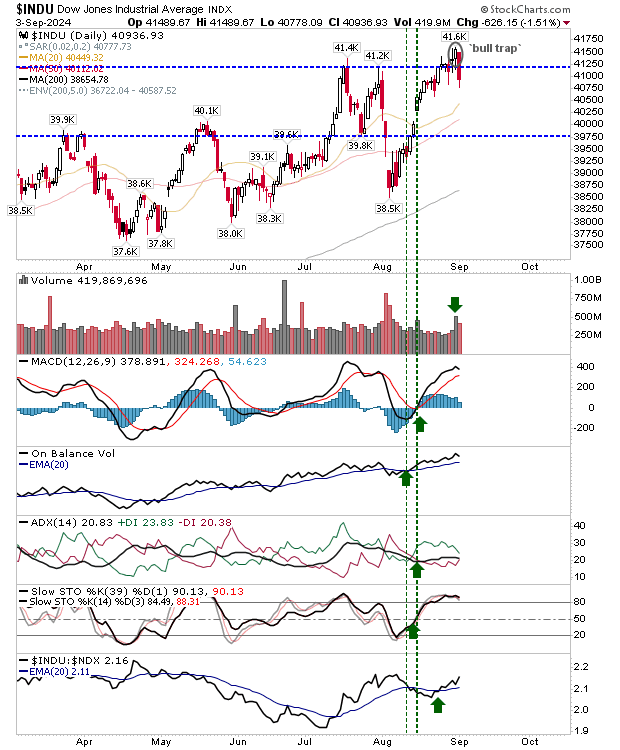

The selling pressure in the Semiconductor Index was enough to deliver a "bull trap" in the Dow Jones Index.

The index was well placed to advance, but it looks like it will take a little longer to deliver. Technicals are net positive and it will take more than one day of selling to change that.

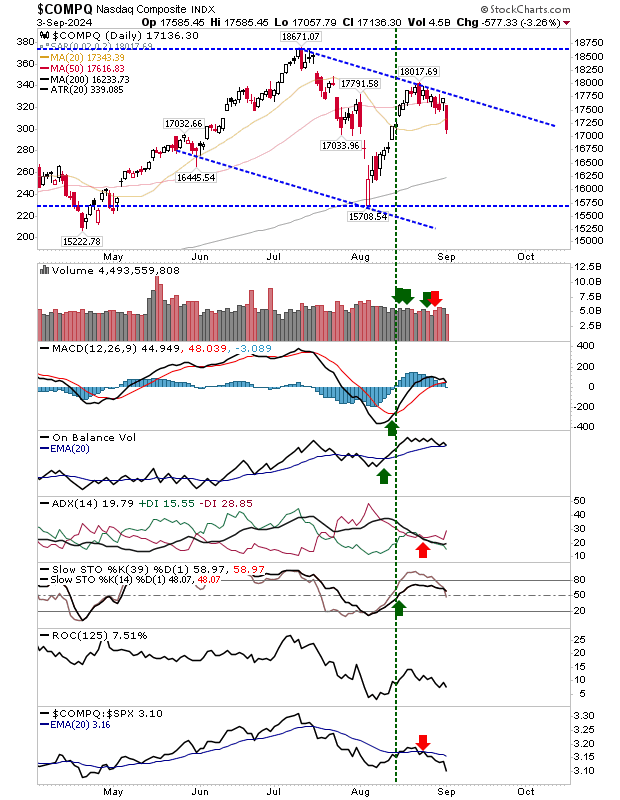

In the case of the Nasdaq, yesterday's loss dropped the index away from 50-day MA support and undercut its 20-day MA in the process.

I have redrawn a broader, downward channel for the index, but I would look to the 200-day MA as the first port of call for a support test. Of technicals, the +DI/-DI trend indicator has switched bearish.

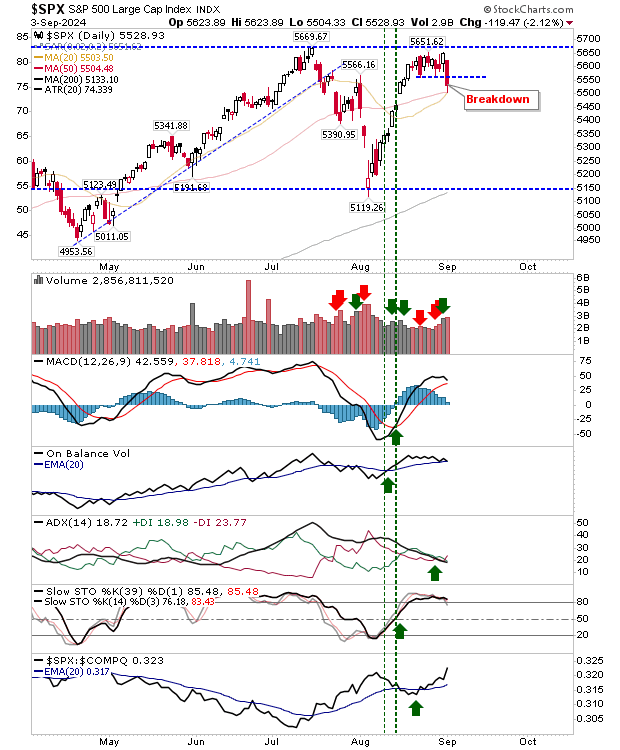

The S&P 500 hadn't cleared the July high - trading in a narrow range - but this changed yesterday with a clear undercut of this range, and a close at converged 20-day and 50-day MAs support.

It would be a good time for a bounce, particularly if there is a bullish candlestick like a dragonfly doji or bullish hammer at these moving averages. Technicals are net bullish.

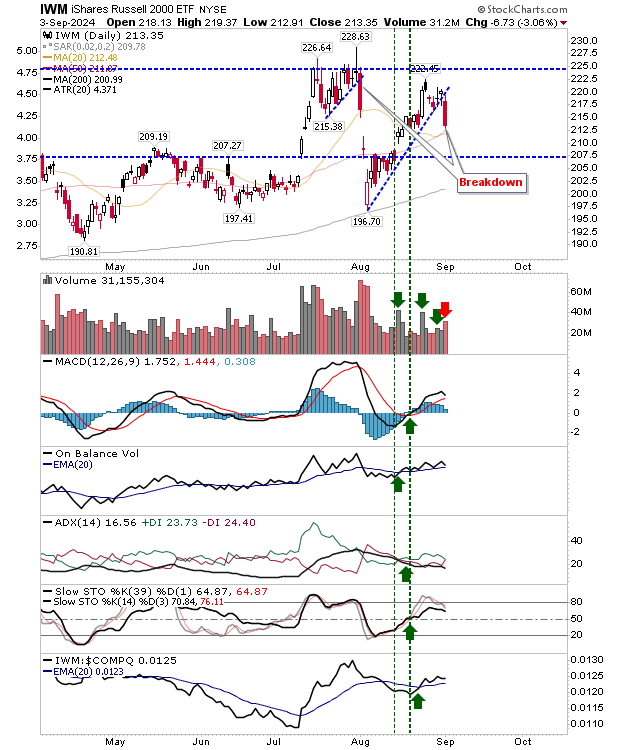

The Russell 2000 (IWM) experienced a bit of a repeat of the breakdown from July. The key will be what happens at $207.50 support. A loss of the latter would open for a last stand at the 200-day MA. Technicals are net bullish and have room to go (down) before turning bearish.

It was disappointing to see the reversal, particularly in the Dow after its breakout. Markets had set up for a new phase higher, but it looks like things will turn more neutral as we head into the traditional bearish period for the market. Markets may have to wait until the traditional Santa rally before they take off.