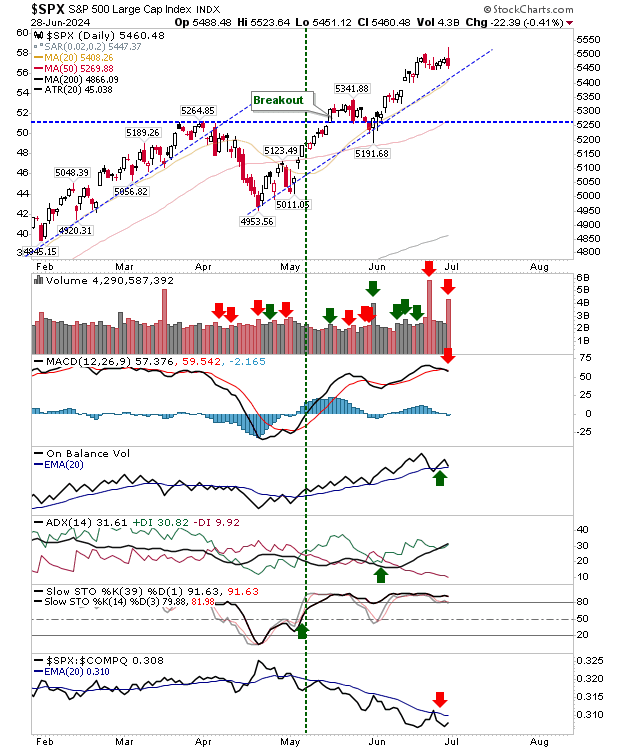

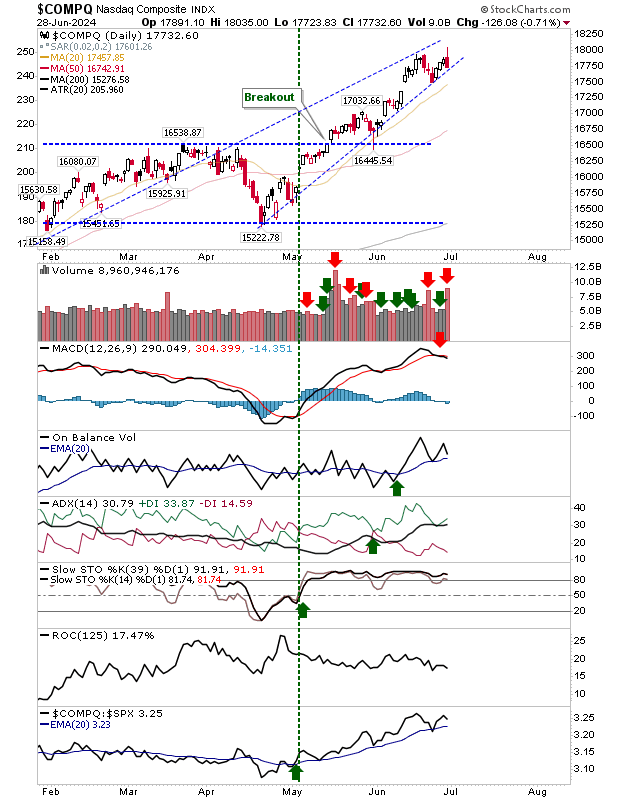

After a bright start by bulls last week, markets quickly took a turn, and bears were left in control into the close. Both the S&P 500 and Nasdaq finished with similar candlesticks; a nasty inverse hammer on higher volume distribution.

This isn't great news for today as indexes were looking to come out of a week-long pause. It's too early to say what the long-term impact of Friday's action will be, but Friday's was the kind of candlestick you typically see at a market top.

In addition to the bearish candlestick, there was a weak 'sell' trigger in the MACD for the S&P 500 (a strong 'sell' candlestick comes when the trigger occurs below the bullish zero line).

The Nasdaq differs from the S&P 500 in the advance rate from April through June is faster than the advance that preceded it. Collectively, this is shaping a bearish wedge that looks destined to break. As with the S&P 500, there is a 'sell' trigger in the MACD.

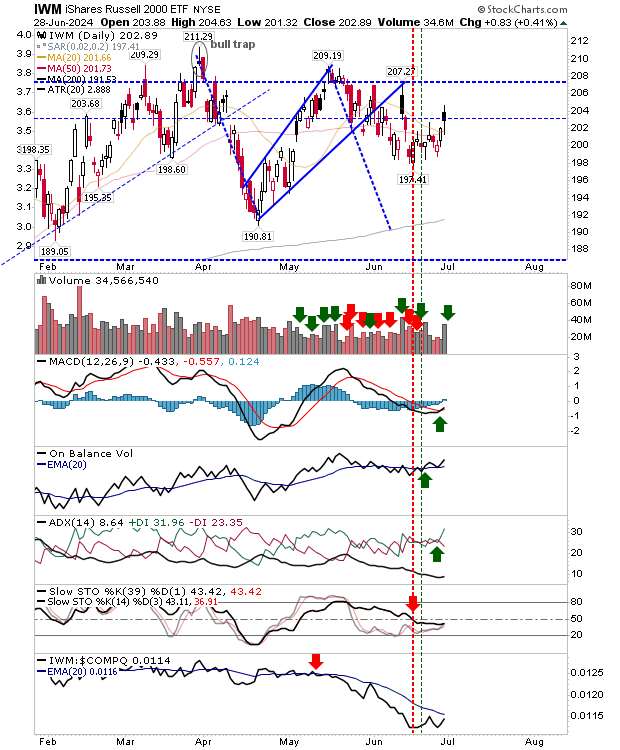

The Russell 2000 (IWM) is range bound, but Friday's "black" candlestick is similar to the one that appeared a few weeks ago and has the potential to deliver the same bleak opening gap down. The technical picture is a little different as a consequence of its trading range; momentum sits below the midline, a bearish scenario, but other technicals (like the MACD) are bullish.

For today, we are favoring a weak open, but if we see a positive premarket that opens near Friday's finish, then there is a chance things could stabilize and the small trading range built over the last week continues.