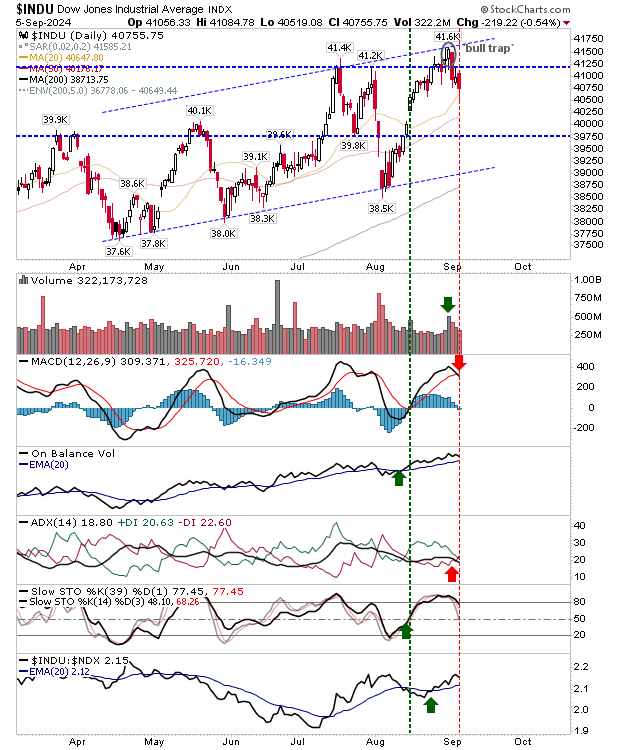

The index that had managed to break to new highs last week, the Dow Industrial Average, now finds itself pulling further away from its "Bull Trap" into a test of its 20-day MA.

Selling volume was light, but there are new 'sell' triggers in the MACD and +DI/-DI to mark a shift in the August bullish trend. Given current momentum, a test of the 50-day MA looks likely.

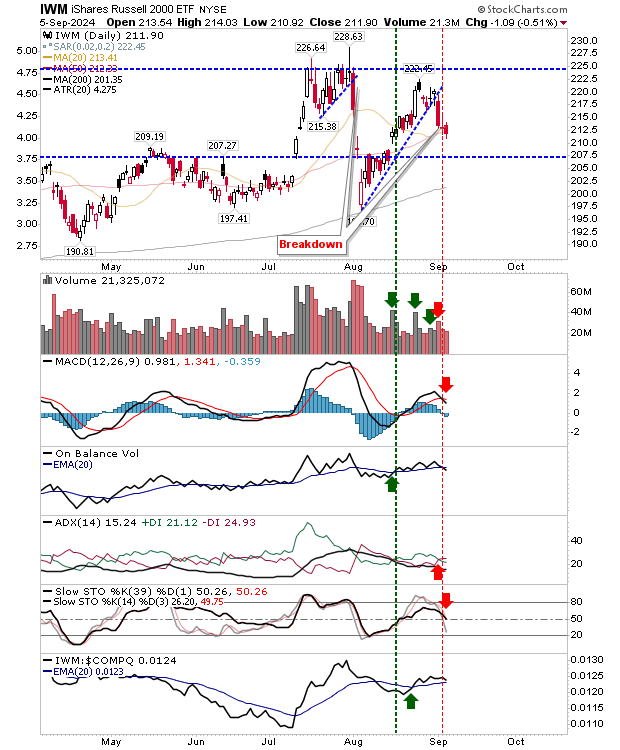

The Russell 2000 (IWM) gave up support of its 50-day MA and is now looking at a test of the 200-day MA. A return/close above its 50-day MA would set up a bear trap against this average and likely be enough to challenge $225 again.

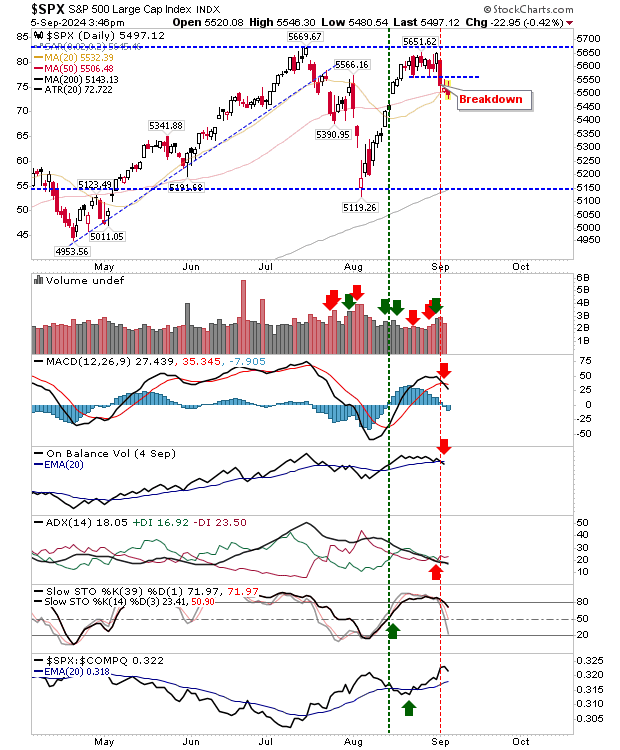

The S&P made a half-hearted attempt to regain support from the narrow price handle around 5,600 before it finished the day below converged 20-day and 50-day MAs. Technical weakness expanded with 'sell' triggers in the MACD, On-Balance-Volume and +DI/-DI.

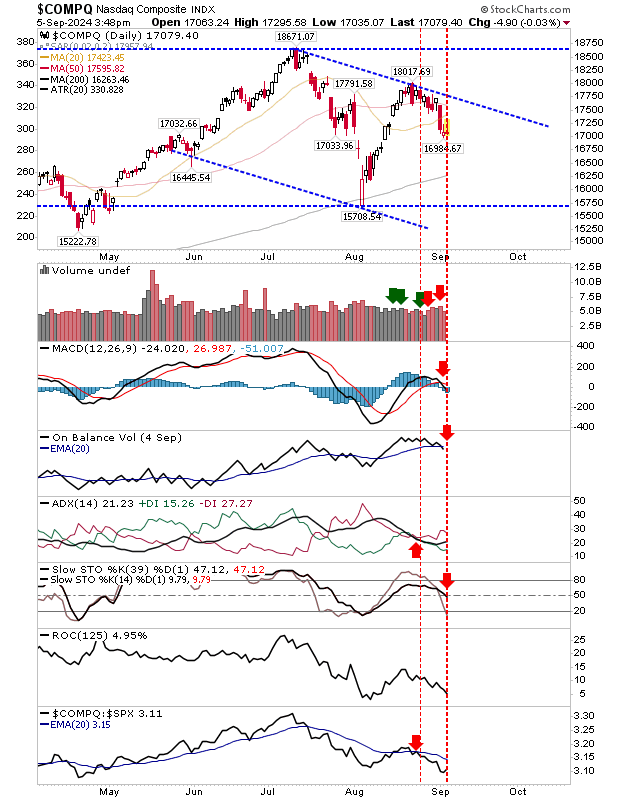

The Nasdaq was the first of the lead indices to turn net bearish in technicals as downward price momentum increased. It has already lost support of its 50-day MA and is on course to test its 200-day MA.

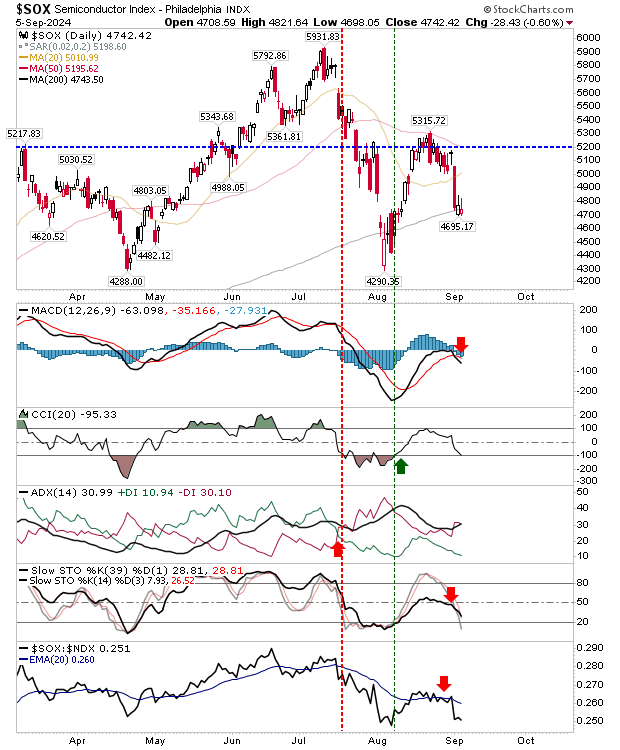

Honorable mention to the Semiconductor Index. It's in the process of testing its 200-day MA for a second time in the space of the month. The probability of a test failure has increased, thanks to the weakening technical picture that is not oversold (so further losses can be expected).

For today, watch for downside expansion off the back of poor intraday rallies. Semiconductor and Nasdaq Indices are the weakest and likely to suffer the most. The index that could surprise to the upside is the Russell 2000, particularly if it can make it above yesterday's high.