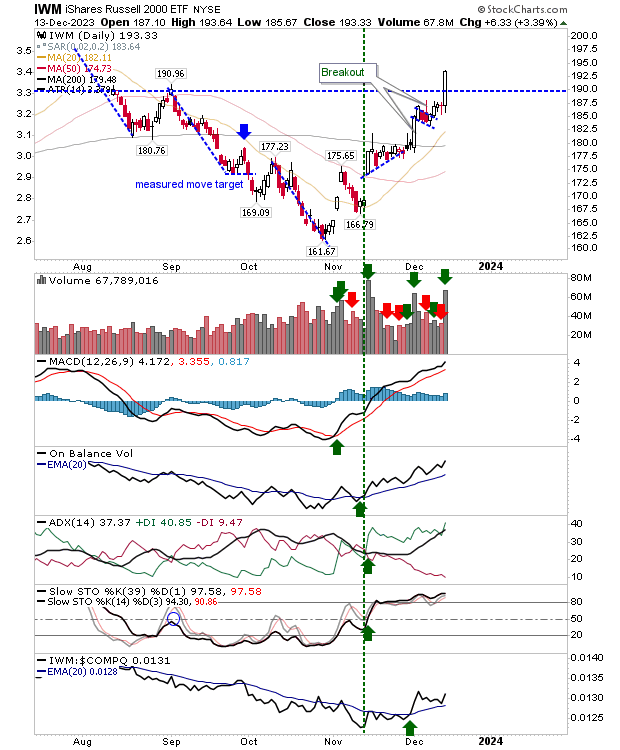

With the Fed signaling rate cuts for 2024, yesterday was another good day for markets, with the Russell 2000 (IWM) cashing in on its resistance pressure with a 3%+ gain. In doing so, it easily surpassed the August swing high on higher volume accumulation.

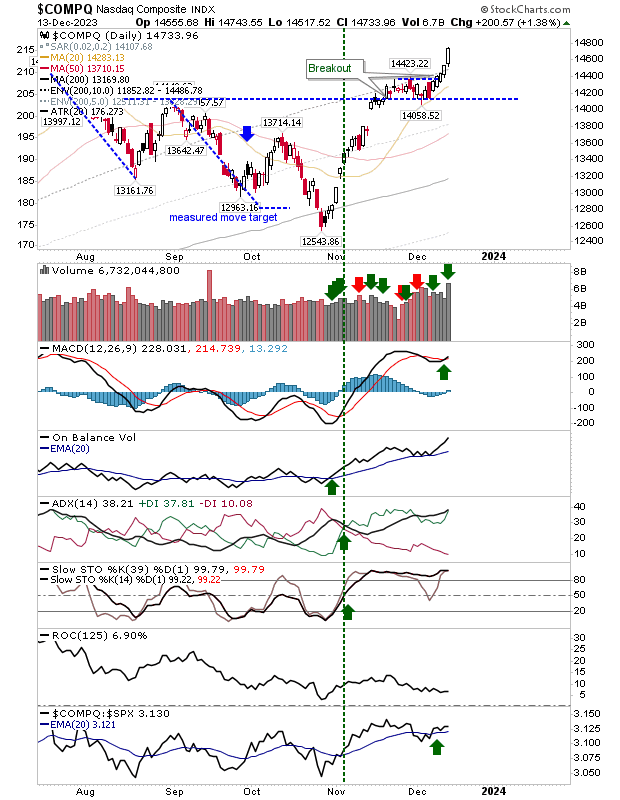

The Nasdaq had already posted solid gains, but it was able to add to its push higher for a fifth day in a row. With the gain came a new MACD trigger 'buy' to return technicals to a net positive state.

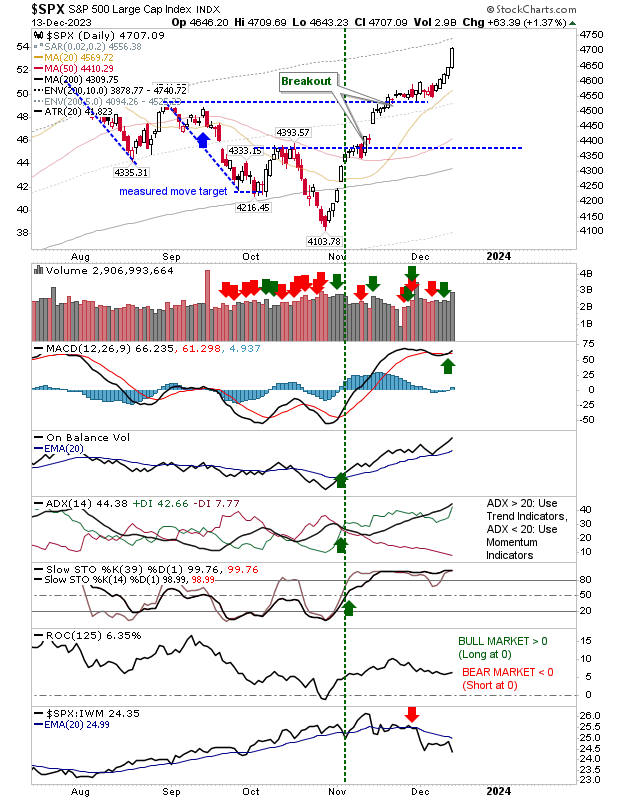

The S&P has extended itself to 9.2% above its 200-day MA and needs to be tracked to see when it reaches an historic extreme (above 10%); this is a good time to sell 'covered calls' or take profits on existing positions.

My day-trade experiment was done before I could take advantage of the Fed's reaction. The Russell 2000 trade was well-telegraphed, but I was not in a position to benefit. I suspect we will see some profit-taking after a sequence of profitable days, this will make day trading difficult as we will probably see some inconsistent action.