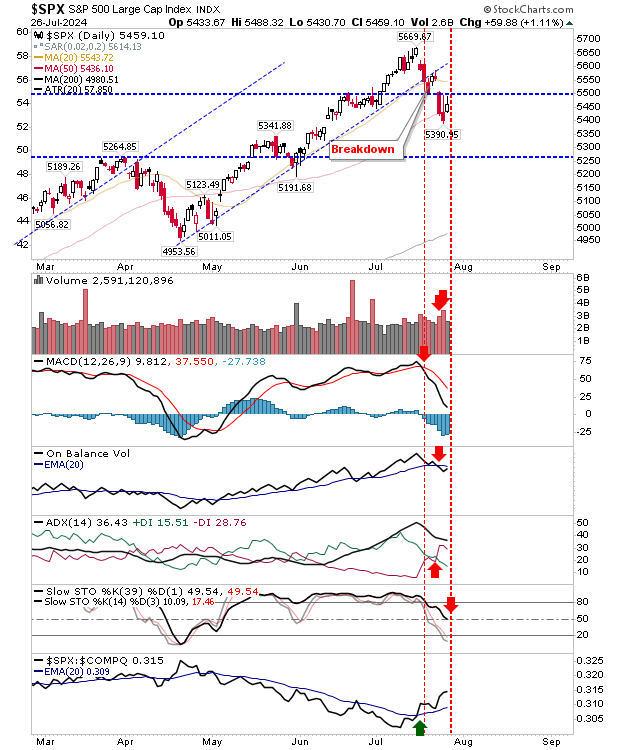

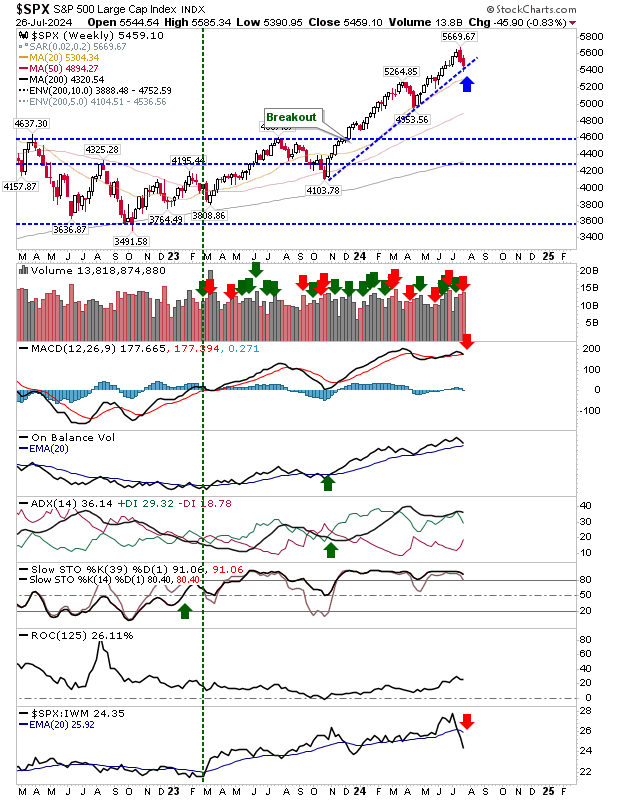

Last Friday's trading session was a bit of a mixed bag. Buyers stepped in at the 50-day MA for the S&P 500, but they lacked conviction with light trading volume and a net bearish turn in technicals. The likelihood is for a return to the downside for today, particularly if there is premarket drift below the closing price.

However, there is more of a positive picture in the S&P 500 weekly chart. While it's no guarantee, the index did finish on a weekly support trendline dating back to the end of 2023. So, even if we see an early week break of support of this trendline, watch for a rally to return the index above this line by Friday.

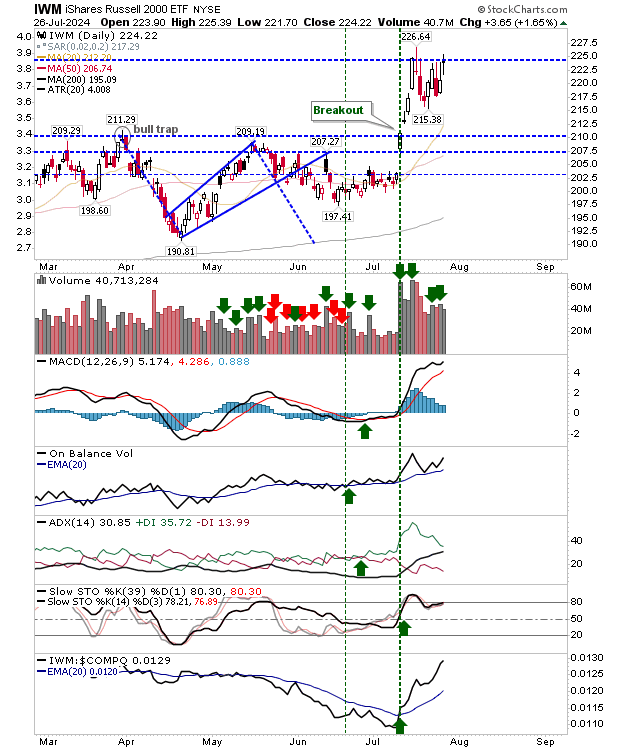

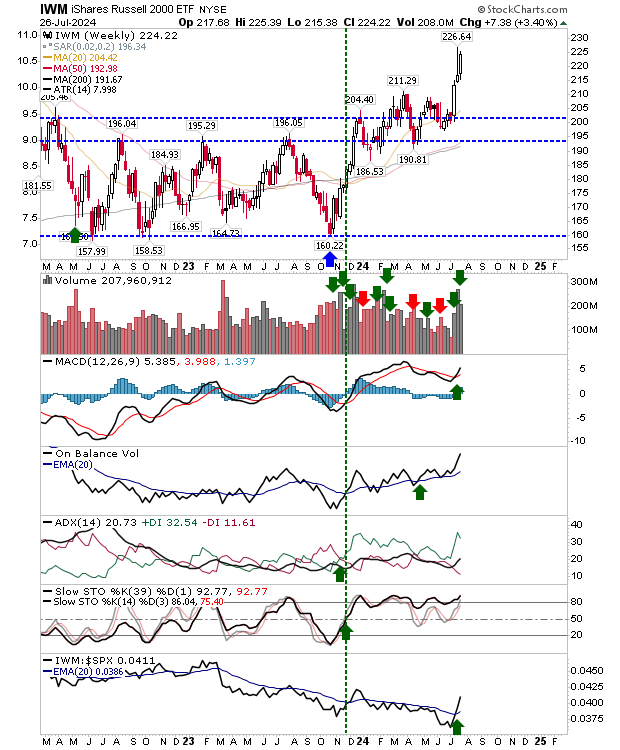

Russell 2000 Bulls May Regain Control This Week

As has been the case for the last number of weeks, the Russell 2000 ($IWM) was again pressuring $225 resistance on a good day for the index. Friday's trading closed as a doji, so there is still some trader indecision to overcome before the breakout can be delivered. Relative performance surged as other technicals are net positive.

The weekly chart for the Russell 2000 ($IWM) was much cleaner. In particular, the large upper spike from the previous week could have generated a period of weakness on a reversal, but last week's action has eaten into that indecision. The weekly buying volume could have been higher, so no confirmed accumulation.

For today, we are probably looking at some weakness, but as the week wears on, look for bulls to retake control.

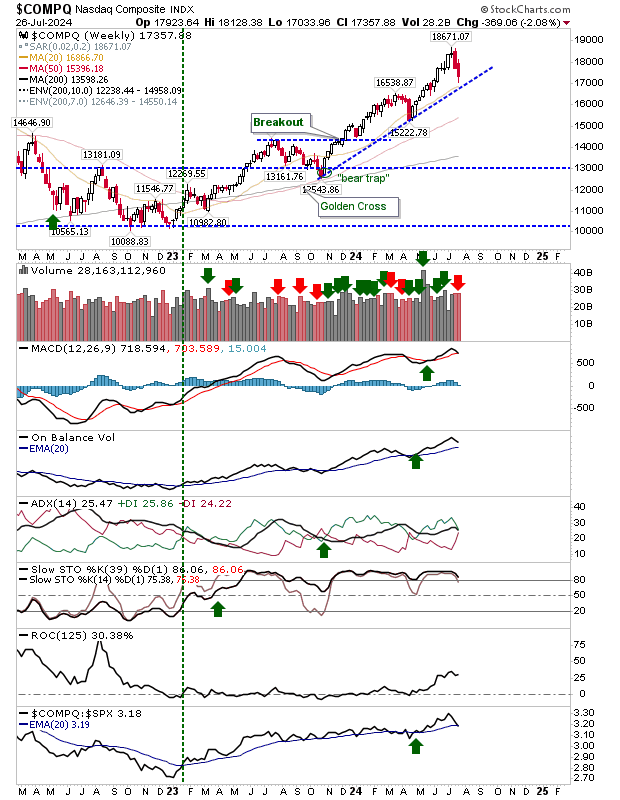

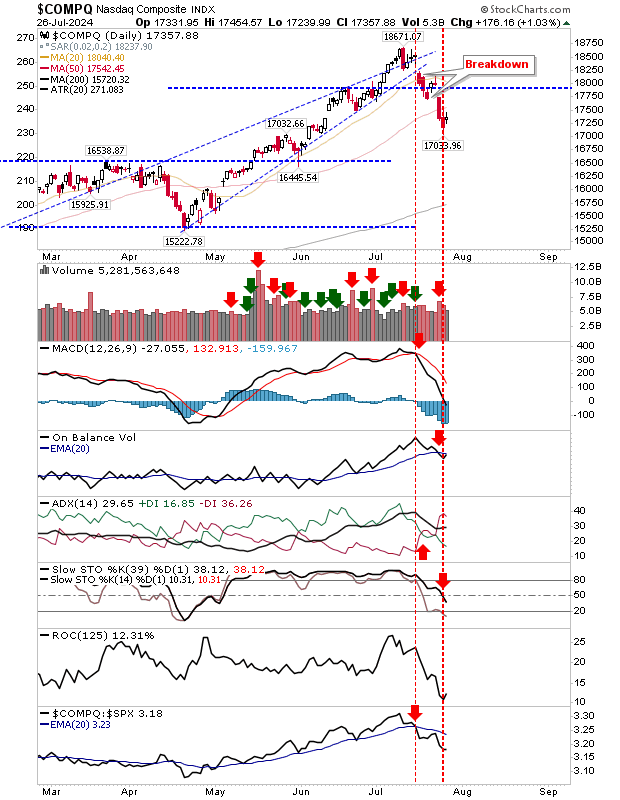

The Nasdaq had a more low-key Friday with a narrow intraday range after the earlier break of the 50-day MA during the week. Technicals are net bearish and the index is underperforming both the S&P 500 and Russell 2000 (IWM).

The weekly Nasdaq chart has more room to run to support. The 50-day MA is running along weekly trendline support (also from late 2023) and looks like a good point for long-term swing traders to attack.