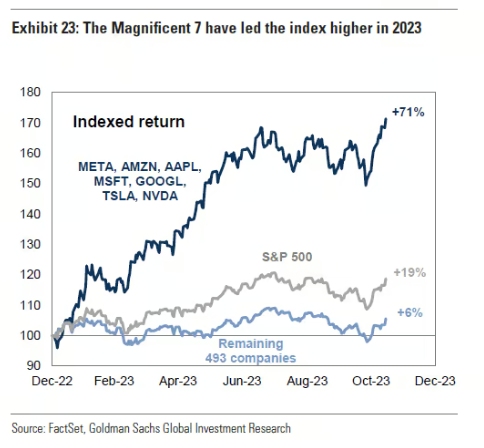

- The S&P 500's performance this year has mainly been driven by the 'Magnificent 7' stocks,

- Meanwhile, the other 493 stocks have lagged with Goldman Sachs (NYSE:GS) forecasting that the top 7 could continue outperforming

- While November was a great month for stocks, this performance could easily extend into December

- Missed out on Black Friday? Secure your up to 60% discount on InvestingPro subscriptions with our extended Cyber Monday sale.

Despite the S&P 500 gaining 19% since the year's start, many individual investors' YTD performance has likely fallen short.

A closer examination of the index's performance reveals a somewhat deceptive trend, primarily driven by the seven stocks with the highest market capitalization concentration in the index.

The performance of the 'Magnificent 7' stocks against the remaining 493 underscores this.

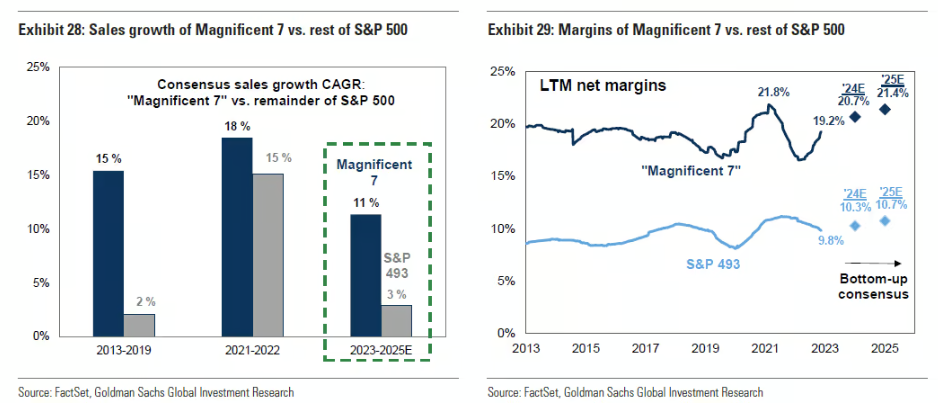

According to Goldman Sachs, the Magnificent 7 will continue to outperform the rest of the basket.

Analysts' estimates show that the large-caps are set to increase sales at a CAGR (compound annual growth rate) of 11% through 2025 compared to a mere 3% for the rest of the stocks.

These titans are also poised to do much better in terms of the P/E compared to the rest of the market

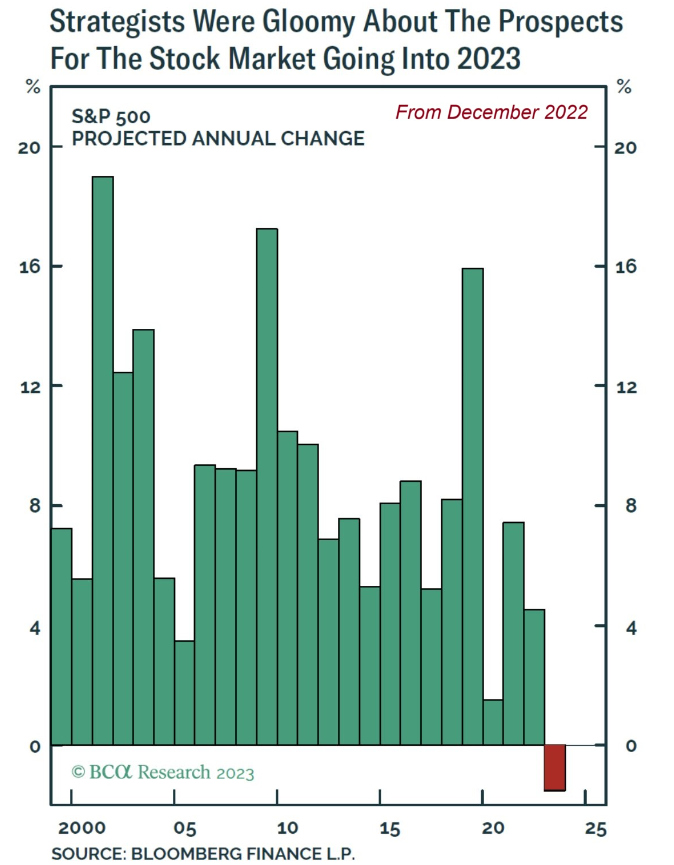

Yet a year ago the 'strategists' at the major investment banks were predicting a real collapse in stocks in 2023, the first time since 2000 that they had predicted such a loss.

Apparently, the strategists, up to this point, have been incorrect. This could be a key factor supporting continued bullish sentiment in December, particularly given the sustained positive trend over the past few months.

The S&P 500 has achieved nearly a 20% gain, tripling its average annual return, while the Nasdaq is currently yielding over 36% YTD.

For many investors, the level of optimism or pessimism often hinges on their individual performance, especially towards the end of the year.

However, maintaining optimism in investments is crucial, given that pessimism can significantly diminish long-term returns.

It's advisable to focus on understanding the markets, disregard negative media biases that can distort perceptions of downturns, and determine one's capacity to withstand volatility, adjusting the portfolio accordingly.

Key Ratios Are Sending a Bullish Signal

Examining the ratio of commodities to low-volatility stocks (NYSE:SPLV) can provide insights. When commodities underperform, it signals strength in the broader market, particularly the S&P 500.

Today, low volatility and commodity trends relative to the S&P 500 always point to new lows, as they have done all year.

The fact that these ratios are pointing downward should give us an initial positive view: Risk assets probably still have room for growth between now and the end of the year.

***

You can easily determine whether a company is suitable for your risk profile by conducting a detailed fundamental analysis on InvestingPro according to your own criteria. This way, you will get highly professional help in shaping your portfolio.

In addition, you can sign up for InvestingPro, one of the most comprehensive platforms in the market for portfolio management and fundamental analysis, much cheaper with the biggest discount of the year (up to 60%), by taking advantage of our extended Cyber Monday deal.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.