Is the long-running drought in relative returns for foreign stocks vs. American shares starting to fade? It’s getting easier to consider the possibility as developed-markets equities ex-US continue to rise.

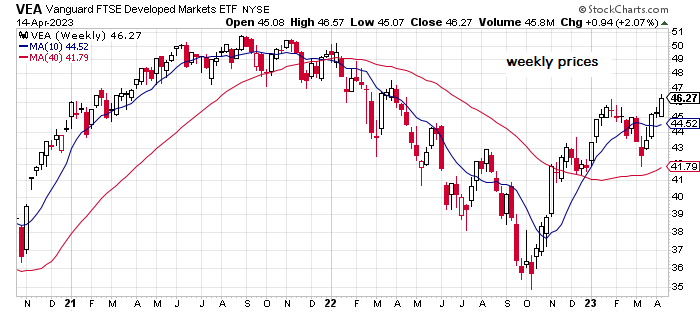

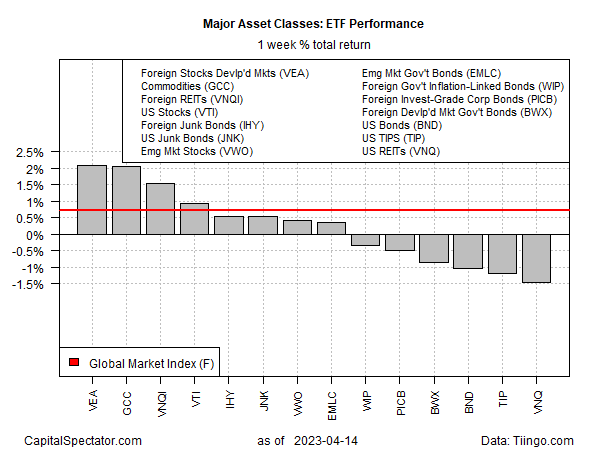

Shares in developed markets outside the US led performances for the major asset classes last week, based on a set of ETFs as of Friday’s close (Apr. 14). Vanguard FTSE Developed Markets Index Fund ETF Shares (NYSE:VEA) rose 2.1% in last week’s trading. The gain lifted the ETF to its highest weekly close in more than a year. VEA is now leading US stocks (NYSE:VTI) by a respectable margin so far this year: 10.7% vs. 7.7% for year-to-date rallies.

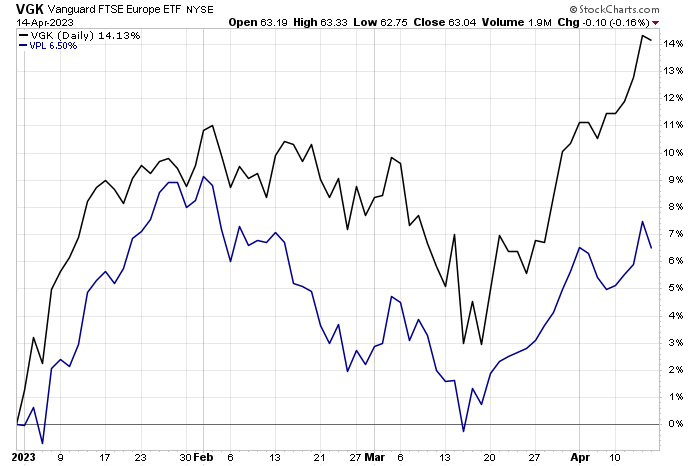

The main driver for VEA is the hot run for European shares. Separating the fund into its main regional components – Europe and Asia – highlights the contrast. Vanguard European Stock Index Fund FTSE Europe Index ETF Shares (NYSE:VGK) is up 14.4% year-to-date, more than double the 2023 gain for Vanguard FTSE Pacific Index Fund ETF Shares (NYSE:VPL).

Roughly half of the major asset classes scored gains last week. The biggest loss was in US real estate investment trusts. Vanguard Real Estate Index Fund ETF Shares (NYSE:VNQ) closed down for a second week. Although the ETF is above its recent low, the trend remains bearish as the fund looks set to retest its 2022 trough in the weeks ahead.

The Global Market Index (GMI.F) rose 0.7% last week. This unmanaged benchmark holds all the major asset classes (except cash) in market-value weights via ETFs and represents a competitive measure for multi-asset-class portfolio strategies. The gain marks the fifth straight week that the index has rallied or held steady.

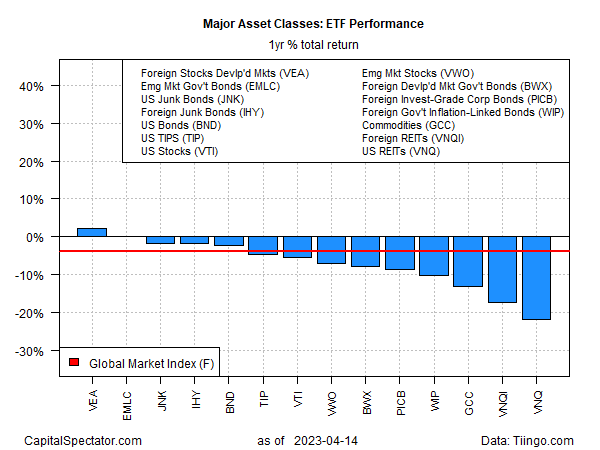

For the one-year trend, developed markets stocks (VEA) edged into the positive column after an extended stretch, with all the major asset classes posting losses vs. year-ago levels. VEA is now bucking the trend with a modest 2.2% rise over the past 12 months. Government bonds for emerging markets (NYSE:EMLC) are also enjoying a fractional gain. By contrast, the rest of the field remains in the red, which includes a modest decline for GMI.F.

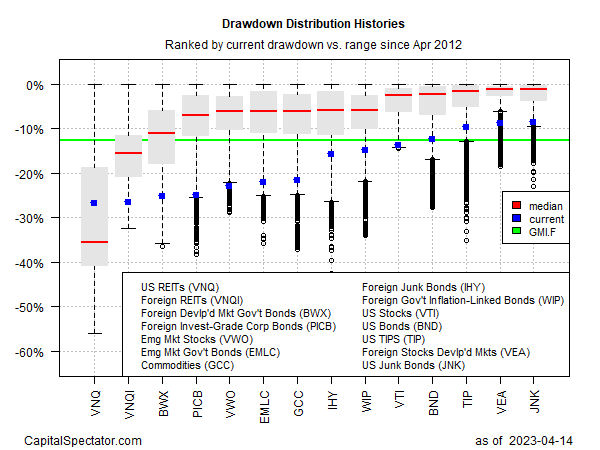

Comparing the major asset classes through a drawdown lens continues to show relatively steep declines from previous peaks for markets around the world. The softest drawdowns at the end of last week are essentially tied between US junk bonds (NYSE:JNK) developed-markets stocks (VEA), each with peak-to-trough declines near -9%.